You are here: Home1 / Premium

The market volatility has been whip sawing people left and right. What used to look like the perfect set up falls apart in just a day or two, so having 'stops' in place has been very important. Lets take a look at the markets and then review some very interesting things that took place in the Metals and Miners area today.

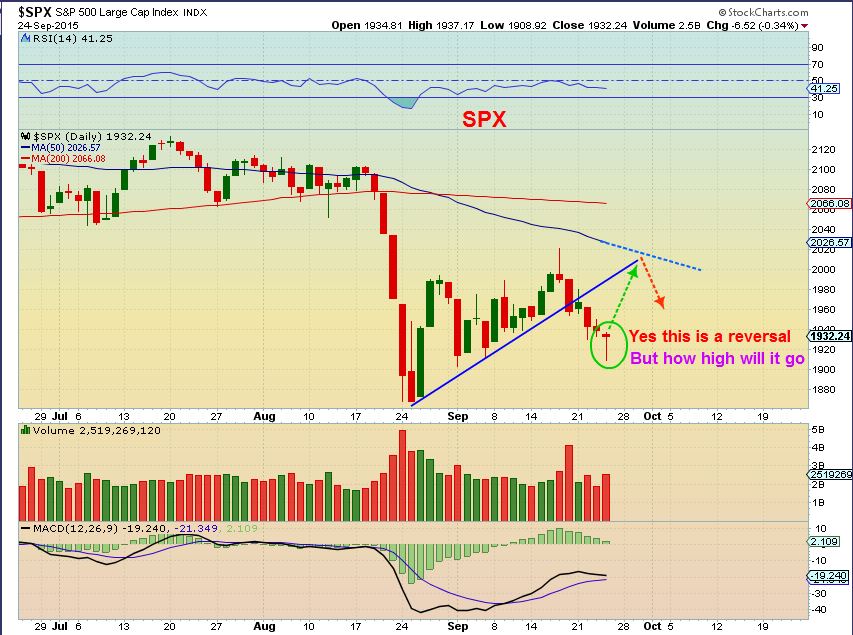

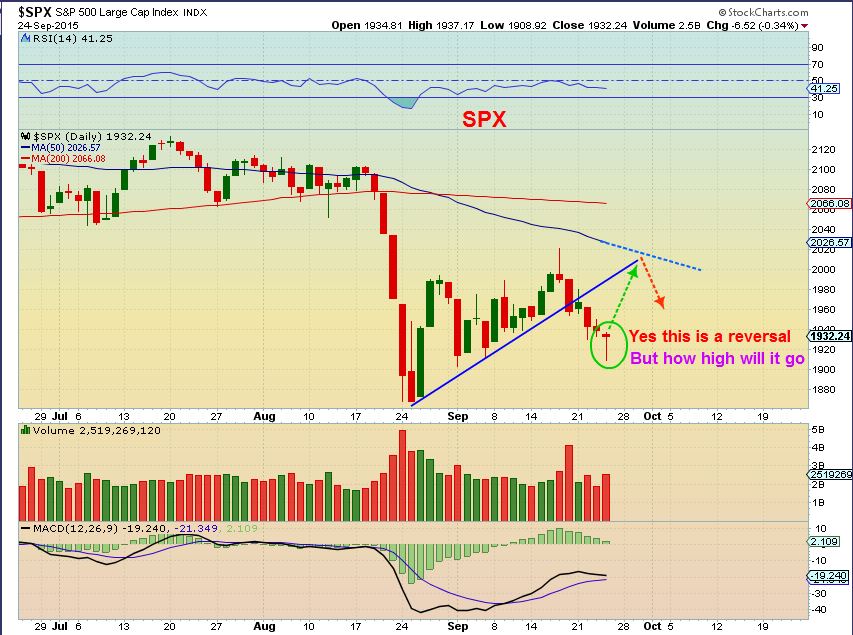

SPX- This bounce was expected.

Read More

Read MoreIt's time to discuss decay in the Oil and Metals markets, but first lets do a review of the equity markets.

SPX- This was Sept 15. I have been saying since August that I expect the lows to be tested sooner or later.

We see that happening now, so what next? ...

Read MoreCrazy action in the markets today. Some of it was expected, but some of it doesn't seem to fit. Lets take a look.

