Archive for month: March, 2016

In the premium section of chartfreak, we’ve discussed using Low risk entries to take a position in a stock, but what makes them low risk? Lets take a look at a couple of examples.

.

First, we have been trading sectors that looked to have bottomed recently after seriously selling off . They give evidence of little downside and greater upside. As pointed out here in recent weeks, we’ve traded Miners since January, and Commodities and Oil since February. Lets look at commodities for example.

.

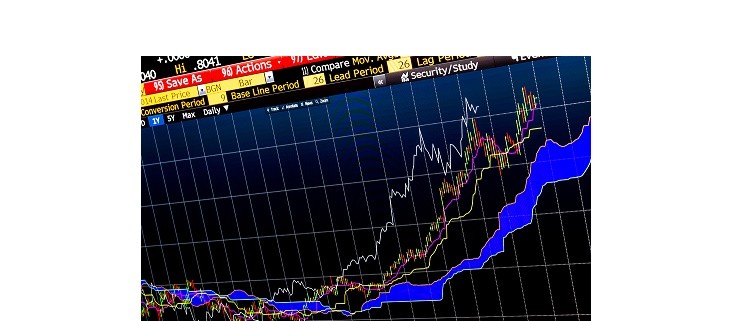

CRB – We caught commodities after the second bottom formed with divergence. The commodities chart still looks bullish after consolidating for a week heading into the Fed Meeting. I believe that this can run higher now.

.

