You are here: Home1 / Exclusive Strategies

I would venture to say that by now, after the past several weeks of choppiness and selling off, most if not all here know my thoughts on how things could play out going forward. It does seem that things are lining up now. let's let the charts speak for themselves. Let's get right into it...

.

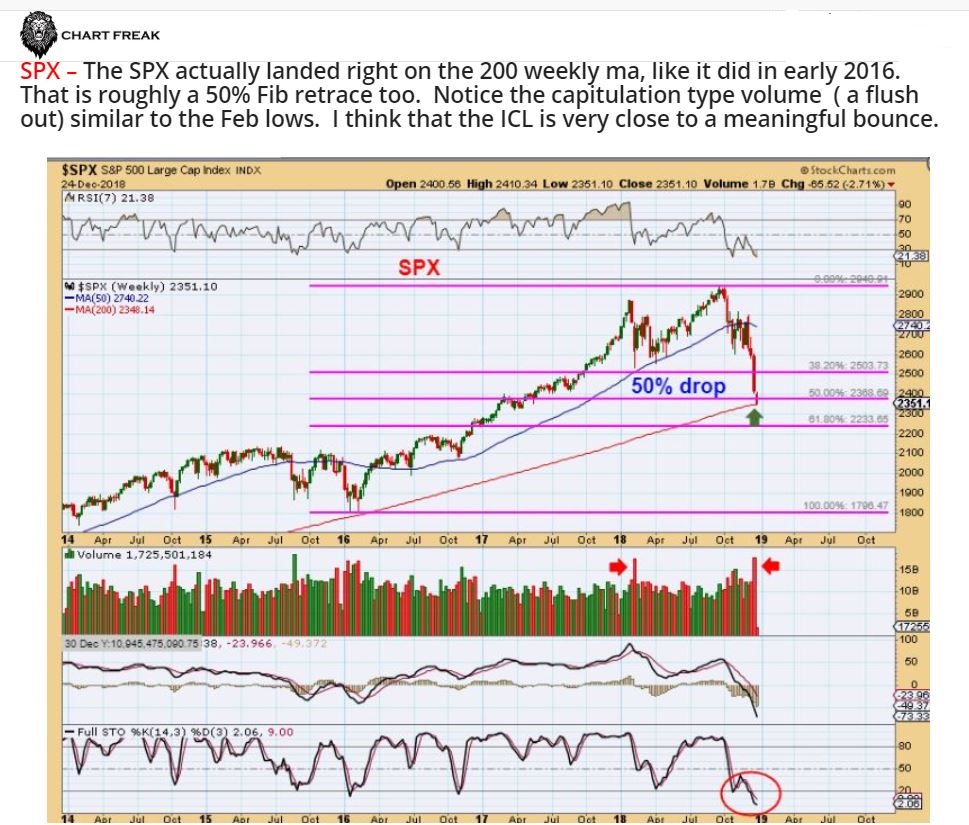

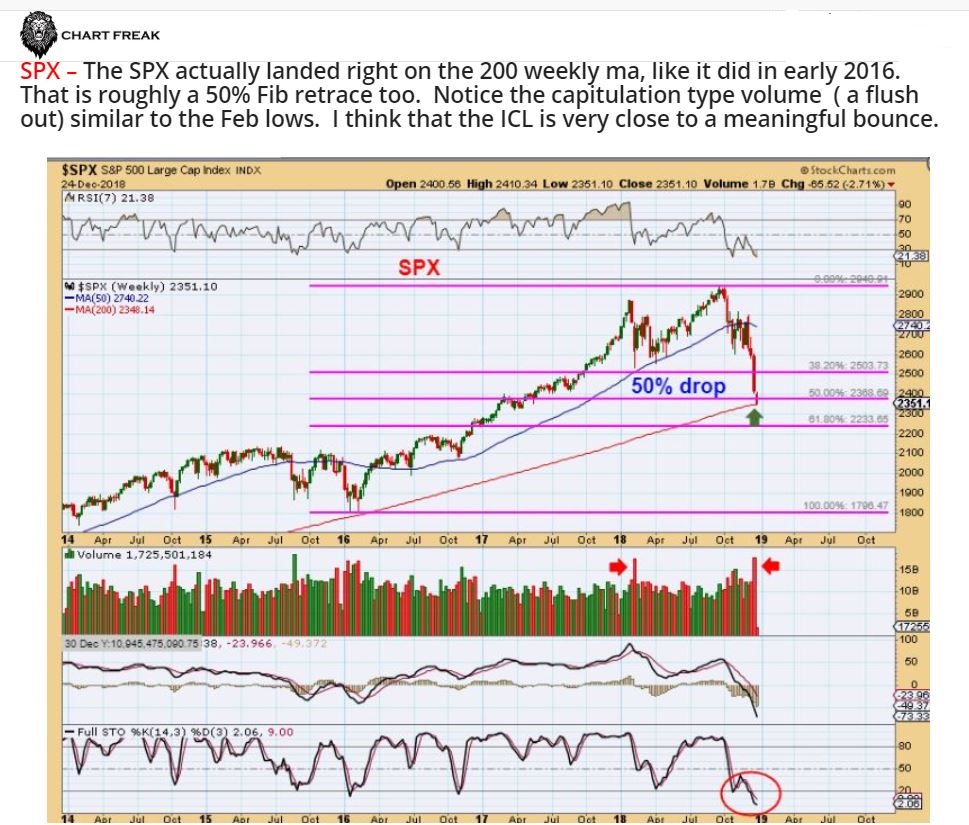

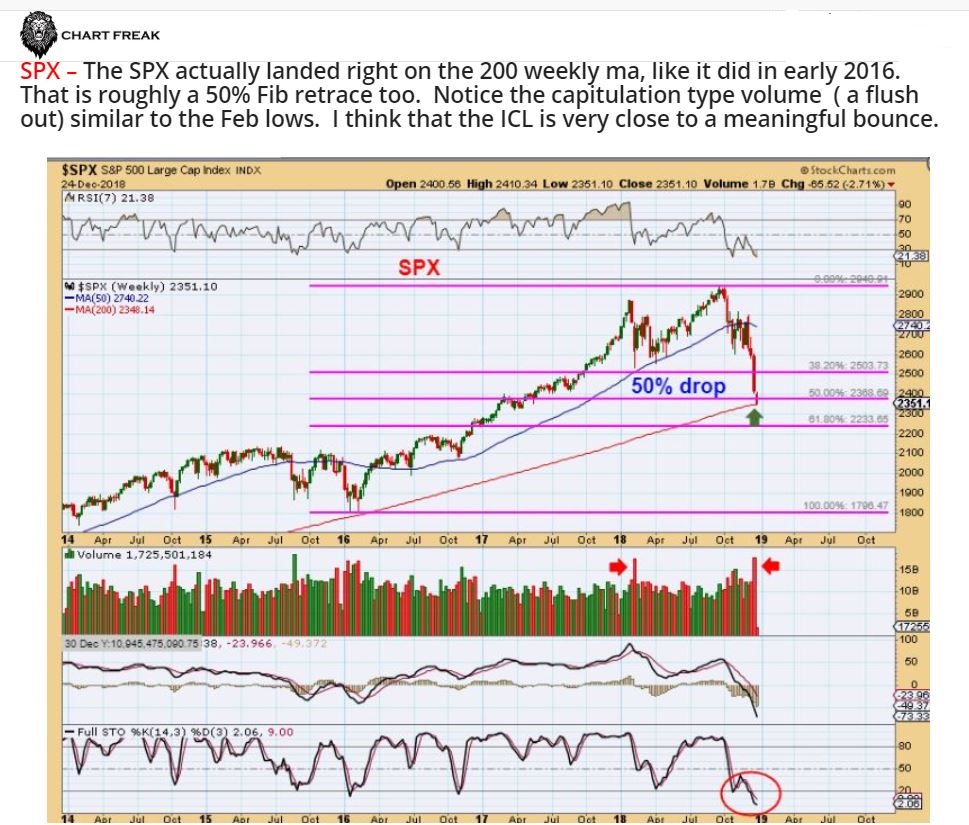

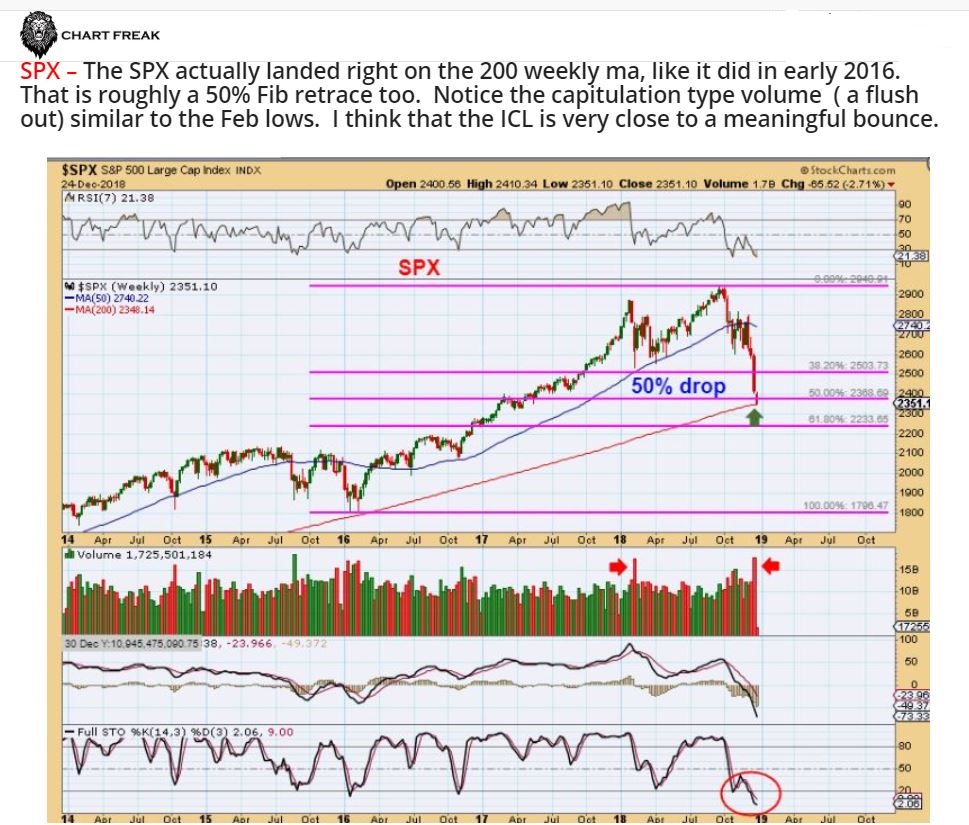

SPX - On Dec 24th, I gave several reasons that this should be the ICL that I have been expecting. I mentioned the PUT / CALL Ratio, Sentiment, etc, so a reversal here is a buy with a stop under the lows...

