You are here: Home1 / Public

Back in Dec, I noticed some interesting activity in the charts of 3D printer stocks, and pointed it out in my reports. Often after a large sell off, when selling gets exhausted , you get a period of short covering. Sometimes that can turn into a mini rally, but the inevitable pullback is to be expected . What can we look for then? Is there a way to tell if they are a Buy? Lets review:

I noticed a strong high volume POP in VJET

SO I decided to look at other stocks in that sector and see if anything was interesting ...

Read MoreThe following is a portion of a ' Premium Report' put out Monday Jan 26. This is only 1/2 of the report, but should be helpful . To be honest, I initially only made small profits on some of these trades at first. I had to leave town after the New England Storm , and since positions are volatile at the lows , I cashed out & re-entered later when I could monitor them. I 've added a few updated charts too. Enjoy

JAN 26 ,2015

Let me start by showing you an Energy stock that got taken out to the whipping post. It is beaten down and has double bottomed. It seems like all of the downside ( At least for now) has been met. Risk reward is skewed toward less risk (Using stops) and more upside potential if conditions play out. Some of these stocks could just "Bounce" and do very well.

EXXI WEEKLY - Double bottom with a MACD cross? $2.60

Read MoreI have to be honest, I was recently looking at the markets and thinking that the apparent weakness was going to prevail. Recently I've been staring at the SOX and something is starting to pop out at me. let me explain...

I had mentioned to my readers back in DEC that I thought I saw internal weakness in the markets. As the markets began to weakly bounce & Roll over, I then posted this chart JAN 6 and mentioned that though I expect a bounce here, I thought we may 'fail " at the 50sma. BUY THE DIPS might not work, and possibly a short set up .

By Jan 21 the weak bounce had played out, I began to think we may get a good shorting opportunity, but wait for that ECB mtg.

But then I saw those SOCKS! No, not the multi colored array of Socks above, I mean ...

Read More

Here at CHARTFREAK.COM, we have been all over the buying of Miners and Metals related positions for many weeks now . Since pointing out the lows in Gold in Early Nov, some miners have gone up over 100% . It has been profitable, but Some were a little concerned about SILVER lagging. What did I think of that? Was it concerning to me ?

No. I posted this chart for Jan 12 showing prior “POPS” in Silver and pointed to a proprietary indicator that I have developed that was indicating that-

“SILVER IS ABOUT TO POP”

I actually immediately recommended USLV on Jan 12 with this chart at $22.23. It hit $28+ today.

As for GOLD , I said I loved this Weekly chart on Jan 9… and couldnt believe there were still naysayers. This was a strong set up.

I loved this even more on Jan 16, when our follow through was evident. Is this move done?

My Dec 26 targets are playing out – I was so alone then ; )

1st target $1275 (done) , and then $1320 to $1330- can we still get there? We do have an ECB mtg this week.

GDX WKLY There are resistance points, but so far the Miners have done a nice job of cutting through them.

Why? Because GG & NEM have broken out and make up a good part of the GDX ETF .

Look at what GG alone had done on a wkly basis in January

ABX was lagging and some were concerned about that, I liked the set up a lot

I called it a BUY at last Thursdays close on this chart . Looked ready to break that 50sma . It did Friday, and today is over $12.55 only 2 trading days later.

I put this in my weekend report. This is how it closed Friday – LOTS of buying & or short cover off those lows (Cup & Handle)

We will get pullbacks in Miners along the way. We have an ECB meeting later this week that can affect things too. Will they be buying opportunities or another bear mkt rally ending? I will have to wait and see how things unfold. Why not sign up for 1 month and join us if you need any help navigating these markets. We have done very well so far and you will gain immediate access to all previous reports as well as future reports. I occasionally post here on the public site, so thanks for being here , I hope this helps you to also see what we have been seeing and trading.

~ALEX

I posted for the public blog in Nov & Dec many times that I was expecting a strong move in Metals and Miners. It was Very unpopular and many were ( Understandably) quite nervous about entering and holding any positions, especially over the weekends. Others doubted the idea all together. In the premium strategies section of this site, I have been recommending Miners with proper 'Set ups' that were projecting strong moves higher and I was also giving strong reason in both Nov & Dec that buying then would pay off going forward. Bases were being built and could move up at any time. Still, it wasnt easy back then at the lows.

Some Miners have done very well since then. People are gaining confidence that maybe the move could be profitable for them too . Let me show you what we here at chartfreak have been looking at.

IAG , CDE , HL, AG were just a few that were recommended early on .

IAG ran from $1.40 to $2.50 and consolidated for a while. It ended up moving 100% off of the lows already. Last week it pulled back and reversed at the 10sma. These leaders are looking good and acting correctly , which adds confidence to our holding positions.

