Author Archive for: Alex - Chart Freak

About Alex - Chart Freak

I’ve been a full time trader for well over a decade and began trading in the late 1990s while working in management and sales at a well-known aerospace company. As my style evolved, so did my success, and it allowed me to leave corporate America to pursue my passion and trade full time.

Entries by Alex - Chart Freak

April 25th – Staying In Focus

April 25, 2019 in Premium /by Alex - Chart FreakToday I really want to Focus on the precious metals, so after a very brief review of a few other sectors, we'll get right to it...

.

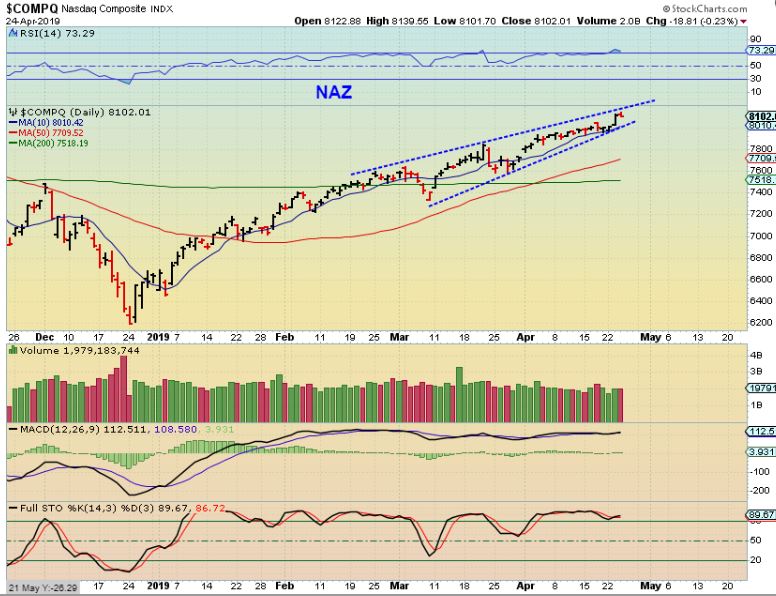

NASDAQ - Nothing changed with the General Markets since yesterdays report.

Wednesday April 23rd

April 24, 2019 in Premium /by Alex - Chart FreakTuesday April 23rd –

April 23, 2019 in Premium /by Alex - Chart FreakEven though only 1 day passed since the weekend report, we do have a lot to cover, so let's get right into it...

April 20 Weekend Report

April 20, 2019 in Premium /by Alex - Chart FreakTo the joy of many readers here, we are finally getting some of the sale prices on Miners that we have been expecting for a while now. Let's take a look at our weekend review and see how things stand after this 4 day trading week...

.

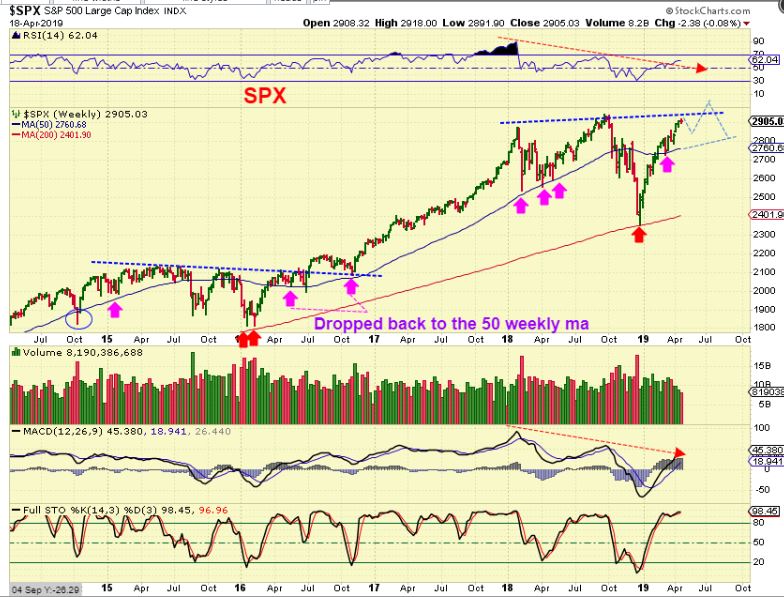

SPX WEEKLY - We are coming due for a pull back cycle-wise. In the past, we have seen pull backs drop to the 50 week ma, as shown here.

1. It could happen at the next drop to a dcl, or

2. It may happen after a small drop to a dcl and then a break to news highs that rolls over, as shown here.

Let's discuss this a bit further...

Thursday April 17th

April 18, 2019 in Premium /by Alex - Chart FreakFriday is a holiday and the markets are closed, so today is the last trading day of the week. Earlier this week I had mentioned cycle counts and a possible bearish rising wedge, so 'tighten stops and stay alert' was the thought for the General Markets at that time, but now? It may be time to consider 'Safety First'. Let me explain...

.

XBI #1 - This was the XBI ( A Biotech ETF) Tuesday. It landed on the 50sma and also had the support of the 200sma below it.

XBI #2 - This was the XBI on Wednesday, the very next day. Look at that volume and how easily it sliced right through both moving averages. If that is some kind of warning of what might be coming in the rest of the markets, we better be listening.

