May 11th – A Big Picture Report For The Public

/1 Comment/in Public /by Alex - Chart FreakIt has been a while since I posted a Public Report, so I want to post part of this past weekends report to the Public.

For my Readers, I post daily reports to discuss the markets and also offer 'trade set ups' if certain sectors are acting bullishly, but I like to use the weekend report to step back and take a look at the Bigger Picture. This report will show you some of what we have been discussing at Chartfreak. This is part of the May 11 Big Picture Weekend report .

Read MoreAn Index & Market Update

/in Public /by Alex - Chart FreakWe have been expecting a bit of pull back in the General Markets, and it would likely start after the SPX tagged that 200sma. I am not expecting a wash out sell off, it will be more of a ' Buy the Dip' type of pull back into the first dcl, but if you want to hold on to most of your recent gains? Then at the first signs of cracks in the ice, you would certainly tighten stops or take some profits. You want to Stay Frosty for a while.

.SPX - The SPX tagged that 200sma, dropped to the 10 sma, and bounced bit into the end of the day. We are on Day 30 and I expect this to eventually back test the 50sma.

Read More

Read MoreTrading Technique: Go Where the Action Is

/in Public /by Alex - Chart Freak(The following is a sample of Alex’s work from the week. This is more of a sophisticated trading technique best served for traders with some experience under their belt.)

(From 2/1/19)

This example is a case where a trader is holding several positions and while active trading them, notices that one is beginning to run while the other is maintaining its bullish nature; but, it is ‘crawling’ along. Alex mentioned in the comments yesterday that he was planning to roll part of his position, here is his explanation:

I sold some ACB and bought more HEXO. Why? Is there something wrong with the ACB Set up? No, but using intra-day charts, HEXO looked ready to start running ‘NOW“. I have been waiting for HEXO, ACB, and NBEV to get moving faster, but they have just been bullishly crawling along. Well, if I see one start moving on intraday charts… I just wanted to flip over to the action, but nothing is wrong with ACB, and I still own some.

.

HEXO – So I like the way it has held the 10 sma and volume started to surge today again. ACB is still on the 200sma, it just needs to get moving. Who knows, maybe HEXO runs to $7, and then ACB starts going, and I switch a portion back , from HEXO to ACB. That is just how I trade.

(From 1/31/19)

For the experienced trader, playing the ‘bounce.’

KEG – KEG has a double bottom low, yet the MACD is strongly pushing higher. The first low was the Final capitulation low, usually a solid Bottom. It closed green, so we have a small reversal, but if you see upside, that could be a buy with a stop under the double bottom lows. I have to post this as a bit risky, it has had a reverse split and sold off heavily etc, but notice that it sold from $10 to $1 in a month. A ‘Bounce’ alone could offer very good gains for the experienced trader.

Chart Freak Membership

Alex has been successfully writing a daily newsletter service for nearly four years now and is considered one of the best traders of precious metals miners, energy/uranium stocks, and biotechs. This is your opportunity to join his service as a member and follow along as we enter the next bullish gold Cycle higher.

If you would like to find out more about the service or sign up, please click the buy option for more details.

Round 2. Pot Stocks

/in Public /by Alex - Chart FreakI want to show you how I follow individual stocks over the course of a month. In this post, I’ll show you how I have been covering NBEV.

[The following is a sample of Alex’s work over the past few weeks]

(1/10/19)

NBEV DECEMBER 21 – Back on Dec 21, NBEB broke down through an uptrend and notice that it was Overbought . I mentioned that it is possible that the 50sma would support it, it could go sideways, and form an INVERSE H&S as drawn here. If so I would re-buy it, because this too ran swiftly. Well guess what?

NBEV – no longer overbought, it is oversold and did form an inverse H&S, so I have been watching it daily as it rode along the 10 sma, and …

NBEV – INTRADAY I watched a triangle form along a support line . It was at he APEX at the open yesterday and as it broke out I jumped in. I posted this to show that I would also like to ‘add’ on a possible back test, but…

NBEV – It flagged sideways by midday, so I just ‘added’ again and mentioned it in the comments. This too then broke even higher…

Finally, By the end of the day NBEV had run up 11% and closed at $6.10. The sector is acting correctly.

