You are here: Home1 / Premium

There was no significant change in most of what was covered in yesterdays report. Draghi is scheduled to speak in London this morning, could his speech change things? It has in the past. For now, lets just do a review of what we've been looking for.

With a pullback due in the SPX, I drew this possibility yesterday. We could Tag the 50sma and lower trend line.

A reversal yesterday doesn't change the idea that we will still pull back, so I've added the fib #'s. We could bounce & still drop to the 50sma

Read More

Read MoreAs mentioned in the weekend report, Gold & Silver have been selling off at a very rapid rate, and I think that they should be due for at least a bounce. I want to take a look at that idea in this report, but first a review of the markets.

The markets don't look bearish, but this possible rising wedge formed by Nov 4.

SPX currently- This does not have to drop too far, it could even go sideways.

Read More

Read MoreFrom the time of the Fed Meeting to the Jobs report Friday, we have had a lot of action in the markets. Action in the markets is what draws our charts, and we have an interesting mixture of charts to examine this weekend, so lets get to the 36 charts that I have prepared 🙂

Lets start with the $USD WKLY. Nov 4 this looked too legit to quit, but we had to wait for Friday to see if out Dollar break out was real.

$USD - legitimate break out. This could have major implications.

Lets look at the Dollar on a daily basis...

Read MoreJobs Report, Flying Dollar, Diving Gold. Please dont forget Energy 🙂

Read MoreCount the Green days vs the Red days in Gold for the past 2 weeks, and you could say that it has been in free fall for a bit. We'll discuss that after a market review.

The SPX has been moving rapidly higher and recovering from the August - September sell off quickly. Since the former highs could offer resistance, we may see a drop with the jobs report .

Now I want to show you a chart of the SPX that really looks like a drop could come soon.

Read MoreI want to discus a few things in todays report, and then I will have a small ton of charts & Set ups in Energy and Commodities. I will start with the markets and their nice run higher lately. I did mention that the IWM, TRAN, and the IBB looked to be lagging a bit. IWM had a bullish set up and popped higher, but it hit another short term resistance area. I wanted to see a pop higher if it is going to possibly play catch up.

This was the IWM at that point on Oct 30. I expected a break higher.

IWM Nov 3 - We got he break higher ( Note: We may back test that break soon).

Lets look at the NASDAQ before we discuss Energy, The CRB, & The Precious Metals...

Read MoreWe had some nice reversals in certain sectors today, so I wanted to share a few ideas here with that in mind. Some ideas are Bullish , and a few cautionary notes in there too. This is your Tuesday morning report a tad early. 🙂