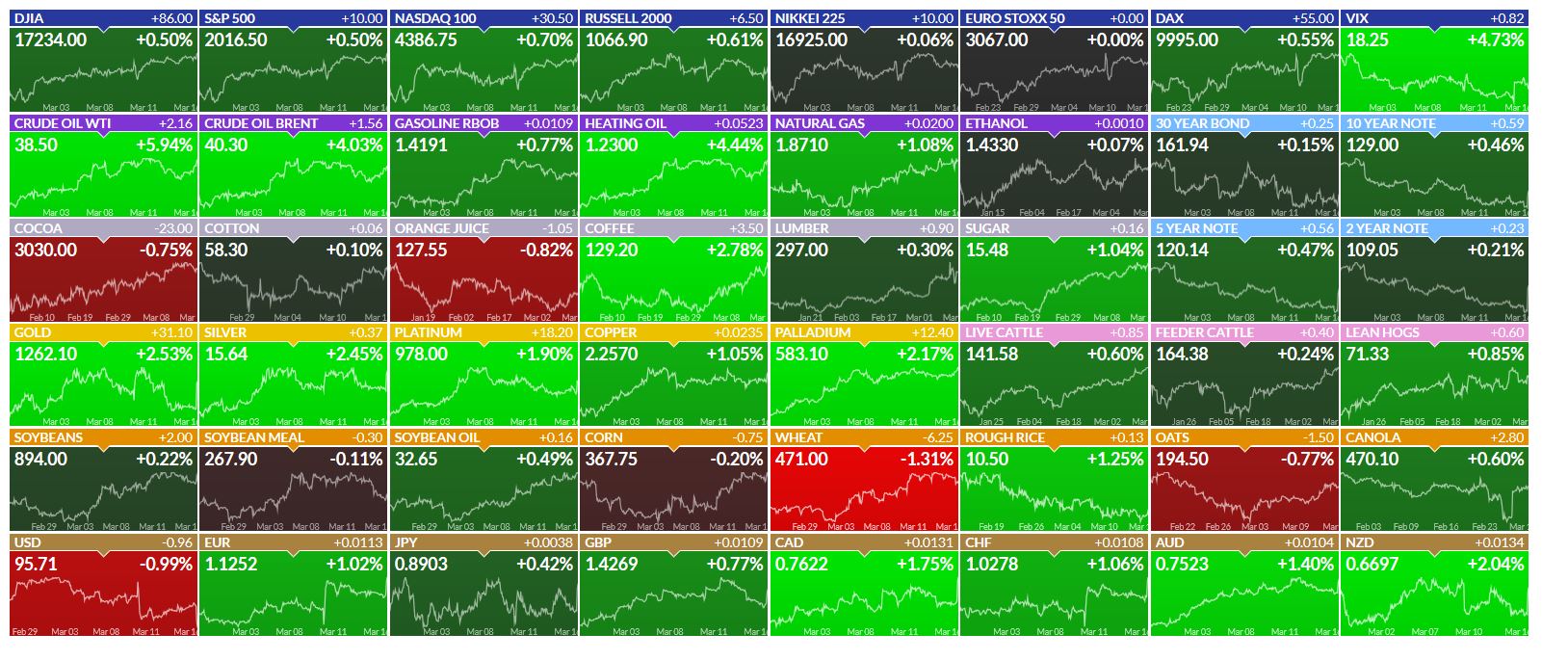

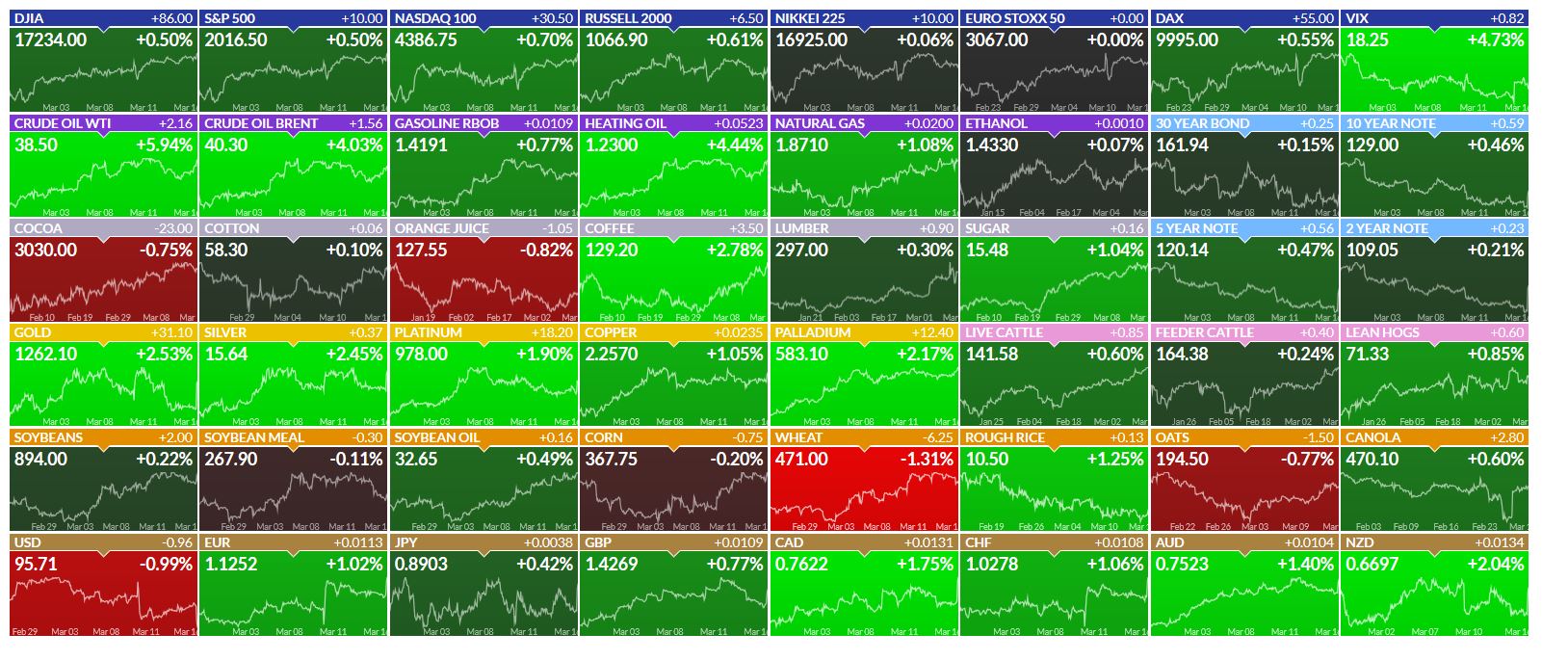

We’ve been watching various Metals stocks pulling back or consolidating after running higher recently. See stocks like X, CENX, AA, FCX, VALE, CLF, STLD, Etc .  Look at The sea of Green in various Commodities after the Fed Decision was released.

Look at The sea of Green in various Commodities after the Fed Decision was released.

.

Sidenote: While I believe that individual MINERS may have a little upside left, Cycle timing says that they should actually be maxing out soon. We will be prepared to buy the pullback at a low risk point. Short term traders have been given charts and instructions to trade individual Miners if they want.

So lets look at my recent lessons on trading and then watching a stock like VALE pull back after a nice run higher.

.

VALE – I bought Vale near the gap fill in the $2.50 area, after watching commodities bottom. On March 1st, a second lower risk entry point would be the break above the 50sma and trend line back test too. Why low risk? Because you could place a stop a little below those moving averages to limit risk if the trade goes against you.

I called for a run to the $4.80 – $5 area using this inverse H&S , and began to sell on the way up over $4.50.

.

Then after the run fulfilled (Topping candle), we had to look at a logical place that Vale may drop to. These were two ideas, if vale had in fact topped at that $4.87 high & reversal. We’d be looking at the $3.82 and $3.50 area for starters.

Vale almost hit the 50% retrace on March 10, and volume was lightening up. The 20sma was entering that $3.50 area.

March 14, selling was slowing up in that support area, and I mentioned that I started a position. I started small, because this ‘could’ still drop to the 50sma, but it was above support ( Yellow) .

VALE – Vale pulled right back to the $3.50 area as hoped for Tuesday and also on Fed Wednesday. It took off after the Fed Decision. I captured this chart at 3:30, but it closed even higher at $3.99. So you can see why that was a low risk entry. That doesnt mean that it will go straight up from here though.

REMINDER CHART – Notice how long the price lingered at the 50sma at the end of March? This may or may not go right back up to the highs. It could also play out in a consolidation manner as shown, time will tell. The entry is low risk, even during possible price swings.

These are 2 more examples from Thursdays report showing a lower risk area to enter a position. A ‘stop’ is placed below a reasonable support area.