To further add confidence to the possible moves, lets review another set up recommended here .

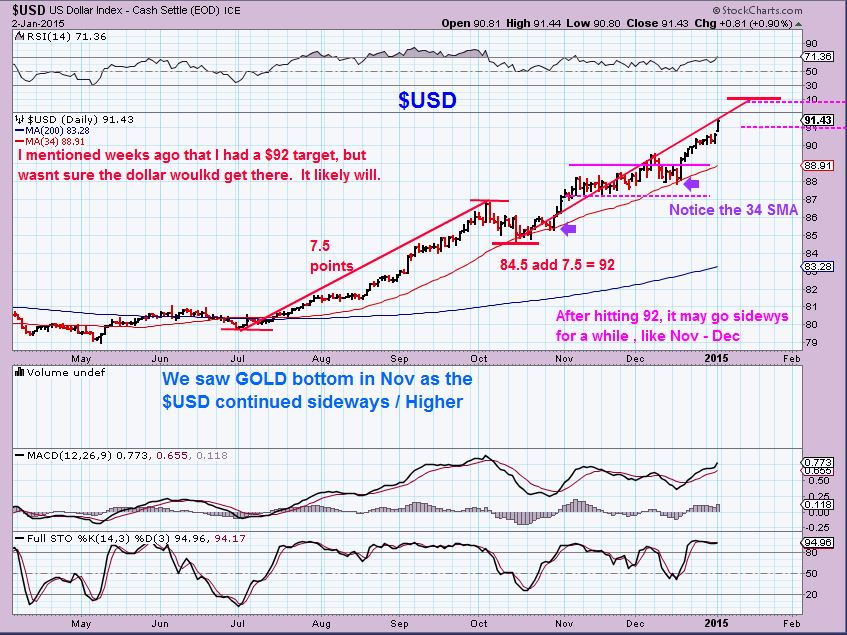

Read MoreI have been watching the various markets intently , examining internals and how they've reacted under similar circumstances in the past to try to get an idea of what to expect . I think that I have done rather well with the general markets and Metals and miners, but I must say...there are some extremes in some areas that I have just left alone until I get a clearer idea of how things may unfold going forward. What am I referring to? Well, specifically the ENERGY sector with OIL and NATGAS has been a little tricky, and of course the $USD has been very strong - now even higher than I anticipated. lets take a look at those areas. They that have been difficult to call, for Sure.

I know what I "Guess" they could do, but when it comes to putting advice in my premium reports on these sectors, I have decided to just wait until things clear up , and focus on some other very trade-able areas.

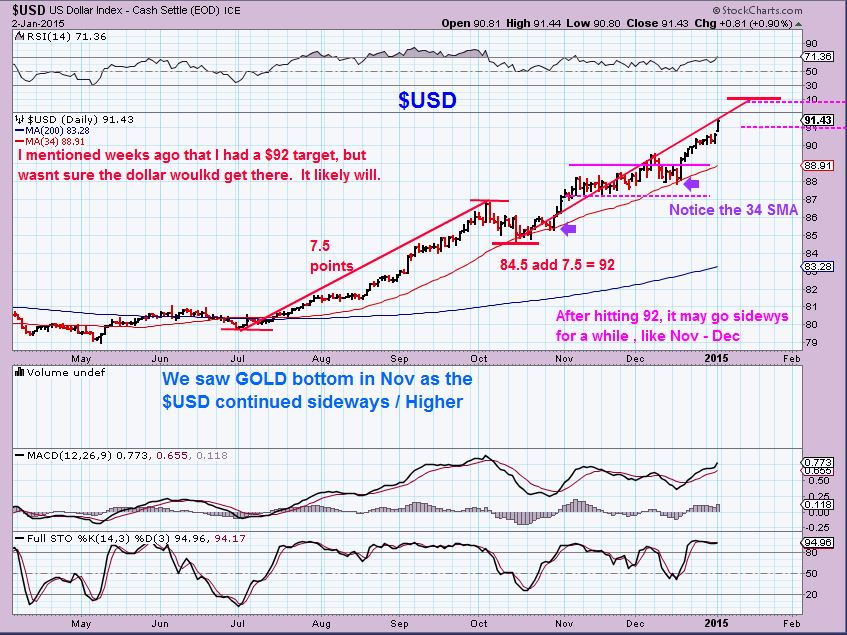

I expected the $USD to stop in the $92 area. ( Actually, I had that as a target, but I thought it may not make it there, I mentioned that it could roll over near 91 because GOLD began completely ignoring the $USD strength. I assumed GOLD was sniffing out Dollar weakening).

I posted this chart Jan 2- $92 target

Then on JAN 5 , I noticed this ...

Read MoreReal Strength and Real Weakness.

