Archive for month: October, 2015

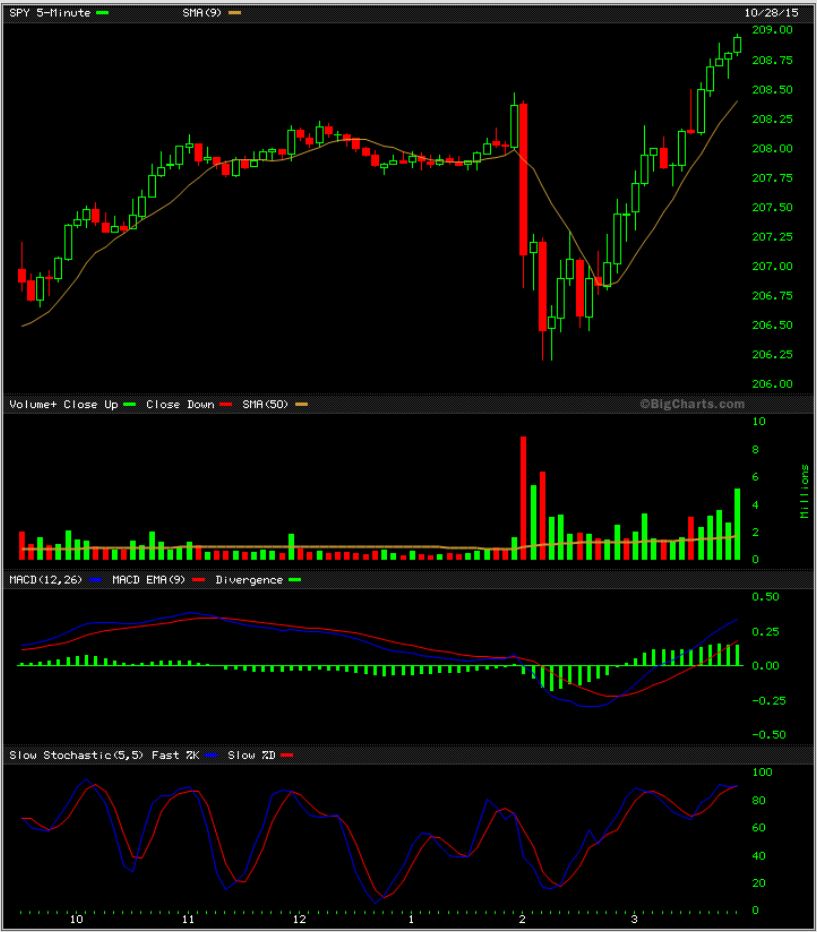

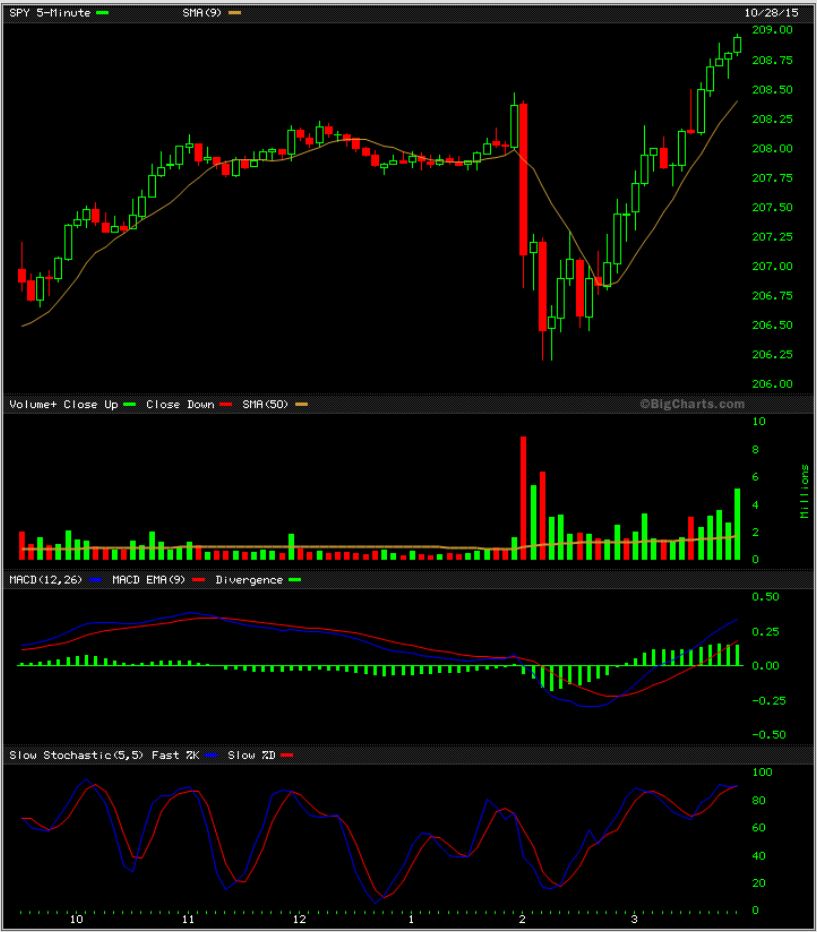

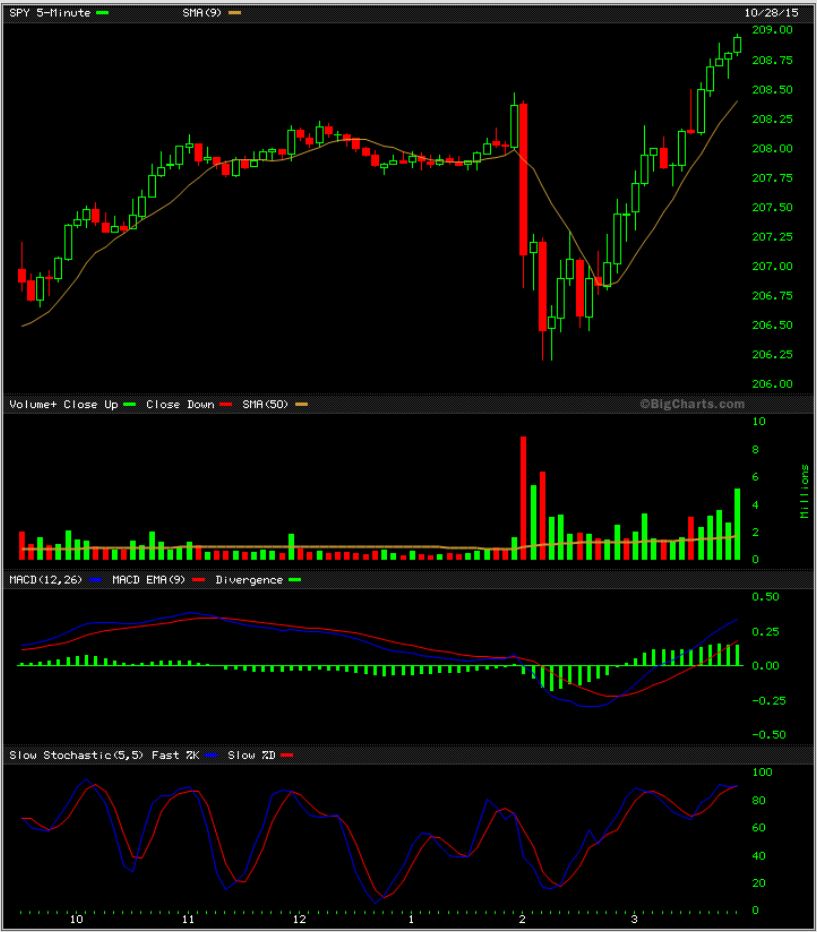

As expected, the Fed Mtg on Wednesday certainly gave us some dips to work with. We saw both strength and weakness as a result.

SPY - This was a tough dip to ride 'real time', but the markets closed back at the highs.

Read More

Read MoreWhat can I say here when we all know that charts could be quite different after the Fed Mtg on Wednesday? Lets just review some expectations.

.

The SPX, Dow Jones and NASDAQ have recovered nicely from the summer sell off, but a few areas have yet to catch up (If they are going to). I showed this rather bullish looking set up yesterday, but...

Today the TRAN , IWM, and IWC sold off nearing the close. Is it a fake sell off or is smart money heading for the exits Pre-Fed? Lets take a look...

Read MoreI’ve been hearing a lot of talk about the NATGAS plunge. It has dropped roughly from $3.00 to $2.00 since May! It’s bouncing today , so I wanted to take a look at a couple of charts and point out to members in the premium report this morning what we have before us technically. I will share 3 of those charts here.