CLF – I had been watching this one for re-entry too. Look what it did during the FED MTG.

CENX – That recent pull back to the 20sm offered a low risk entry with that reversal.

There were others pointed out too.

.

The FED Decision seems to be favorable for a continued run in Commodity stocks and they’ve presented a low risk opportunity (if you honor your stops). Many Metals stocks have pulled back and consolidated going into the Fed Mtg. Now they may be at a lower risk entry point. OIL moved higher after the Fed Decision too. We’ll see if some more of our Energy stocks that have been pulling back can also tack on some gains. If you didn’t buy the pullbacks in commodities yet, this may be your day. Happy trading!

.

~ALEX

Bonus Energy possibility (Caution, they are higher risk due to debt and lower oil prices. Due diligence is due.

LGCY 3-16 …Yes, it is still acting correctly consolidating that blast higher. I’d like to see a repeat of that orange box.

Nobody wants to take unnecessary risks in the market, but the saying "Nothing ventured, nothing gained" applies too. So you have heard me mention looking for "Low risk entries", but what is that? It is timing an entry where the risk to the downside is minimal, and the gain on the upside outweighs it. We will discus that further later in this report.

,

SPX -Friday is Quad witching. The Fed didn't kill the markets this time, but that wasn't a very convincing push either, was it?

Read MoreIt's Fed Wednesday, and so far there is no real change here, going into that decision.

SPX - No real change in this chart, but there may be a change of character. We have the Fed decision Wednesday and Quad witching Friday to pop this above the 200sma, or drop it down to maybe the 50sma area. Tuesdays selling recovered.

Let me point out this ...

Read MoreThe short term trade set ups seem pretty clear, but with that Fed Wednesday Meeting rapidly approaching, the end of the week could host a number of reactions. Lets see how things are currently unfolding .

.

SPX - This bearish wedge was forming last week (March 9 chart).

The SPX did drop quickly and recovered last week, as seen here. Is this still a wedge though?

The Fed Mtg is approaching and could affect the outcome.

Read MoreWell, after several weeks of good trading , it appears again. Yes, I'm taking about that Elephant in the room - only this time things He's levitating as we head into the Fed Mtg this Wednesday. Lets take a look at our markets, keeping in mind that we do have a Fed Meeting this week.

.

SPX - I see a rising wedge and on day 20, we could drop to a 1/2 cycle low. So we could drop heading into the Fed Wednesday or possibly see a drop after?

I mentioned something important last week and I want to remind friends of that here...

Read MoreQuick update on the Pullbacks...

SPX - Remember that Wedge from March 9 below? I still expected it to run to the 200sma , and then a drop to the 50sma in a 1/2 cycle low.

SPX - The 2 spike down days could be changing the way that lower trend line looks. The SPX has the run up /sideways/ run up/ sideways look. It is in a congested resistance area, this as it heads into next weeks fed mtg. That is where it bears watching ( For strength or weakness).

Read More

Read MoreHave you ever noticed that when we are waiting to see if a pull back presents a buying opportunity, it feels like price just drips down in slow motion day after day , no matter how sweet it looks? I'm feeling that now 🙂 Lets review the markets and then check out a few areas of interest.

.

SPX - No change from the last few reports

Read More

Read MoreYesterdays report mentioning Anti-Gravity stocks was just the right thing to start the corrections 🙂 In Energy stocks I think we were getting a bit spoiled with 70 & 80 % gains in a single trade, but not so spoiled with giving back 20 - 25% today in BAS, LGCY, ARP, etc. Commodities are pulling back and Miners may start joining them. Will we be buying this dip? Lets take a look.

.

SPX - My chart from yesterday. I had called for a rally , but now calling for caution.

SPX - And we did start a little selling Tuesday. We can go higher since we are still inside of that wedge, but eventually I expect a drop to at least the 50sma.

Read More

Read MoreThe stocks that we have been trading / investing in have been defying gravity for weeks. The fact that we are catching them right at the lows gives us time to enjoy the ride and nit worry about a short term pullback. So far, a short term pullback is rather hard to come by. Lets review the markets and look for more set ups.

SPX - It may be early in the investor cycle, but this doesnt look ready to power higher to me. I expect the markets to fail at resistance, at least short term.

Read More

Read MoreWell, the past several weeks have been excellent for trading Metals, Miners, and Energy, and whether you follow me in the Public area or the premium side, I hope you've had a chance to make some solid gains. I've already discussed in past public posts about chart set ups in Miners and Commodities like X, AKS, FCX, CLF, etc, so Lets take a look at the recent crazy but very lucrative trading set ups in Energy.

OIL & ENERGY - Why?

.

WTIC - As I pointed out in a public report weeks ago, I was looking for a possible bottom in Oil around $26.09 from this Nov Wkly chart.

WTIC WKLY - I believe Oil bottomed in a shake out type manner. Is it just a bounce? This chart looks quite Bullish.

Read More

Read More

Scroll to top

Look at The sea of Green in various Commodities after the Fed Decision was released.

Look at The sea of Green in various Commodities after the Fed Decision was released.