You are here: Home1 / Uncategorized

May 22

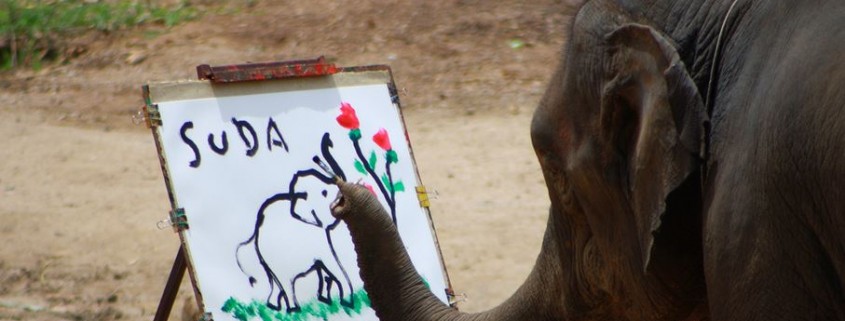

Computers are painting the charts? I'll believe that when I see Elephants painting Elephants! Oh wait- I HAVE seen that. So 'IF' they have hired a bunch of tech savvy students to run algorithms to "Paint the Charts" into forming Head & Shoulder patterns that break upwards and the MACD crossing down only to see prices spikes up after many go short, etc , then they're doing an AWESOME job in the P.M. markets. I've been Bullish ,flipped to bearish , and now I'm seeing signs of bullishness again. Lets look at the charts and then review some OTHER areas of possible trades setting up too.

$GOLD

So far, when it comes to the expected drop , they haven't been able to sell it off. PRICE , RSI & MACD in GOLD have formed higher lows so far. A close above the 50sma is Bullish I.M.O.

Read More

So far, when it comes to the expected drop , they haven't been able to sell it off. PRICE , RSI & MACD in GOLD have formed higher lows so far. A close above the 50sma is Bullish I.M.O.

Read More FRIDAY MAY 9

Hi , This is me  - Above you'll see a picture of a Bear. See the difference? I am not a bear. I just thought that I should clear that up, because after my last report I was asked , "Why are you a bear?"

Really I am not a bear when it comes to Gold & Miners, but taking things step - by - step , there was simply a little downside coming and I'm not so sure that its done yet. I DO see both bullish and not so bullish things in the charts at the end of this week, so how about a quick review.

GDX WEEKLY - Everybody is staring at this pattern, so I almost feel like it wont quite play out the way it seems...but here is how it is set up anyways. Inverse H&S. For now, I must say that a weekly chart with price UNDER THE 10WMA struggles. Notice what GDX did the past few weeks under the 10WMA.

And what does that Stochatics tell you?

- Above you'll see a picture of a Bear. See the difference? I am not a bear. I just thought that I should clear that up, because after my last report I was asked , "Why are you a bear?"

Really I am not a bear when it comes to Gold & Miners, but taking things step - by - step , there was simply a little downside coming and I'm not so sure that its done yet. I DO see both bullish and not so bullish things in the charts at the end of this week, so how about a quick review.

GDX WEEKLY - Everybody is staring at this pattern, so I almost feel like it wont quite play out the way it seems...but here is how it is set up anyways. Inverse H&S. For now, I must say that a weekly chart with price UNDER THE 10WMA struggles. Notice what GDX did the past few weeks under the 10WMA.

And what does that Stochatics tell you?

And there is more...

Read More

And there is more...

Read More MAY 7 (Intraday thoughts)

Lets not find out the hard way. When Gold / Miners are acting correctly , Trading can be profitable. Have you ever traded them when they get caught up in a sell off though? I mean a REAL SELL OFF? They pick up speed and start defying support levels , Moving avergaes, over sold markers, and so on. We may be starting one of those now, so I wanted to point out a few reasons why I think that that may be.

GDX DAILY - we just lost support of the 10 & 20 sma this morning. That was my line in the sand, especially with the Stochastics overbought and the R.S.I. rejecting 50 again (REMEMBER- THIS WAS JUST AFTER THE DOLLAR WAS GETTING CRUSHED YESTERDAY).

I was holding JNUG, but flipped to JDST this a.m.--I believe we may see Metals / Miners accelerate in their selling - lets discuss why and look at a few POSSIBLE targets along the way.

Read More

I was holding JNUG, but flipped to JDST this a.m.--I believe we may see Metals / Miners accelerate in their selling - lets discuss why and look at a few POSSIBLE targets along the way.

Read More SUNDAY MAY 4 7 Charts Update on Metals/Miners

I'm still short term Bullish, long term 'Cautious'. We have to be. The charts are shaping up nicely, but I'm always open to further lows into the Summer months. This caused me to want to look at Mostly weekly charts for this update. I want to keep commentary fairly brief and let you allow the charts to do the talking.

GDX WEEKLY- Notice how it Lost the 30WMA in the fall of 2012. It has regained and remained above it. It is something to watch. Will it hold Or will a perfect Inverse H&S form into the summer??

Read More

Read More APRIL 26 (Saturday Update added here)

In Trending markets, investing with a bias can be profitable. At other times, however, like possible turning points or periods of volatility, you have to be willing to change direction FAST and Leave out any BIAS until direction is established. That said, lets quickly review the recent action in GDX.

After a nice Dec to March Bull run in GDX , we got a false break out and an Impulsive drop. A tag of the 50sma & rejection (while Gold was up & $USD was down) alerted us to go short. THIS CHART shows that I thought we were in for another impulsive wave down.