IBB - Really taking it on the chin lately. This is a weekly chart and todays volume was massive.

Read More

Read MoreIt would be good to look back at the past weeks activities and see how things are stacking up.

TRAN WKLY - This surely hasn't looked bullish as the trend changed. The Tran was rejected at the 10 ma this week again.

Read More

Read MoreA quick look at the markets and a brief discussion on shopping

On Sept 22 - I said that I was looking for a possible 'Test' of the break down and then a drop.

SPX - Reversal candle. Maybe that 'Test' comes now.

Read More

Read MoreWhenever we get mixed signals in the markets, it may take time to allow things to clear up. We are seeing that with the divergence between Metals and Miners right now, but until time resolves the differences, we can also look for clues. We'll do that here, but first lets review a few other sectors.

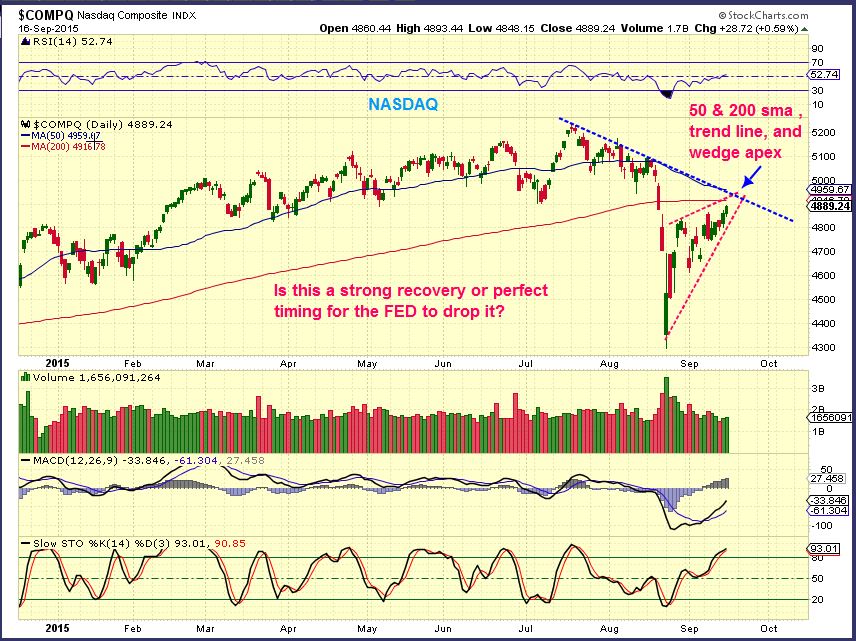

NASDAQ - We got the back test that we expected and then the drop back down. I expect the Aug lows to be tested or broken, but you can see that volatility has kept things from being a smooth move. We may bounce around inside this down channel too.

Read More

Read MoreWe are still keeping an eye out for various signs in these markets. Lets take a look...

TRAN - I posted this wdge as a warning in Monday nights report

TRAN - There was some follow through.

The selling was not on very heavy volume, so I am starting to think this move is going to drive longs and shorts crazy, here is why -

Read MoreOur positions in the Miners are pulling back, but it is a slow pull back so far. This pullback was expected. We'll discuss what to expect later in the report, but lets start with the pull back that came in the equity markets first.

SPX - It started with a shooting star and the stochastics indicate that we could see more downside. In fact, I have mentioned that I expect a test of the 'high volume candle lows' sooner or later.

The TRANNIES looked pretty strong re-gaining that 50sma, but they've done that before and a rising wedge is bearish. Notice the shooting star candles at past tops?

OIL is playing out as expected too...

Read MoreAs mentioned in last nights report, we saw an explosive move in Commodities yesterday one day before the Fed Decision. That caught a lot of people who were not in front of their screens flatfooted. Last nights report also pointed out that it looks as though what we have been expecting to occur during the Fed Speech is beginning to play out. Lets go shopping and see if we can find some low risk entries developing in OIL and Precious Metals.

Lets re-visit WG. Rather low priced, I recommended this beaten down Energy stock here at $0.80 and $1.00 in early Sept.

It Popped and ran to $1.80 rapidly and now has formed a bull flag type pattern, landing on the 10sma. You could buy this with a stop under the 10sma as a low risk entry.

Lets keep shopping...

Read More

Scroll to top

Read More

Read More