SPX - Capitulation volume came in on day 38, and that is good timing for a DCL/ ICL. The 3 day bounce is not even near 'Overbought".

This is where it gets important...

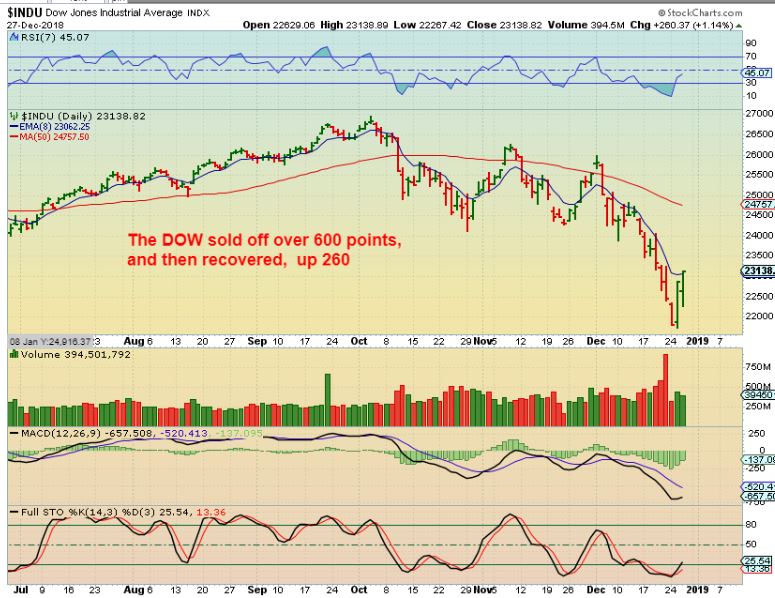

Read MoreThe DJIA was up over 1000 points yesterday! Now that's a bounce, in fact, I believe that it was the largest up day in the DJIA....Ever. I want to review what I mentioned in my last report. I had about 6 charts of the General Markets, so if you need to go back and review them all, I had a few in the beginning, and a few at the close...

.

I pointed out the Capitulation type volume, 50 % Fib retrace, the 200 weekly MA, etc . and then stated...

After that SPX chart, I wrote this:

.

" When I look at the Equity Market Sentiment ( FEAR AND PANIC), and I look at the Puts Call ratio, I Look at the cycle count, the Fib #’s, The number of stocks trading below the 50 & 200sma, and a number of other things etc etc etc, it really looks like we are very close to an ICL. I will have to watch how the first 2 daily cycle play out from there, but a snap back rally seems overdue. A 1-2 month rally in the General Markets would also fit in with a pull back for Gold into the next Gold ICL."

.

Wednesday, we saw the DJIA rally up 1000 Points! - Well, that sounds pretty awesome, but it does feel like the Dow has also been giving up about 600 every few days, so is this what we have been waiting for?

Let's discuss how things seem to be LINING UP...

Read More

Scroll to top

Read More

Read More