Not much changed from The weekend report to now, so lets quickly review the mkts and then review a couple of trade set ups...

For the NASDAQ- I have been showing a bearish wedge, and I pointed out how they occasionally can consolidate & turn bullish like in this 2011-2013 wedge. I shared this chart

Lets look at the SPX currently

Read MoreI am seeing a lot of Triangles forming in the markets, some bullish by nature and others bearish. Lets take a look and review the past week and look forward to a few ideas too...

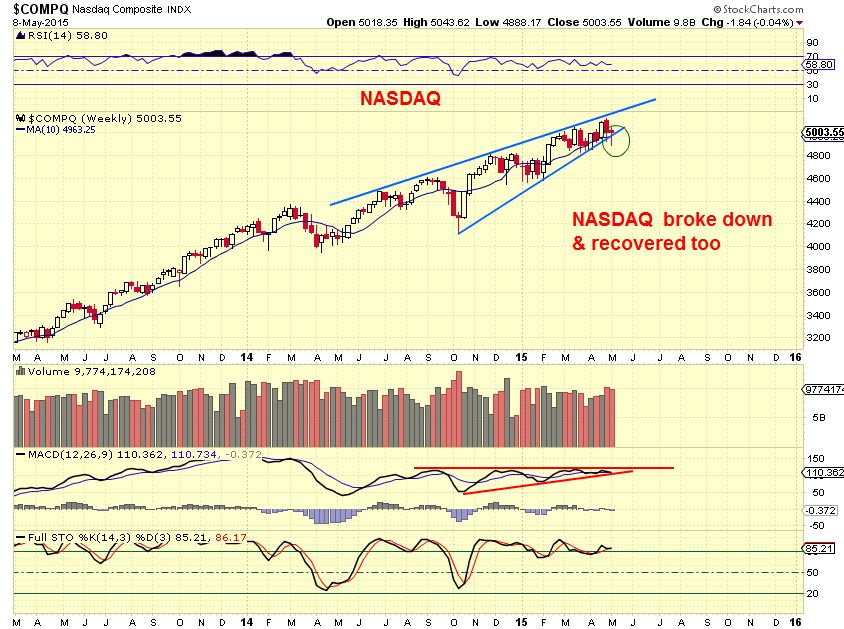

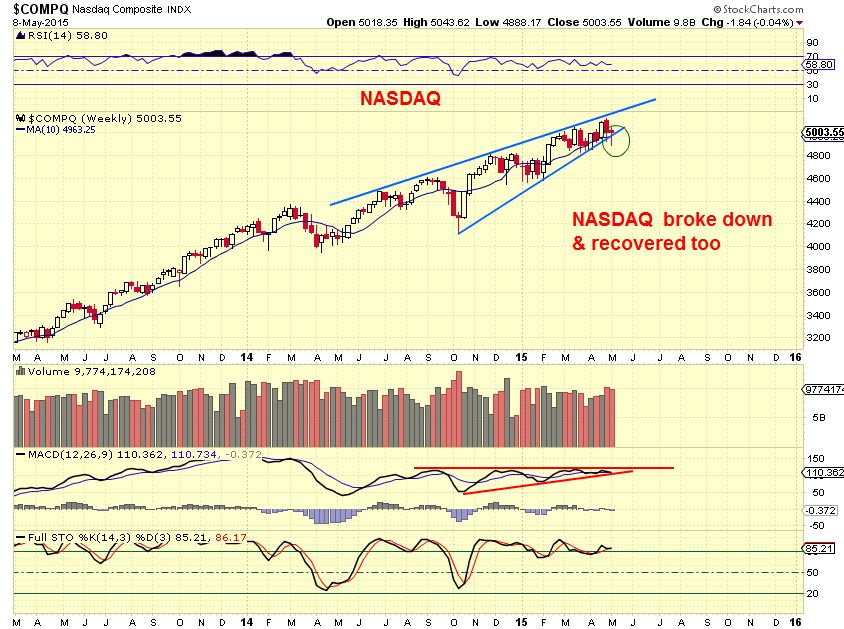

I posted this WKLY NASDAQ in a mid-week report on MAY 6. Could it recover?

Amazing. It recovered by week end.