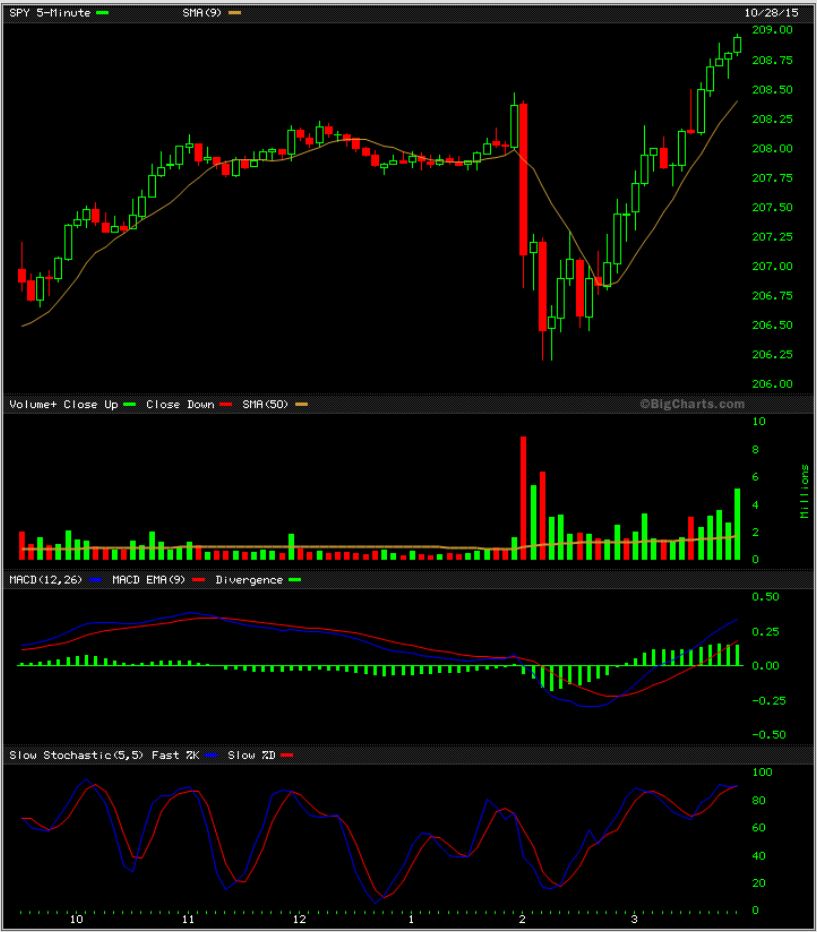

Read MoreIt was a Fed Week and the Action (or lack thereof ) and reaction were somewhat expected. Lets look at our week in review.

Thursday I mentioned that I found it surprising that the USD & CRB were both moving together Post Fed. Was one faking it's move?

Now lets take a closer look...

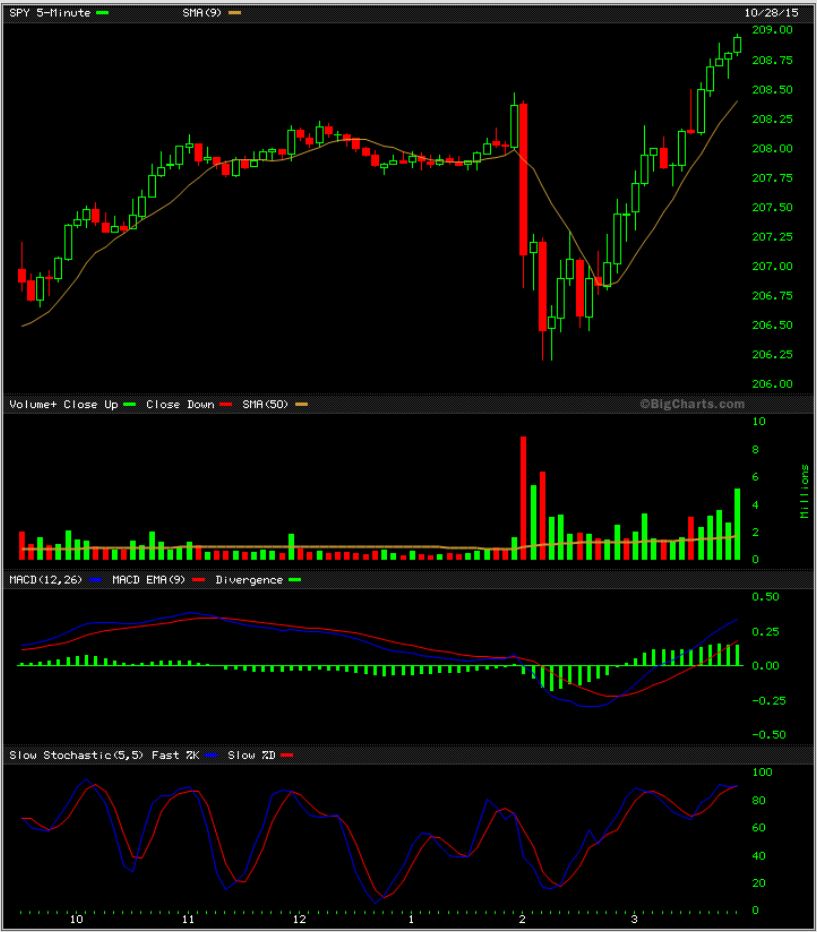

Read MoreAs expected, the Fed Mtg on Wednesday certainly gave us some dips to work with. We saw both strength and weakness as a result.

SPY - This was a tough dip to ride 'real time', but the markets closed back at the highs.

Read More

Read MoreWhat can I say here when we all know that charts could be quite different after the Fed Mtg on Wednesday? Lets just review some expectations.

.

The SPX, Dow Jones and NASDAQ have recovered nicely from the summer sell off, but a few areas have yet to catch up (If they are going to). I showed this rather bullish looking set up yesterday, but...

Today the TRAN , IWM, and IWC sold off nearing the close. Is it a fake sell off or is smart money heading for the exits Pre-Fed? Lets take a look...

Read More

Scroll to top

Read More

Read More