(1/18/19)

NBEV – I posted this in the morning, and NBEV traded all over the place yesterday. THIS may be support that now holds going forward, I will look for follow through. I own NBEV.

(1/24/19)

NBEV Daily – New Age Beverage has entered the CBD infused Beverage business, and has been drawing in buyers, but it DOES move quickly in both directions. The daily chart of NBEV seems to have price climbing along a trend line or channel rather nicely, so this would be a good place to add or even start a trade. We got a nice reversal Wednesday, and I would expect that it continues higher from here. If it breaks above the RED TREND LINE Thursday, that is bullish. Let’s look at the weekly.

NBEV WEEKLY – We have a weekly reversal off of the weekly 8 ema and that uptrend line too. You could put a stop under the weekly low, which is about $5.90.

As a bonus, the $MJ etf from 1/25/19

MJ ETF – As mentioned in prior reports, I expect a second leg higher here soon. Crawling along the 200sma is bullish and can be bought with a stop ( loose) .

Chart Freak Membership

Alex has been successfully writing a daily newsletter service for nearly four years now and is considered one of the best traders of precious metals miners, energy/uranium stocks, and biotechs. This is your opportunity to join his service as a member and follow along as we enter the next bullish gold Cycle higher.

If you would like to find out more about the service or sign up, please click the buy option for more details.

Precious Metals – “Oh My Precious”

/in Public /by Alex - Chart FreakLet’s take a look at Precious Metals

(Below is a sample of Alex’s work from the week)

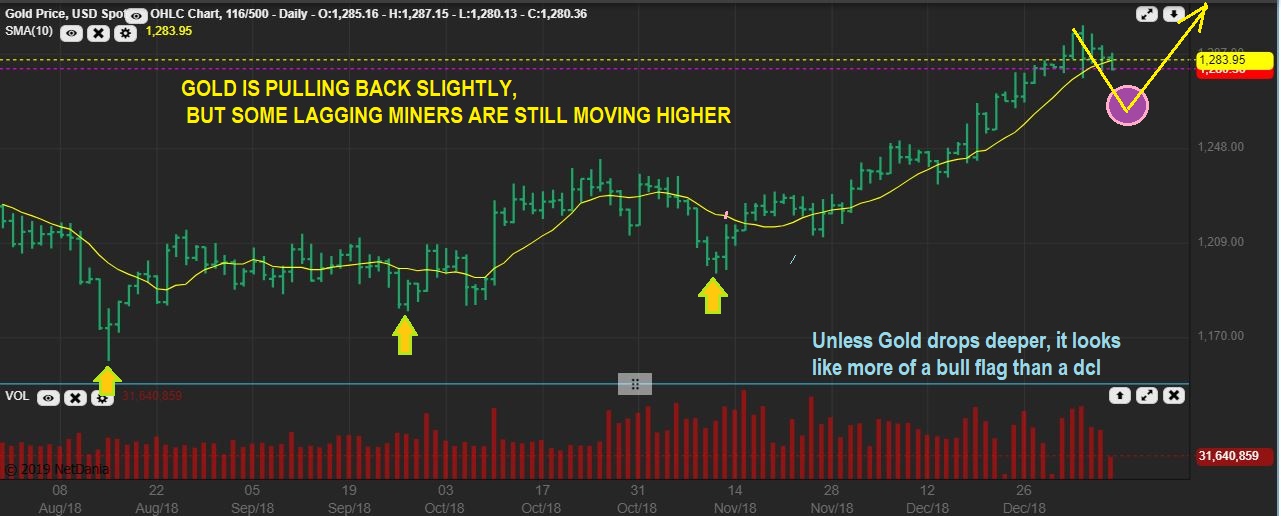

GOLD – I posted this in the comments, just showing how GOLD does not want to sell off, it has formed a triangle so far.

GOLD #1 – I have stated in the past that ‘TRIANGLES’ usually mess up daily cycle counts, so I just focus on what is in front of me. At this point, it is a Bull flag chewing away at consolidation on the far left ( May / June trading). I would have expected a back test of the 50 & 200sma, but so far it just wont sell down.