Lets look at some other triangles and wedges...

Read More6:30 a.m. Eastern time : I collected most of the Charts for todays report last night. I thought to myself that like I wrote in the weekend report, it looks like we are seeing some Big Picture changes lately. I awoke this morning to Futures down quite a bit and that makes the charts you are bout to see all the more interesting. We all know that when you wake up to Futures down, the day can reverse and still close green and visa versa, but take a look at where we are , and you'll see that things look quite interesting.

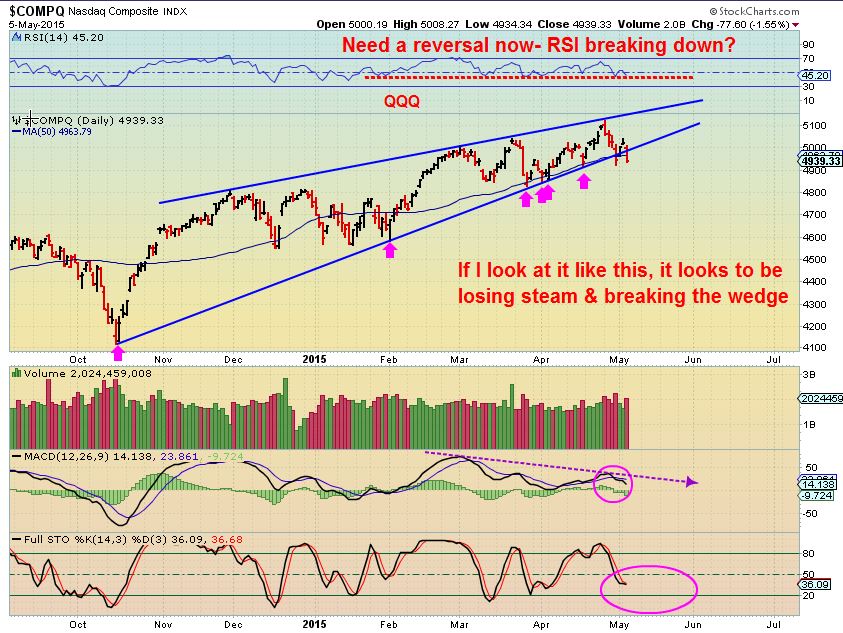

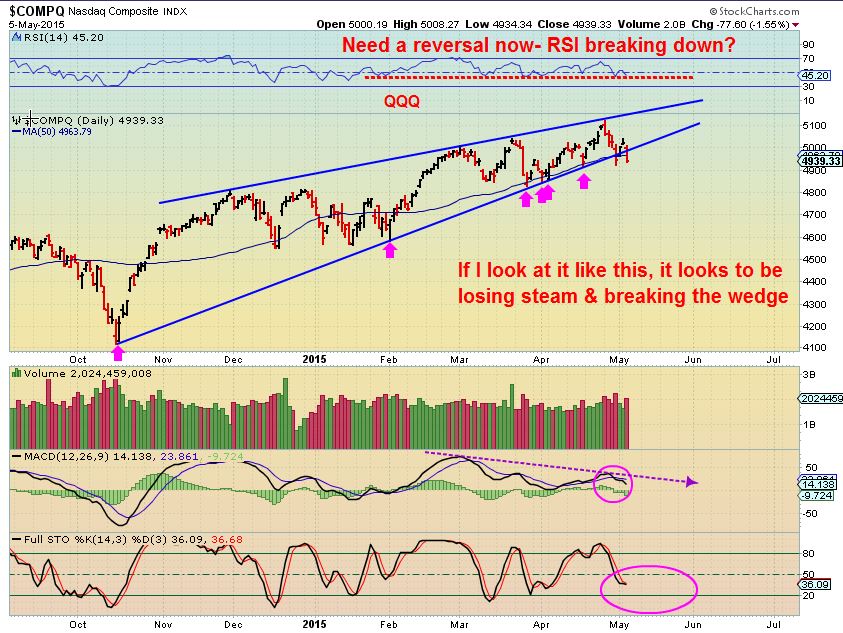

I like to start with the previous days chart, so here is the Nasdaq from Tuesday. Breaking down?

