Let me tell you a story about gold.

Gold has been on a run during this market correction. There is more to the story and I’d like to show you.

Before we get started, lets look back at $GDX and $GDXJ how they closed out 2018…

THE MONTH OF DECEMBER HAS NOW CLOSED, AND THERE IS NOTHING BEARISH ABOUT THIS MONTHLY CHART. THIS IS A VERY BULLISH LOOKING CHART! THIS LOOKS VERY BULLISH FOR 2019!

GDXJ MONTHLY – December has ended and this is the first Positive Month since MAY! I pointed out that down trend line last weekend, and it has been broken! Again, I see NOTHING BEARISH about this chart. 2019 Could be a very profitable year !

(The following is a sample of Alex’s work from the past week)

(1/9/19)

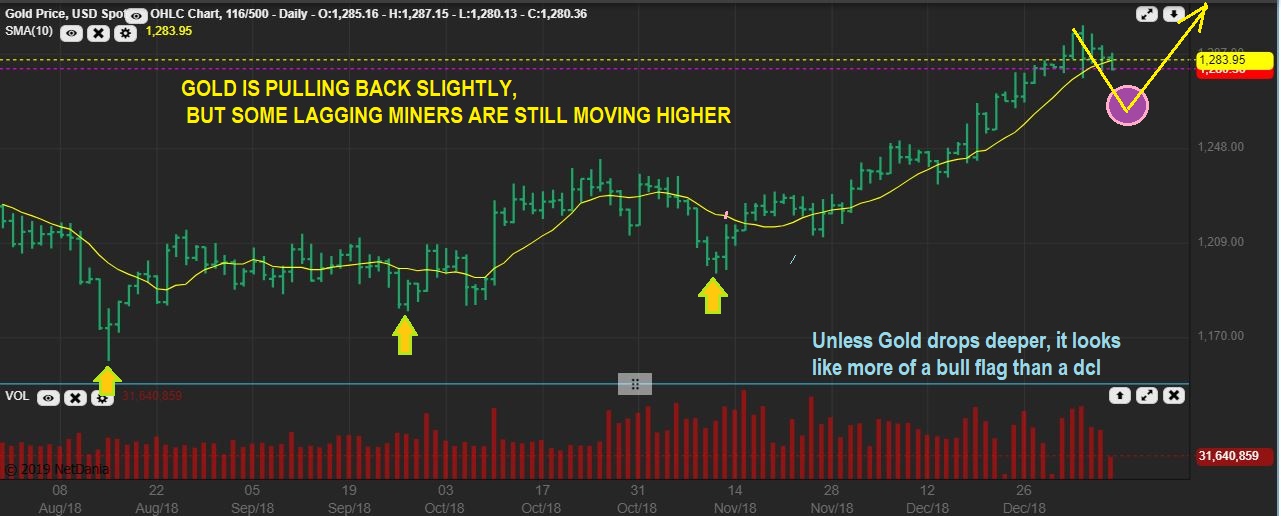

GOLD LIVE WEDNESDAY JAN 9th- Gold has been dropping, but it is mild at this point. I’d like to see more of a drop.

ALO – In December I pointed this out as a lagger that Popped and was a buy. I pointed out that these bases can actually produce a nice run .

ALO – It ran and is now Bull Flagging. I then pointed out other stocks that resemble this set up, and mentioned that they could be bought as those ‘lagging stocks trying to play catch up’ ( Advice: a small basket to avoid individual risk, and you can also use a small position size).

NGD – Here we go, JAN 3rd, a similar base as ALO was pointed out here and looking ready to go. It popped 10 % here and I was looking for a nice run to the 200 sma as possible over time.

NGD – Boom Boom Boom- it is playing catch up, even on days when GDX & GDXJ were down. So I see that as an indication that some of these will act on their own, as buyers step in to accumulate.

GORO DEC 31 – So I used this chart and said that it looks similar to ALO and NGD, but it needs a bit more sign of strength. I wouldn’t just buy a 1 day reversal, but…

GORO – It started pushing on that 50sma, and Tuesday it POPPED above it. THAT IS A BUY. GDX & GDXJ were down at the time, they were pulling back, but GORO was being bought up. This is a buy, but I did notice the DEEP RED CRASH DAY every 3 months before the base (red arrow). That MIGHT be earnings, so be aware of the earnings date.

HL – HL was a BUY on JAN 3 too. It has lagged, and it was a Silver stock still at the very lows, MACD rising. Low risk, with a stop at the lows. $2.47

HL – It started flagging sideways and Tuesday HL has a 10 % POP. Again, this happened while GOLD, GDX, and GDXJ were down. SO IF CYCLES SAY GOLD & GDX Need a pull back, maybe some of these that didn’t join in on the run higher in December (laggers or Base building) will still just do their own thing in January?

HL – It could easily run, crawl along the 50sma, and break out as shown here.

(1/11/19)

GDX – If we can get a drop, it might only look like this, but so far GDX got choppy again. Believe it or not, this is 3 weeks sideways. It is simply going sideways along the 200 sma now, and that can be a Bullish Crawl. IF GOLD BREAKS OUT HIGHER, THIS CRAWL ALONG THE 200 SMA MAY BE THE ONLY PULL BACK THAT WE SEE ALSO.

CDE – So some Miners do look like they could pull back for a buy opportunity. CDE could tag that 50sma unless it just breaks this apex higher.

Chart Freak Membership

Alex has been successfully writing a daily newsletter service for nearly four years now and is considered one of the best traders of precious metals miners, energy/uranium stocks, and biotechs. This is your opportunity to join his service as a member and follow along as we enter the next bullish gold Cycle higher.