GOLD – We are in the APEX, so this has to break up or down now. Breaking down would break the blue trend line, and usually that is what we see as a dcl, so look for a break of the blue trend line, and a reversal higher may indicate a dcl. Honestly though, I ignore cycles when triangles form & Bullishness persists.

SILVER 10 sma – Silver broke below the 10 sma, but it also looks like a bull flag, so…

SILVER 20 sma – Let’s see if the 20 sma acts as support, price did not break the 20sma on the run higher in November.

GDX – My current thoughts : I know that GDX held the 200 sma lately, but is it a mini bear flag? I think that this can drop to the 50sma. Notice – It is under the 10sma, the 10sma is curled down, and I would normally expect a break of the blue trend line. So I’m still watching for a tag or break of the 50sma. IF THIS BREAKS OUT HIGHER above the 10sma, you can simply ‘adjust to that’ and Buy it with a tighter stop under the 200sma, or a loose one under the 50sma. .

(from 1/17/19)

Let’s look at some Bullish Metals leaders, and then some that should play catch up

.

HBM – I pointed out This as a BUY, inverse H&S. I also had some other bullish looking METALS stocks . HBM as an inverse H&S, TGB, WRN, CPST, X, AKS, etc etc . were bullishly popping too. Here on Jan 4th, the HBM volume pops look Bullish…

HBM – HBM has been running with strong volume from there, and the Metals still seem to be basing and Bullish.

CPST #1 – Capstone Turbine usually runs with Metals. I posted that this had a large POP out of the base, look for a possible bull flag to buy…

CPST #2 – I posted this as a bullish crawl along the 50 sma, a Bull Flag, and a break out. It popped 10% again as a leader. It continued higher as the day went on…

CPST #3– And closed up almost 20%, and …

CPST #3 – CPST continues to lead the way higher. So let’s look at a few other Metals stocks setting up bullishly…

CLF – Crawling under the 50sma, this looks ready to pop higher soon. I would buy this , AKS, X, or many of these below with a stop in a reasonable place , in case of any bed news releases. Hold a small basket of stocks for safety or start with smaller positions.

AKS – This is also crawling sideways and looks ready to pop soon. Read the chart. So keep your eye on your watchlist of X, CENX, AA, VALE, TGB, WRN, ETC.

ZEUS broke out yesterday, as a possible leader, so watch X, AKS, etc.

Chart Freak Membership

Alex has been successfully writing a daily newsletter service for nearly four years now and is considered one of the best traders of precious metals miners, energy/uranium stocks, and biotechs. This is your opportunity to join his service as a member and follow along as we enter the next bullish gold Cycle higher.

If you would like to find out more about the service or sign up, please click the buy option for more details.

Let me tell you a story about gold.

/in Public /by Alex - Chart FreakGold has been on a run during this market correction. There is more to the story and I’d like to show you.

Before we get started, lets look back at $GDX and $GDXJ how they closed out 2018…

THE MONTH OF DECEMBER HAS NOW CLOSED, AND THERE IS NOTHING BEARISH ABOUT THIS MONTHLY CHART. THIS IS A VERY BULLISH LOOKING CHART! THIS LOOKS VERY BULLISH FOR 2019!

GDXJ MONTHLY – December has ended and this is the first Positive Month since MAY! I pointed out that down trend line last weekend, and it has been broken! Again, I see NOTHING BEARISH about this chart. 2019 Could be a very profitable year !

(The following is a sample of Alex’s work from the past week)

(1/9/19)

GOLD LIVE WEDNESDAY JAN 9th- Gold has been dropping, but it is mild at this point. I’d like to see more of a drop.

ALO – In December I pointed this out as a lagger that Popped and was a buy. I pointed out that these bases can actually produce a nice run .

ALO – It ran and is now Bull Flagging. I then pointed out other stocks that resemble this set up, and mentioned that they could be bought as those ‘lagging stocks trying to play catch up’ ( Advice: a small basket to avoid individual risk, and you can also use a small position size).