SO what happened Wednesday? Oh yes, it wasnt a FED WEDNESDAY, but The Fed did say something in an interview that shook the markets a bit more...

Read MoreAs mentioned recently in a prior report, The Markets seem to breath in and out with human interaction. They can Ebb & Flow like the ocean, and some pullbacks can be very healthy , giving the upward move more energy to break above resistance. The picture above shows the idea of a pullback that has done its job. SO in this report I wanted to discuss certain pullbacks that can be buying opportunities, and of course there are some that aren't. Lets do a market review...

NASDAQ- This was my chart for yesterday, I mentioned that a pullback usually occurred with the little move that we saw on Monday. It too could be a healthy little pullback.

So we did dip yesterday, lets take a look...

Read MoreNot a whole lot has changed since the weekend report, but we can review the little changes that took place and see if it changes anything in our big picture outlook.

.

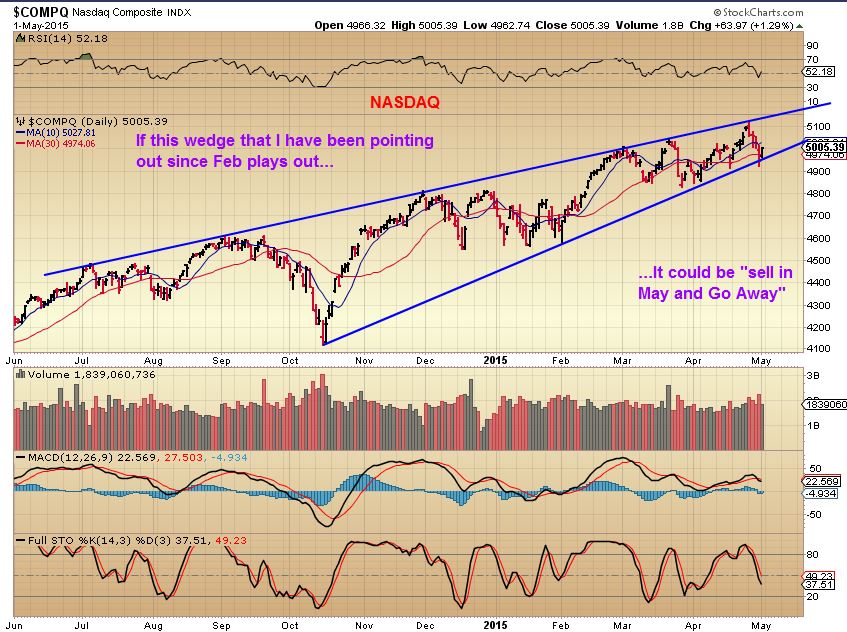

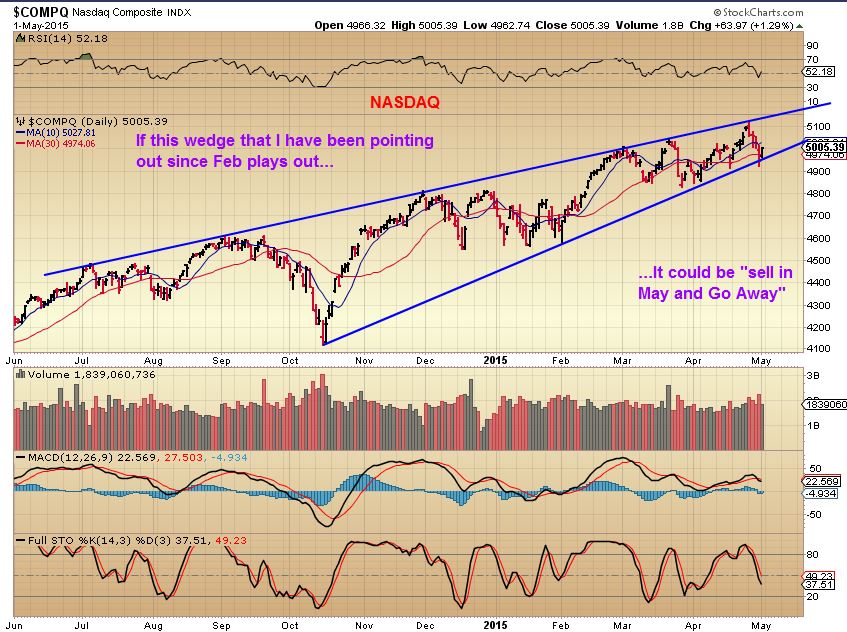

NASDAQ may 1- The Wedge pattern still had wiggle room

You can see on the next chart that on Monday there were minor changes...