.

Starting with a close up. ( Note: This volume was erroneous and later adjusted at stockcharts).

NATGAS has basically finished a measured move. It also broke well below the Bollinger Band, so a bounce was to be expected. A buy for a trade maybe, but will the bounce put in a higher low or could it roll over like prior bounces? It would be good to know.

So stepping back, I see that a bounce to the wedge and another drop wouldn’t be out of the question. If I was trading this bounce, I would keep this chart in mind. Prior lows in 2012 were at $1.90. and the lower wedge trend line is around that area. Lets zoom back one more time.

This chart shows that a prior Double Bottom Low in 2002 in the $1.88 area. That 2nd low on that double bottom was an undercut of $1.85, so we may see support in the $1.80’s and lower $1.90’s. $1.90’s since the 2012 lows were $1.90 shown in the chart above.

I am not trading NATGAS right now, but the bollinger band crash on Mondays daily chart was indicating that a bounce should follow shortly. Stepping back and looking at a couple of longer-term charts, we see that we either made higher lows here or there could be better support a little bit lower near $1.90. Double bottoms are common and sometimes they undercut recent lows with divergence.

I will be looking for that in the future and we may see another entry point if Natgas returns to its recent lows. If I was trading this bounce, and maybe you are, I would just keep the long term charts in mind and use a trailing stop or take profits with Fib Bounce #’s or whatever method you use to cash in on a trade. I would also keep in mind the crazy market activity that is often seen around FED WEDNESDAY and stay alert.

Happy trading

~ALEX

Not a whole lot has changed since my Weekend report. This is a week with a Fed Mtg on Wednesday, and I dont usually expect a lot of action until the deed is done. My weekend report covered a couple of different scenarios going into the Fed Mtg, so lets see how things played out on Monday.

.

$USD - 2 left translated cycles and then a strong surge higher with news from the ECB & CHINA last week. We are pausing at resistance. Is the USD waiting on the Fed?

Read More

Read MoreThe Dollar was ripping higher this week and we saw the Markets break out higher too. Oddly enough, Gold, Silver, and the Miners were staying green during that run higher too. That was different. Lets take a look at the weeks action and discuss what we are seeing.

SPX WKLY - This was pretty impressive, I expected at least a pause at overhead resistance. Notice the break above horizontal resistance / Magenta line too ( I will discuss that in a moment).

I had this chart in a report last week, to show that the SPX broke down from a long term channel and may struggle a bit ( Just a Back Test or break back inside?). We are very close to breaking back inside.

So here is what I wanted to look at next...

Read MoreDid you see the Dollar rocket higher 1.38 and not send Gold, Silver, and the Miners to their knees? Silver and Miners actually closed higher, so that was like a crazy illusion. And then AMZN reported a profit and shot up $70 in after hrs, MCD, GOOG, and MSFT are up big in after hrs after the markets already broke out higher today. Lets check out the action...

.

SPX - The SPX , DJIA, and NASDAQ broke out today, but the BIIB, IWM & IWC lagged seriously.

Read More

Read MoreDid you read my Tuesday report and the Wednesday report? Not much has changed in the way of expectations really. We could say that we are just seeing a slight variation of the same theme.

Wednesday morning I pointed out the resistance above at the close on Tuesday for the NASDAQ, SPX, IWM, etc. Even though the Futures were Green, I thought that we would drop later in the day.

NASDAQ Tuesday OCT 20

Read More

Read MoreMany sectors of the market look ready to break one way or the other. Can we gain an edge as to which way they will go, or is it just a coin toss? Lets take a closer look.

This was the NASDAQ at the close on Monday. It was pushing against resistance in various forms.

Notice what seems to have showed up by the close today...

Read MoreMany sectors of the market look ready to break one way or the other. Can we gain an edge as to which way they will go, or is it just a coin toss? Lets take a closer look.

.

This was the NASDAQ at the close on Monday. It was pushing against resistance in various forms.

Notice what seems to have showed up by the close today...

Read MoreMondays show opened up to mixed reviews.

SPX - SO far we have seen a nice move up from the double bottom lows, but there is some resistance slightly overhead.

So here is where the reviews get a bit mixed...

Read More

Scroll to top

Read More

Read More Read More

Read More

Read More

Read More

Read More

Read More Read More

Read More