NGD – Here we go, JAN 3rd, a similar base as ALO was pointed out here and looking ready to go. It popped 10 % here and I was looking for a nice run to the 200 sma as possible over time.

NGD – Boom Boom Boom- it is playing catch up, even on days when GDX & GDXJ were down. So I see that as an indication that some of these will act on their own, as buyers step in to accumulate.

GORO DEC 31 – So I used this chart and said that it looks similar to ALO and NGD, but it needs a bit more sign of strength. I wouldn’t just buy a 1 day reversal, but…

GORO – It started pushing on that 50sma, and Tuesday it POPPED above it. THAT IS A BUY. GDX & GDXJ were down at the time, they were pulling back, but GORO was being bought up. This is a buy, but I did notice the DEEP RED CRASH DAY every 3 months before the base (red arrow). That MIGHT be earnings, so be aware of the earnings date.

HL – HL was a BUY on JAN 3 too. It has lagged, and it was a Silver stock still at the very lows, MACD rising. Low risk, with a stop at the lows. $2.47

HL – It started flagging sideways and Tuesday HL has a 10 % POP. Again, this happened while GOLD, GDX, and GDXJ were down. SO IF CYCLES SAY GOLD & GDX Need a pull back, maybe some of these that didn’t join in on the run higher in December (laggers or Base building) will still just do their own thing in January?

HL – It could easily run, crawl along the 50sma, and break out as shown here.

(1/11/19)

GDX – If we can get a drop, it might only look like this, but so far GDX got choppy again. Believe it or not, this is 3 weeks sideways. It is simply going sideways along the 200 sma now, and that can be a Bullish Crawl. IF GOLD BREAKS OUT HIGHER, THIS CRAWL ALONG THE 200 SMA MAY BE THE ONLY PULL BACK THAT WE SEE ALSO.

CDE – So some Miners do look like they could pull back for a buy opportunity. CDE could tag that 50sma unless it just breaks this apex higher.

Chart Freak Membership

Alex has been successfully writing a daily newsletter service for nearly four years now and is considered one of the best traders of precious metals miners, energy/uranium stocks, and biotechs. This is your opportunity to join his service as a member and follow along as we enter the next bullish gold Cycle higher.

If you would like to find out more about the service or sign up, please click the buy option for more details.

Some Winning Stocks You Might Have Missed

/in Public /by Alex - Chart FreakThe overall market has been very choppy and that an be frustrating for a lot of traders. However, there were some real winning stocks this week. Did you catch them? Some of the highlights were $NBEV $TWTR $UBX

(Below is a sample of Alex’s work from throughout the week. )

(Below chart from 12/11)

NBEV – WHAT A RUN IN SEPTEMBER! I bought NBEV instead of WTER and it moves fast. It is pushing on the 50sma, so lets take a look at WTER.

(Below chart from 12/14)

NBEV – NBEV Reversed Thursday, and I think that it could drop to the $5 area, if this is a back test of the 50sma.

(Below charts from 12/12)

TWTR – The Stock Market (NASDAQ) is back at the October lows, but TWTR moved from $26 at the October lows to almost $36 in at October highs, and now it is still at $34 and looks ready to break out even higher. And…

TWTR – I stepped back and saw

1. A large inverse H&S formed

2. With price now above the 50sma, and

3. The 50sma is already curling upward. This looks Bullish now.

(Below chart from 12/14)

TWTR – This remains a bullish set up. I personally would not use too tight of a stop on a set up like this. A stop under the 200sma should keep you in the trade and not have to worry about the wiggles. This has rallied since the October lows and did NOT follow the markets back down to the lows, so it is a bullish set up.

(Below chart from 12/6)

I said that I bought UBX near the 50sma, and it continued higher.

(Below chart from 12/14)

UBX – This stock just will not stop 🙂 $12 to almost $17 since last week. I liked this one for the volume coming out of that base too.

As a bonus: Keep an eye on Oil.

(Chart from 12/14)

WTIC – Oil seems to be basing after putting in a low 9 days ago, and the MACD is rising. This looks pretty promising.

