AUGUST 29th – Here Again

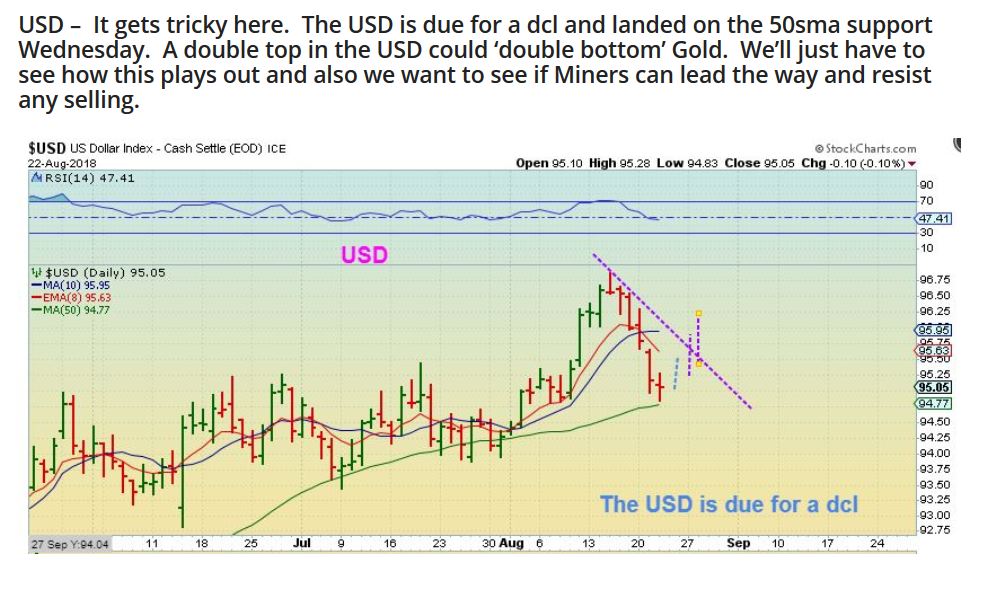

1. Last Night I mentioned to my readers that I was seeing a drop in Gold coming. Gold was at $1212, and I posted this chart saying that we could see a drop to $1200. That is not a big deal, but we are waiting for a short cover rally, so apparently we had to 'expect delays'...

2. The drop started here, and I posted this in the comments section. Again, not a big scary concern, just Expect delays..

Let's talk about Gold $1200