In Humans , sometimes strength & weakness can show up as obvious, seen by outward appearance alone. In some cases, however, it may require an X-Ray to peer inside and see how the internals are doing. Its really the same with the markets. A Rally can appear strong, and yet inside it may show evidence of weakness , and visa-versa can be true too.

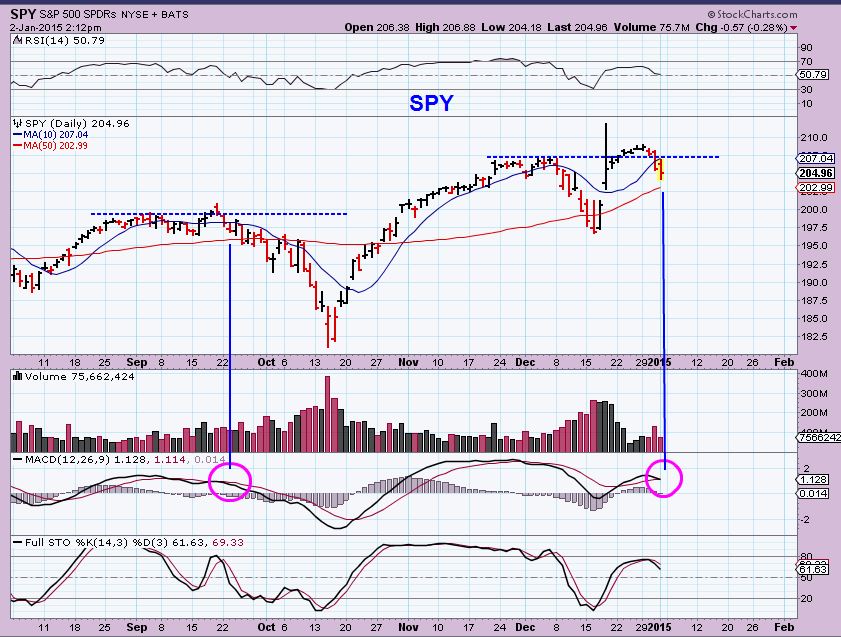

I know many felt that the year end 'Santa Rally ' , as it is often called at the end of the year, looked like a strong continuation of the rallies that we are used to seeing lately. Here at Chartfreak, I was mentioning to my premium readers that under the microscope, the rally looked to be weakening to me. I thought that we might actually see some rolling over and possibly even some selling into 2015. For how long? We will know soon enough, but notice what I was pointing out to my subs last week.

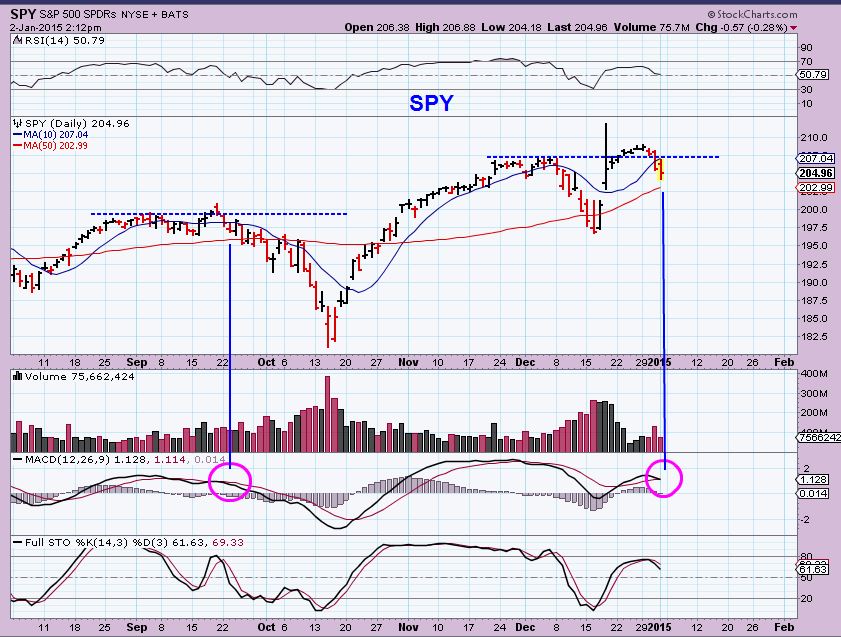

THE SPX was falling short in some of its 'internals'- It looked weak to me as it was breaking out. I thought it might actually roll over after breaking to new highs, like it did in September.

SPY NOW ( Broke with weakness & fell back)

To me the QQQ looked even weaker...