Chart Freak Membership

Alex has been successfully writing a daily newsletter service for nearly four years now and is considered one of the best traders of precious metals miners, energy/uranium stocks, and biotechs. This is your opportunity to join his service as a member and follow along as we enter the next bullish gold Cycle higher.

If you would like to find out more about the service or sign up, please click the buy option for more details.

OIL UPDATE DEC 5th

/in Public /by Alex - Chart FreakJust a quick update of what we at Chartfreak were looking for with Oils recent plunge.

.

OIL – Nov 20th, I was telling my readers that I would be watching for a break above the 8 ema, to make a safe entry at a swing low. Each pause sideways was breaking down ( Bear flags) .

NOV 23- Each pause in the drop remained a bear flag, the 8 ema still capping any progress

WTIC NOV 27th – This is very oversold and also we were keeping a cycle count. The daily cycle near 70 days was VERY extended, so again, we are watching for a break out above that 8 ema ( or 10sma) .

WTIC NOV 29th, we had a reversal or pause and it was late time-wise, so we stayed on alert for a break out

I even did some research and looked back at another similar deep sell off ( in the summer of 2015), and saw that it lasted 61 days , then after the break of the 8 ema, it eventually bounced to the 50sma. A good trade with leverage or options.

We finally had our break out, and this could be a signal to go long (with a stop) .

DEC 5th ( Today) we have a swing low and a back test.

THIS IS WHAT WE HAVE WAITED FOR AS A SAFER ENTRY , WHERE WE CAN PLACE A STOP AND AVOID GUESSING

,

SO I also was monitoring the XLE with Oils sell off – IT RESISTED OILS SELLING TOWARD THE END.

.

XLE NOV 29 – We saw a falling wedge and I would expect at least a run to back test the 50sma, but possibly more if this is a yearly cycle low in Oil.

XLE POPPED on Dec 3rd and…

XLE #1 – It dropped with the Tuesday Market sell off. So far, we have a Back test of the 10sma & Higher? Or…

XLE #2 – Back test the wedge & Higher?

Time will tell, but a stop can be placed under recent lows , and you may even choose to trade options or GUSH.

So this is how we have been tracking OILS big sell off, and the possible opportunity that could come after a low forms. We are also looking at Oil & Energy Stocks. Will the market sell off drag them down? I will update these developments in future premium reports. We may have a major buying opportunity here, time will tell 🙂

.

Why not join us if you think that this kind of analysis would assist you with your trading style too. Thanks for being here at Chartfreak!

.

~ALEX

Let Me Show You Something about Gold (& the Miners)

/in Public /by Alex - Chart Freak

LET ME SHOW YOU SOMETHING ABOUT GOLD

(Below is a sample of Alex’s work from the week. )

.

1. GOLD MONDAY – Above the 50sma, it looked hopeful and Bullish on Monday, even though this was the start of the 3rd daily cycle.

2. GOLD TUESDAY – This was Gold closing under the 50sma during Golds 3rd daily cycle. This now looked QUITE Bearish breaking down Tuesday, since volume increased on the sell off and the RSI & MACD crossed down.

3. GOLD WEDNESDAY – After the close under the 50sma, Gold surged with the Fed Speech midday, putting in a strong reversal? Yes, this looks bullish, but it looked quite bearish just 1 day before. Again, these choppy frustrating markets continue to give us a sideways ride. What can be said about this reversal ? …

GOLD – Many strong reversals or surges higher still just turned into sideways moves, as shown here. This still may not amount to very much in the bigger picture. A break above this down trend line would definitely add to the bullishness and would threaten a run to the green 200 sma line. Read the chart.

I don’t want to burst anyone’s hopes, but please just allow me to point something out with the G-20 Mtg ahead…

GOLD – Gold has had a very big move higher recently on November 1st, but it rolled over too, right? My emails are asking me, “Did this change everything?” We cannot know from one strong day, since we have had that in the past and nothing more became of it. We still need to use stops and be cautious if you went or remained long. These markets are choppy & devious.

SILVER – Silver actually looks like a bullish base with a shake out, recovery, trend line break and back test. I honestly think that Silver looks bullish here, but this has gone absolutely no where for 3 months, it can continue to do that. ‘Base’.