Wednesday April 17th Trading

April 17, 2019 in Premium /by Alex - Chart Freak

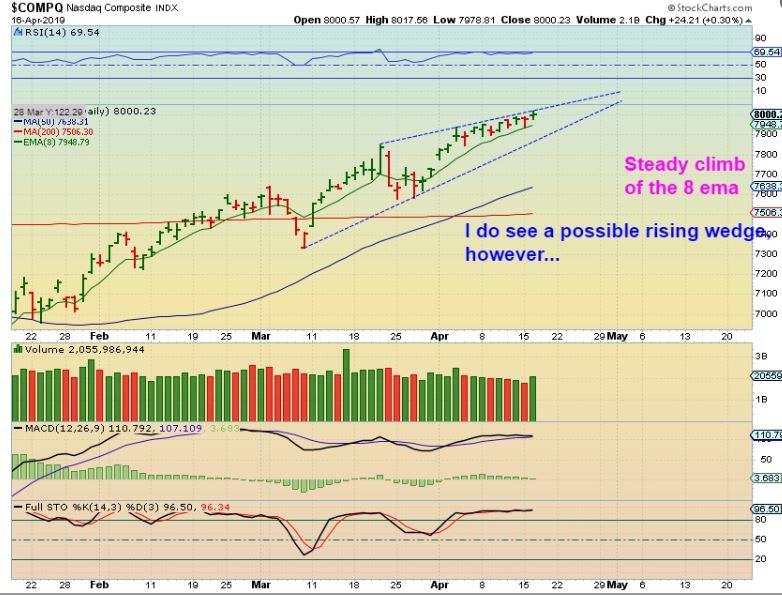

NASDAQ #1 - The NASDAQ has been climbing along the top of that 8 ema ( or 10sma) Bullishly.

Tuesday April 16th – Observations

April 16, 2019 in Premium /by Alex - Chart FreakThe General Markets should have a little more upside, and if you are willing to ride the dips and just hold current positions, you can use a reasonable stop. If you hate losing any of your gains, it might be wise to tighten stops and keep an eye on open positions. The markets have been running strong and pull backs have been fairly shallow, but it is looking like we could be due for another pull back soon. Let's review what we have...

.

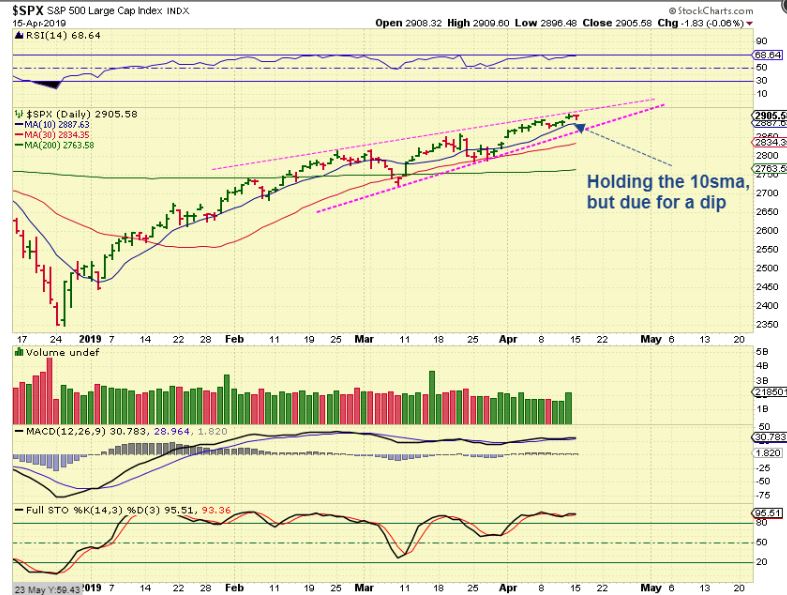

SPX - The bearish rising wedge has been moving closer to the Apex. This is at least shorter term bearish. It doesn't call for a crash, but it does signal a possible pull back may be coming soon, and...

April 13th Weekend Wrap Up

April 13, 2019 in Premium /by Alex - Chart FreakLets get our Big Picture View in the weekend report, the weekly wrap up.

.

SPX WEEKLY - The SPX continues higher, and will likely meet the 2018 highs, whether that happens now or whether we get a pull back to a dcl first, and it happens on the next daily cycle. This current daily cycle seems to be a right translated Daily Cycle, so the next should pop to new highs again. So far, this remains set up bullishly in the big picture, even if we get a short term dip.

Friday April 12th

April 12, 2019 in Premium /by Alex - Chart FreakContact Us

26 Broadway,

8th Floor

New York, NY 10004

admin@bigleaguefinance.com

admin@bigleaguefinance.com

Latest Blog Posts

accelerator diet pills goji berry diet pills ultra 90 diet pills keto meal replacement bar top weight loss diet pills for thyroid patients where to buy t lite diet pills keto friendly thickener diet fuel diet pills peanuts keto friendly rite aid diet pills that work envy diet pills diet pills for breastfeeding moms belique diet pills perfect slim weight loss pills calories in a bottle of white wine