Read More( This post was written Friday a.m. Dec 26)

Have you ever seen those artists that do 'Chalk Art' along the sidewalks of public streets? They amaze me and at times you just cant believe your eyes. I find myself asking ,

"Is what I am looking at real?" Well lately, many are saying the same thing when they look at the Gold / Silver markets. I have been reporting since Nov 5th & Nov 7th that GOLD was putting in a meaningful low (At least a temporary one). See my Nov 5th report here - http://www.chartfreak.com/afraid-alert/

Looking at the chart of GOLD , you can see that the Nov lows have held and this is with the $USD at new highs!

$SILVER also has shaped up nicely in the past couple of months ...

Read MoreWhen I was a kid, I used to really love playing on the swings. Then when I grew up I found that I still love to play with the swings. ‘Market Swings’ ! They can actually be profitable to an investor or trader, because they may afford a low risk entry with potentially more upside than downside risk. The problem is…They can also fall apart. No one wants to swing on a swing thats prone to fall apart. Can we know when a swing is invest-able and less likely to fail? What can help us to identify a proper swing verses a swing that might be prone to breaking down? Since I’ve been trading for years in various sectors, I would say that Experience , Training , and researching with a keen eye have helped here at Chartfreak. Under the “Strategies” tab I have a premium report discussing just that subject in Gold / Silver & Miners. I will share a little of the thinking there…but the details obviously need to be reserved for paying members.

GOLD WEEKLY (Today , Golds daily chart looks lame. The weekly chart could look bullish or bearish as of yesterday, but it swings lower)

The $USD was a rocket yesterday, Swinging up over one Dollar! Todays follow through seems to be hindering GOLD & SILVERS progress.

Then why are GDX & GDXJ green? WHAT ARE THESE SWINGS? Is it just an oversold bounce, about to tank with the metals? OR Are Miners leading GOLD here?

Even individual Miners ( like MVG) have interesting Swings taking place. MVG , a Silver miner , was swinging up higher yesterday as the $USD was up over a buck. Thats odd.

Today it reached resistance, and Gold & Silver began to sell downward- is it DONE? A broken Swing ready to fall apart with the Metals soon? Or could it possibly pullback to gain some strength & then break out higher?

I do think that I have a good idea of whats going on in Metals and Miners right now . I do feel that things are lining up for a decent move in one direction or the other, and that it could be profitable to take positions soon. Its in today’s report under the strategies tab for paying members. To get my thoughts on the matter and see things the way that I do, you can sign up for a 1 month subscription under the ‘strategies tab’ and see my analysis on Metals / Miners / SPX / IWM / in todays report and also I had an Energy report Tuesday referring to XLE & ENERGY being pssibly at the lows Monday . I personally believe that you will be able to more than make your $37.95 back on 1 good trade, if things play out the way I feel that they will.

Even if you cant sign up, Thanks for stopping by and I appreciate your being here and reading along. I will post publicly from time to time , so check in frequently under the ‘blog’ tab / strategies tab for premium content. Also you can Sign up for our free email alert service & be directly notified whenever I post. Thanks again for stopping by.

~Alex

Today is a day full of reversals. The question is , with the FED MEETING tomorrow , will they stick?

Some like OIL & ENERGY seem to have been put in with conviction, if they close here.

Sure- some of the energy stocks are up 15 – 20 % , but in recent days they’ve giving false signals . Oversold POPS and 1 hit wonders. For example we have :

EXXI

SFY

So is there a way to know if the lows are really in for energy ? Cycles are giving a strong clue and a few other areas may help us to identify the answer to that. I just posted a premium report discussing the possibilities in ENERGY.

I had posted this chart on DEC 10 of a target for the pullback that I expected in the markets.

Today we are there with a reversal.

The question is…With the FED MTG tomorrow is it safe to assume that this reversal will hold?

We did do a reversal before in the QQQ in Sept / Oct and in similar fashion, but it failed into a sell off. In fact, the Q’s are selling down again now (See below) .

And the VIX is looking kind of strong

And of course, lets not forget about our GOLD & MINERS . They are also reversing ( repeatedly) , whats going on there? I have been tracking that closely since Early Nov too. It has had curve balls and surprises too, so should we be concerned? Will Gold rally or will the FED kill it? Is it still acting correctly since making lows in Early November ? Or do signs of weakness show that it’s about to fall apart on FED DAY? Again, I am covering that in the premium section under the “Strategies” tab. Things are rocking & rolling, and even the reversals keep reversing. These are , for sure, tricky markets. The FED MTG is tomorrow and things may get a little clearer after that.

I will post here from time to time, but I have to be fair to those paying members and keep some of the information set aside for premium content. If you’re not already a member , I invite you to try a 1 month membership and see if the market analysis in the premium reports can help you to at least see the markets in a different light. Maybe navigate them a little better. It’s Less than the cost of a cup of coffee/day (Well, Mc Donalds may have me beat there)  . Thanks for reading along.

. Thanks for reading along.

~ALEX

Scroll to top