1. GDX YESTERDAY – This definitely looked Bearish as it broke and closed below the 50sma.

2. GDX – Now GDX looks to have reversed at the lows? Yes, this now looks bullish again, and so it can be bought with a tight stop, but 1. G-20 is ahead and 2. this has really been a choppy frustrating set up. 3. Day 6 can still remain the peak & this could break down next week, we just can’t tell at this point. For example: My stop was below the blue arrow DCL when I bought, but I moved it up under the 50 sma, and I got stopped out at the 50sma as a result. I would have to re-buy & risk getting stopped out for another short gain or loss. Choppy sideways action is difficult.

Note: Choppy sideways action seen above is difficult, but after building a base like this, a break out & run higher would probably begin to trend in that direction and buying pull backs would be easier & rewarding. Nobody wants to ‘miss the move’ out of the lows, but this sideways chop has been causing paper-cuts for weeks now. You must decide what is the best trade set up for you to pursue, meanwhile some individual Miners do continue to act bullishly. Lets discuss this sector a little bit further.

.

GDXJ – We are looking for follow through. We have seen large up days, but there is no guarantee that we will see higher price continue. Looking at the large day higher on September 14, the next 2 days were red.

GDX – The current set up is that GDX has a day 6 ‘peak’ and today is day 11. If that peak does not get taken out, this will be a left translated daily cycle. If price beats day 6 Thursday or Friday, it’ll be a peak on day 11 or 12 so far ( Still can be L.T.) And then we face G20. Do you feel lucky, kid? Do ya? It is a very tough call here, because we have seen large up days and large down days often.

MINER THOUGHTS

.

Are you frustrated because you feel you may be missing a move in Miners with all of the false starts and shake outs? ABX , AEM, KL, and others have been shown as Miners that have been leaders, and they ran well? Well, SILVER STOCKS are still at the lows, you haven’t missed a thing, because Silver often roars higher when it gets going, when the time is right for it. 🙂 Notice…

.

AG – This is actually a series of lower highs and lower lows, so several Silver Miners like AG are at their lows. IF A big run was going to start now with the FED SPEECH followed by the G20 Mtg, this would be a shake out, but you’d still be getting bargain prices.

EXK – EXK hit new lows, but suddenly looks like a bullish wedge. So we are getting more Mixed signals.

HL – Inverse H&S with HL. Hecla is also still at THE LOWS, but the RSI is at 50%. Silver stocks look like they want to move higher. Next weeks post G-20 results may be the answer.

.

AU- And then we have bullish leaders pushing higher. Amazing. These are choppy frustrating markets. so…

All I can say is that this is possibly the most mixed I have ever seen the Miners. We have seen Many Silver stocks breaking to new lows right now, and yet several other Miners have been running higher and remaining bullishly at highs, like ABX, AU, etc. We have GOLD & GDX breaking down below the 50 sma one day, and then sharp reversals that are news driven and often short lived. The USD is due for a drop, which is usually good for Gold, but GOLD is in a 3rd daily cycle, that is often when it weakens. Throw in a FED discussion that sounded a bit more dovish and a G-20 meeting that may see Trump enforce greater tariffs on China or come to a trade agreement that is favorable, and you have more volatility, whip saw possibilities, and uncertainty. I think Fridays action will be important when deciding how much of anything you want to hold going into this weekend.

.

Chart Freak Membership

Alex has been successfully writing a daily newsletter service for nearly four years now and is considered one of the best traders of precious metals miners, energy/uranium stocks, and biotechs. This is your opportunity to join his service as a member and follow along as we enter the next bullish gold Cycle higher.

If you would like to find out more about the service or sign up, please click the buy option for more details.

Contact Us

admin@bigleaguefinance.com

Latest Blog Posts

accelerator diet pills goji berry diet pills ultra 90 diet pills keto meal replacement bar top weight loss diet pills for thyroid patients where to buy t lite diet pills keto friendly thickener diet fuel diet pills peanuts keto friendly rite aid diet pills that work envy diet pills diet pills for breastfeeding moms belique diet pills perfect slim weight loss pills calories in a bottle of white wine