You are here: Home1 / Uncategorized

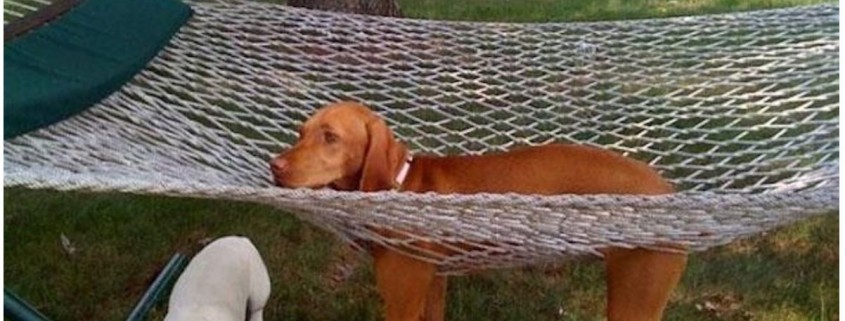

June 26, 2014 As I start writing this at 8 a.m. EST, Gold has dropped to $1305 - This is what I'm hearing now , "Horrible GDP numbers and Gold dropped? Man that's weak!" or "War in Iraq, unrest in the Ukraine, Why is Gold Dropping? Time to go short people!!" I'm just here to say that, like that picture above, everything you see isn't what it appears to be unless viewed in the right light. This GOLD DIP was expected. The lows in June 2013, Dec 2013, and May 2014 were expected. So WHAT is expected with this current dip? Time to short? Or buy the dip? -Charts-

Gold on June 20 - I pointed out 2 possible targets of support (this WAS in my last report, the pullback WAS expected)

But again, Go short or buy the dips? ...

Read More

But again, Go short or buy the dips? ...

Read More June 23, 2014 When you look at various movements in Nature, it is amazing (and educational) to see how things move. Fibonacci still intrigues me to no end and the Ebb and Flow of liquids can be powerful and yet graceful at the same time. Its the same with the Stockmarket when certain areas surge forward. Sometimes what looks like Big Splashes can be just Ripples in the Pool , one of many repeating waves of movement.

While I had planned on writing about Gold/Silver stocks, I want to address the recent movement in the Miners , since I received a couple of private emails with people concerned that the move is only' short covering' and just too steep. It appears to be unsustainable and will it crash soon? So readers wonder 'Should I enter?' 'Will it pullback?' and so on. I'm not sure if anyone knows those answers, but I ALWAYS look to the markets to find clues. Lets start with SILVER/SLV. First thing we see is...The DREADED GAPS! Wait to buy the gap fill?

Is it possible that the GAP wont fill now? It is...

Read More

Is it possible that the GAP wont fill now? It is...

Read More June 20, 2014 Well, I have been mentioning in MAY that I was expecting a "MEANINGFUL LOW" (an ICL in cycle terms) in GOLD SILVER & the MINERS. As expected, what an explosive move since I last wrote! GDXJ has been amazing and some of the MIners stocks have been extremely strong and profitable. I have been using Twitter to tweet thoughts daily while this website was being worked on a little ( Does it look a little cleaner, faster, stronger? The guys have done well  ) I just want to show a few things that I am looking at briefly- and then I will do a full report this weekend.

First, As posted in my last Gold reports, I always look at many things as we move forward to gauge where we MAY be going. I was watching this behind the scenes to give me an Idea of what MIGHT happen as GOLD attempted a "Test" of June 2013 & DEC 2013 lows. I thought to myself..."THIS could be a "Double Bottom" June & Dec 2013 - OR - are we about to see a "Triple Bottom Low" Test? What might I watch for?" I found this and compared as we dipped down.

) I just want to show a few things that I am looking at briefly- and then I will do a full report this weekend.

First, As posted in my last Gold reports, I always look at many things as we move forward to gauge where we MAY be going. I was watching this behind the scenes to give me an Idea of what MIGHT happen as GOLD attempted a "Test" of June 2013 & DEC 2013 lows. I thought to myself..."THIS could be a "Double Bottom" June & Dec 2013 - OR - are we about to see a "Triple Bottom Low" Test? What might I watch for?" I found this and compared as we dipped down.

Those Meaningful Lows are IN. Gold played it cool, but the MINERS were screaming , "GET READY" since they usually lead. My weekend report will cover a few ideas moving forward, but for now there are a few quick things to observe.

Read More

Those Meaningful Lows are IN. Gold played it cool, but the MINERS were screaming , "GET READY" since they usually lead. My weekend report will cover a few ideas moving forward, but for now there are a few quick things to observe.

Read More JUNE 13 - Update

If you had a chance to read my last 2 reports discussing Gold/Miners , then you know I was expecting a low almost immediately and possibly even what we call an ICL (A Very Meaningful Low that produces a Nice invest-able rally). Almost EVERY newsletter I read insisted that we remember that due to Golds "Seasonality" and that "Gold always bottoms in the Summer", we should 'go short' or wait. '$Gold $1000.00 ' was and still is everywhere. As someone who likes to be a contrarian, I posted this chart to show that anything is possible ( Notice that $HUI Bottomed 2 yrs in a row in MAY) and I mentioned that I was seeing a bottom closing in rapidly. Many Miners were forming Lows using various indicators that I use and Bases were forming also. My last report advised that I was getting ready for a rally, and you may want to think twice about shorting.