THAT was April 14th, the Short was profitable. Since then, my April 25th report (which can be read following this one) showed that GDX is possibly morphing into a long position? I went long and here is my update of GDX from Fridays close---

Is is smooth sailing yet???

THAT was April 14th, the Short was profitable. Since then, my April 25th report (which can be read following this one) showed that GDX is possibly morphing into a long position? I went long and here is my update of GDX from Fridays close---

Is is smooth sailing yet??? .....

Read More

.....

Read More APRIL 15 Some see a BULL, but look closely , some see 2 men arguing whether its really a Bull. Well ,if you follow me on Twitter you know that for a short while now I have posted charts calling for a drop in GOLD & especially the Miners GDX/GDXJ. I still think the GOLD Bull is alive, but even strong Bull markets experience healthy corrections to lower sentiment and kick out the weaker hands.

In calling for a drop here, I have had a few Gold Bulls say that we recently had a 'double bottom', so another drop here and the Bull could be over. I was also told we'll crash thru last Junes lows , because "There is no such thing as a double bottom"!

Well, I found something that blew my mind  and I wanted to share it with you. PLEASE STUDY & MEMORIZE THE SHAPE OF THE GOLD (GLD) WEEKLY CHART BELOW. FOLLOW 1-5 on the right hand side, before moving on ...(Click chart to enlarge)

and I wanted to share it with you. PLEASE STUDY & MEMORIZE THE SHAPE OF THE GOLD (GLD) WEEKLY CHART BELOW. FOLLOW 1-5 on the right hand side, before moving on ...(Click chart to enlarge)

The RUN UP, the TRIANGLE, the false break upward, the drop thru support, the double bottom...

-if we drop again, MUST WE CRASH THRU JUNE 2013 LOWS?

-Is there really "NO SUCH THING AS A TRIPLE BOTTOM"??

Read More

The RUN UP, the TRIANGLE, the false break upward, the drop thru support, the double bottom...

-if we drop again, MUST WE CRASH THRU JUNE 2013 LOWS?

-Is there really "NO SUCH THING AS A TRIPLE BOTTOM"??

Read More APRIL 11, 2014 - Please review my last report , it basically is still quite valid. I had some possible downside targets that havent been met yet (For ex: QQQ could visit the 200Sma), however with 'bounces' along the way and the "Should I 'Buy The Dip'? mode firmly in peoples minds- is it really just a roll of the Dice?

No. BUY-SELL-HOLD is still a personal decision based on your trading/ investing goals...and our Energy & Steel trades from weeks ago are still green, but for others - Tech stocks/Momo trades are a mess. Lets review a few charts ...

Nimble Traders can look for lower risk entries based on probabilities ( like oversold areas and trendline/moving average support,etc) but in waterfall sell offs , even these can fail and one should not trade heavy sell offs unless they can monitor their trades intraday.

Read More

Nimble Traders can look for lower risk entries based on probabilities ( like oversold areas and trendline/moving average support,etc) but in waterfall sell offs , even these can fail and one should not trade heavy sell offs unless they can monitor their trades intraday.

Read More Well, to be honest, I got 2 requests on the Markets in general, but they are just as important to me  The Question was , "Did you see a pullback in the Markets approaching and is that why you moved to the Energy Sector? If so, what did you see?"

The answer is ,

"I did think the markets were toppy and in need of a pullback, and I expect a bounce soon, but It does not look like the downside is complete so far. (Recall my chart 2 posts back saying "Sell in May, Go away?").

The second part is , "No, I just entered the Energy sector because using tech Analysis, it was still 'set up properly'. It also did withstand the heat recently."

Here is what I was looking at on March 21 . There was weakness in BOTH the weekly and daily charts

The Question was , "Did you see a pullback in the Markets approaching and is that why you moved to the Energy Sector? If so, what did you see?"

The answer is ,

"I did think the markets were toppy and in need of a pullback, and I expect a bounce soon, but It does not look like the downside is complete so far. (Recall my chart 2 posts back saying "Sell in May, Go away?").

The second part is , "No, I just entered the Energy sector because using tech Analysis, it was still 'set up properly'. It also did withstand the heat recently."

Here is what I was looking at on March 21 . There was weakness in BOTH the weekly and daily charts (

$1800 target?)

Read More

Read More While the Nasdaq was busy Selling off hard Friday, bleeding in earnest with high volume (See QQQ chart below) , and all the MOMO stocks like PCLN, AMZN,NFLX and other market darlings were being thrown overboard last week, something odd was also happening...

Read More

Read More

Scroll to top

So far, when it comes to the expected drop , they haven't been able to sell it off. PRICE , RSI & MACD in GOLD have formed higher lows so far. A close above the 50sma is Bullish I.M.O.

Read More

So far, when it comes to the expected drop , they haven't been able to sell it off. PRICE , RSI & MACD in GOLD have formed higher lows so far. A close above the 50sma is Bullish I.M.O.

Read More So far, when it comes to the expected drop , they haven't been able to sell it off. PRICE , RSI & MACD in GOLD have formed higher lows so far. A close above the 50sma is Bullish I.M.O.

Read More

So far, when it comes to the expected drop , they haven't been able to sell it off. PRICE , RSI & MACD in GOLD have formed higher lows so far. A close above the 50sma is Bullish I.M.O.

Read More

- Above you'll see a picture of a Bear. See the difference? I am not a bear. I just thought that I should clear that up, because after my last report I was asked ,

- Above you'll see a picture of a Bear. See the difference? I am not a bear. I just thought that I should clear that up, because after my last report I was asked ,