You are here: Home1 / Premium

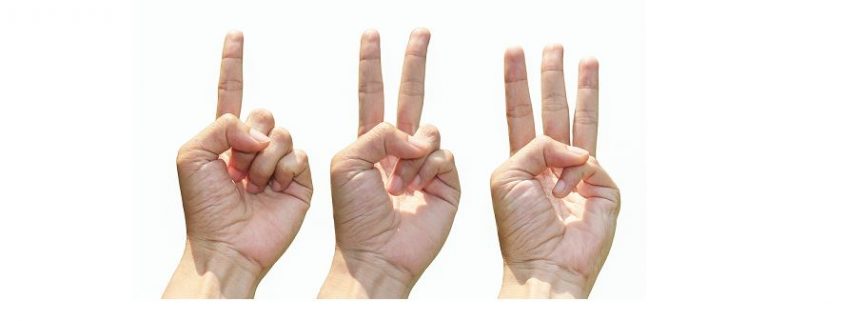

Time for what? The clue is in the picture, and we'll discuss that after a brief review of the markets.

USD - We were due for an ICL and not just a dcl in August, but so far this low is acting just like the other dcls, and they rolled over after going sideways for a while. If this drops and rolls over, I feel that Gold will POP and RUN higher.

Read More

Read More

SPX - We are well within the timing for a dcl, and the swing low on Tuesday gives a valid buy, with a stop under the low of Monday.

If we get the dcl in place here, will the General Markets now just recover and take off to new highs?

Read More After a pretty solid reversal candle on Friday, the Precious metals sector gave us a little surprise to the upside on Monday. We'll discuss that and a few other things in this report...

SPX - 6 days ago I warned about buying the reversal in the General Market, because the 'timing' was not quite right and some of the internals did not look healthy. The reversal on Monday is within the expected timing for a dcl, though some internals are still weak. This one may be the dcl if we get a swing low in place.

Read More

Read MoreI'm starting off the weekly report with 2 charts that I used in the comments section of a recent report. Then we will cover the markets and especially Oil & Precious metals.

These 2 charts were used last week simply to point out the phenomenon that often happens in the markets. It is the round number phenomenon, where markets tend to find support & resistance at round numbers.

SPX - Here you can see how traders temporarily sell at round number resistance or buy at round number support and this affects price action.

GOLD - And my point is that this can just be a temporary pause. A sideways move may begin and build energy for the next break of resistance. Gold was near 1300.

Read More

Read More Let's talk about 3 things here today...

1. QQQ - I thought that QQQ was a bull trap for several reasons, like Cycle timing, The MACD, the Open Gap was pretty obvious, and other internal factors were keeping me cautious, but the Bulls were still buying each reversal.Was this just another Bull Trap?

QQQ - The NASDAQ dropped as expected, actually losing 123 points. The QQQ slammed into the 50sma and it could bounce from here, but ...

Patience in this area is important. I doubt that we will get a swing low on Friday, with a candle as big as yesterdays in place.

Read MoreI sure hope that it is break time! Let's take a look at our markets after the Fed minutes were released...

QQQ - I captured this chart at 1:49 p.m.- right before the Fed Minutes were released. Do you see similarities in the blue boxes that I have been pointing out? I don't like that gap.

Read More

Read MoreAs time moves forward, we are seeing progress in various areas of the market. Today at 2 p.m. Eastern Time, the Fed Minutes are released and that often can affect the markets too, so let's take a look at where things stand...

SPX - No change from yesterdays report & expectation at this point.

Read More

Read MoreIf you need to know how I feel about Miners, check the reports from the last several weeks, but I will add one more thing to that discussion at the end of this report. 🙂 First let's do a market review...

SPX - After breaking below the 50sma as expected, A gap open Monday has put a swing in place, but it is unconfirmed at this point. Another day of follow through may help to clarify this picture. Day 29 is on the early side in the daily cycle count, so let's see what Tuesday brings. See the chart and we'll look at the NASDAQ.

Read More

Read MoreI wanted to put out an extra report this morning to discuss Miners a bit more...

Read MoreThis week was a week of solid activity, and I have quite a few charts concerning the Gold & Silver race, so let's take a look at the action...

Read More

Scroll to top

Read More

Read More