MINERS bottomed in MAY 2 yrs in a row-

Immediately after posting my report , we saw a rather striking Rally in Miners, especially Juniors. Some say its "Only short covering", is it? Will it pullback soon? Should I go short, or just buy a pullback? Was THIS the Train leaving the station & did I miss it?? Lets review...

Read More

Immediately after posting my report , we saw a rather striking Rally in Miners, especially Juniors. Some say its "Only short covering", is it? Will it pullback soon? Should I go short, or just buy a pullback? Was THIS the Train leaving the station & did I miss it?? Lets review...

Read More June 10 2014 Questions - Questions - Questions! There are many when it comes to the illusive Precious Metals Market! Will it Bottom this summer? Has it bottomed yet? Is the Bear Sell off done or are we going to $1000.00? Honestly, I dont think anyone can know the answers to those questions for certain , so instead of emphatically insisting that "Its this..." or "Its that...", Lets just look at some charts and discuss a few things that we can look for (And maybe we should look out for) going forward.

First - Most know from prior reports (See the Learning Patience article) that I had been expecting a low here, and we are there now. I am uncertain, however, as to whether its THE MEANINGFUL LOW that I expect with a great rally to follow, or just a bounce & one more drop to that ICL (The meaningful Low) . For starters we are still in this down trend, so even if if we bounce as far as $1290 , $Gold could still drop further.

If we start to drop here & now, even spike down, do you want to go short? You may want to consider this first...

Read More

If we start to drop here & now, even spike down, do you want to go short? You may want to consider this first...

Read More June 9,2014 ... Continuation of the earlier report The reason that I want to mention possible long set ups (Even though I expect a dip in the major indexes) is that 1. Some do not like to short the markets , and they've been very difficult to short anyways. 2. if the Markets do correct, these set ups can be checked during the correction for possible strength - IF they just go sideways or pull back mildly AND the Markets just put in a normal correction, they may become buy candidates . I also expect MANY MORE set ups will develop as overextended rallies in individual equities correct. I will cover those in the future. At this point, please note Biotech...

BIOTECH - The "report" is written on the charts (May pull back with the markets, though it did already Correct strongly) I would expect it to return to the break out around the 50sma

After that HUGE correction...Some Biotechs are recovering

After that HUGE correction...Some Biotechs are recovering

So Are there others setting up bases & breaking upwards too ??

Read More

So Are there others setting up bases & breaking upwards too ??

Read More June 9,2014 I see a lot of trading set ups in the markets lately, various sectors too, but am I comfortable taking them? MAYBE as trades, but please be careful and don't get TOO comfortable. Like the Hammock above, These markets may look comfortable place to jump up on & rest (as they rise day after day) , but they are getting extended- and even nice set ups could fall through if a sell off starts. I am expecting a sell off (Not sure how much) sooner than later.

I TWEETED these charts last week , thinking that we would get a pullback, but they paused or dipped for 2 days and UP UP UP they went .

Now they are again overextended...

Read More

Now they are again overextended...

Read More May 27

As I speak , Gold is down $13. Is it breaking down from this triangle pattern that has formed over the past month? Quite possible- Most have heard that a triangle pattern is a "continuation pattern" and that follow thru is in the direction that the pattern started in. So Question is: Was Gold moving UP or DOWN when it started the Triangle?? Many expect GOLD to continue DOWN from here, since it appears that it entered this triangle as it headed down .

FOR EX: This is what the continuation pattern looks like in action. Heading up into the triangle pattern, it broke out upside.

FOR EX: This is what the continuation pattern looks like in action. Heading up into the triangle pattern, it broke out upside.

EVEN THOUGH GOLD is selling off now , and looks to be follow thru to the downside, I wanted to point out something that I found interesting and AT LEAST WORTH A DOUBLE TAKE

Read More

EVEN THOUGH GOLD is selling off now , and looks to be follow thru to the downside, I wanted to point out something that I found interesting and AT LEAST WORTH A DOUBLE TAKE

Read More MAY 23 $NATGAS

I am looking at $NATGAS after its extremely bullish run up January & February. Last week a friend of mine POLY of The Financial Tap.com mentioned it as a possible short candidate a week ago, but I saw things a little differently . I was looking at $NATGAS close up & shared this chart,showing possible support & MACD divergence . Notice also, however, the 50sma overhead "Could" act as possible resistance. I was obviously thinking it could be a "Long".

I've said this many times...you cant argue with the markets, you must change with them if what you think you are seeing changes. Well POLY may have been early & correct in what he was seeing. Another friend of mine, Steve Chapman of The Refined Investor also noted NATGAS as a possible short , so I re-visited the charts and low & behold I noticed that NATGAS was rejected at the 50sma & the RSI 50% also turned down. (See the chart below, click to enlarge) .

Read More

I've said this many times...you cant argue with the markets, you must change with them if what you think you are seeing changes. Well POLY may have been early & correct in what he was seeing. Another friend of mine, Steve Chapman of The Refined Investor also noted NATGAS as a possible short , so I re-visited the charts and low & behold I noticed that NATGAS was rejected at the 50sma & the RSI 50% also turned down. (See the chart below, click to enlarge) .

Read More

Scroll to top

But again, Go short or buy the dips? ...

Read More

But again, Go short or buy the dips? ...

Read More But again, Go short or buy the dips? ...

Read More

But again, Go short or buy the dips? ...

Read More

Does

Does