Archive for month: October, 2015

Yesterday we saw some of the Energy and Mining stocks running swiftly. There are some small bases that have formed in the past few weeks, and now they may be starting a small leg up. Some had Gains of 20 % in one day, which could just be a mix of short covering and a little buying, but they may still continue higher. We'll take a look at some individual stock set ups like the one below.

SGY - A break above the 50sma, we see a possible Inverse H&S forming.

Read More

Read MorePart 2 of this mornings Gold report. I'll start with 2 charts that I pointed out recently in premium reports and in the public post yesterday, indicating some bullishness in the miners...

Sept 30 - GDX buy above the blue line and confirmation above the green dotted line . We are currently seeing that today ( we need to close that way)

Why was this important? Using only Cycles, the volatile movement in Gold and the Miners was causing concern and looked ready to fail. While using some of the indicators that I have developed to monitor internals at the lows, I was still seeing bullishness in a number of ways and technical analysis was also leaning toward bullishness, as seen above. I dug a little deeper to try to reconcile the differences and came up with this...

Read MoreThis report will only cover Gold, Silver, and Miners

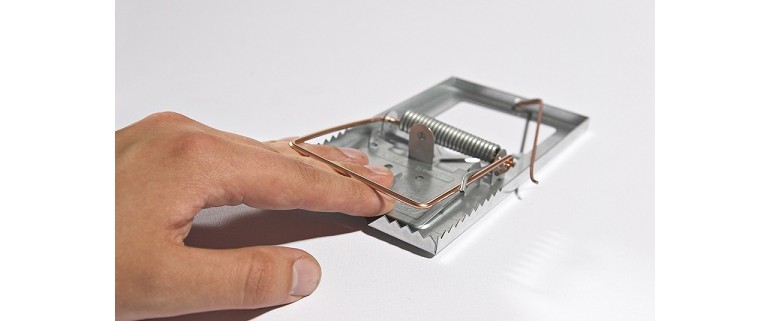

Read MoreHave you been trading Gold, Silver, or maybe some of the Miners recently? They have been quite volatile lately, with many good traders being stopped out and frustrated. I was recently stopped out last week, when some miners did a false break higher above their 50sma, only to turn down and close below the 50sma again.

That may cause some to wonder, “Is this a trap?” and “Why does this keep happening?” Others outright scream, “Bear market rally is over, down we go and soon! Go short!” Since anything could happen, I wanted to look at some charts.

ABX – Sure this could break down, but its actually sporting a bullish descending wedge, a rising MACD, and isnt it possible that we are just looking at a bottoming process?

NEM – It is struggling for sure, but is it basing out or ready to break down? It actually looks like a base is building with that divergence in the MACD & RSI. This could be building energy for a break above the 50sma.

I am writing because I do hear many people saying to short the miners for a big drop coming. At this point, I look at ABX and NEM and I see the possibility of an upside pop soon. ABX and NEM are major components of GDX, so if you were thinking of going short , I would say to stay away from JDST and DUST until the true direction of the Metals and Miners presents itself clearly.

Consider this: Not all Miners are at recent lows and ready to fall apart. Take a look at the following charts. These had their lows back in July and are currently holding onto gains. Was this reversal just a stop run?

This was yesterday when Gold was down $15

SO I am watching a number of things , including cycles and other clues to shape my view of what may be going on in the precious metals markets. I will also cover more in the premium report Friday morning. Care to join u for a month? Thanks for being here.

~ALEX

Consider a membership at the Chartfreak…it’s just $95 for three months.

The market volatility has been whip sawing people left and right. What used to look like the perfect set up falls apart in just a day or two, so having 'stops' in place has been very important. Lets take a look at the markets and then review some very interesting things that took place in the Metals and Miners area today.

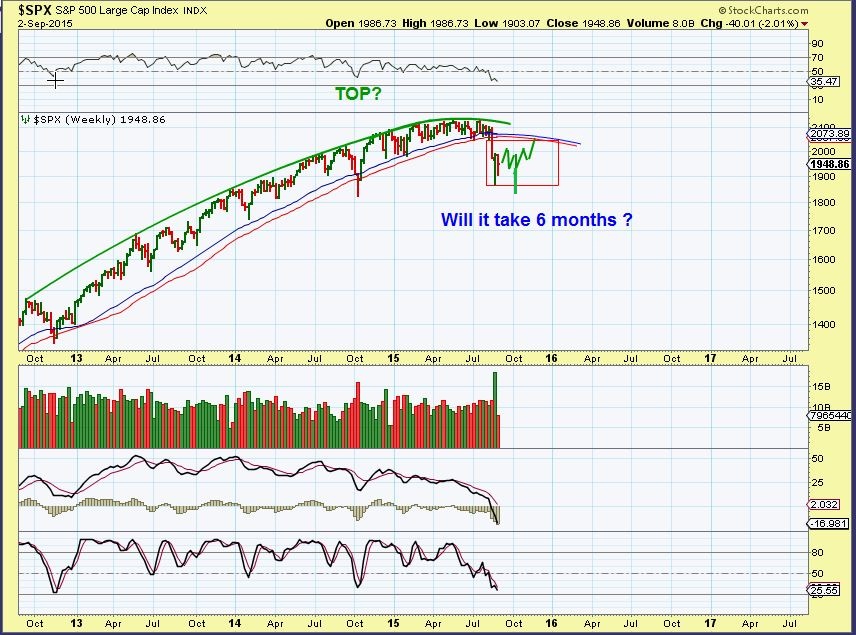

SPX- This bounce was expected.

Read More

Read More

Scroll to top

Read More

Read More