In this weekend report I wanted to briefly review various sectors as we usually do. We have been quite focused on Energy and recently I was calling for the double bottom lows in NATGAS. We have seen these ideas play out perfectly. Now, in this weekend report, we're mostly going to focus on GOLD/SILVER/MINERS. I have about 40 charts and this will be my longest wkend report to date, enjoy!

SPX & NASDAQ - I have pointed this out for many weeks now. Very trade-able lately, buying dips, selling rips.

Here is the NASDAQ...

Read MoreMany people read my public posts but have missed out on my private reports.

Is it possible that you are missing out on something that could add insight to your trading by adding my reports to your trading style? Could you possibly even make that money back ( $37.95 / month) on your next trade?

To answer that, I am going to show you what we at CHARTFREAK focused on over the past few months. AMONG other set ups-

1. Many were afraid during the oil sell off Aug through Jan. I was reading everywhere in Jan that you should be SHORTING OIL to the low $30’s. I am a contrarian during certain times and I found Many reasons to be one then. This is what I was telling my readers in late JAN.

“BUY OIL / ENERGY STOCKS ABOVE the 20sma. It has NOT been there in a while.” I was buying certain Energy stocks at the end of Jan while Most others shorted these lows.

I recommended these energy stocks on JAN 23 , knowing they were crushed to ridiculous levels and could explode higher. Reasons were pointed out in my reports. Many have since moved up 50 -100 + % or more. (Its not easy buying at lows, but my reports detailed the many reasons why)

REXX JAN 23 – 1 of 3 REXX charts I posted then.

REXX NOW- that was the lows.

EXXI– Jan 26, at $2.60 . Double bottom lows . 1 of 3 charts that I posted on EXXI – I thought we were looking at a great opportunity if one could be brave and then be patient. 100% 300% Gains over time?

EXXI – ran to $5 ( 100%) and dropped in March. This week was back well above $4, almost hitting $5 again so far , on April 15. I think there is more upside for the patient investor. I personally traded this one in & out with stops.

Again, many called to go short OIL on the MARCH DIP. There was fear of that break down to $30’s or $20’s everywhere. I declared it a shake out in real time and BUY! I pointed out the many reasons why and what I was looking at . This chart days later was to encourage readers that what we saw was indeed that shake out, NOT a break down.

2. Recently I was focused on NATGAS, also looking for a Double bottom low (Not a break down as I’ve been hearing . Many are in fear of the surplus , etc, but my charts called for a low).

I mentioned CHK, XCO and a few other stocks to take advantage of this ahead of time. As NATGAS broke down below recent lows, I was more bullish and I was looking for this break out too.

NATGAS Posted APRIL 27 – double low in place. Buy or wait for this break out to be safe/ conservative .

NATGAS 4-30 (2 days later) Some trader took UGAZ @ $1.80. It is now $2.43 , up 35% in 2 days. ( See also CHK)

We’ve also looked at trades in the equity markets , Commodities like STEEL, Uranium ( Honestly, I didnt want to chase & I missed most of that first move up in Uraniums and Rare Earth), SOLARS, etc VALE, CLF, FCX, were mentioned. The markets have been quite volatile lately , so some work out and some havent in the equity markets. The commodities, Energy , and Solars have been a bit more reliable.

.

3. What are we focused on at CHARTFREAK NOW? The moves in the GOLD/SILVER / MINERS Sector have had my attention again since March.

Today I hear many say , “GOLD is breaking April support, thus it will break March lows soon. The plunge in GOLD yesterday & Today is just the start, and todays follow through will plunge us down to $1000.” Yes, that could happen, it could look like this …

At this point I am looking at things differently again. ANYTHING is possible, but what am I seeing? I had reports this week discussing Precious Metals, and I posted an important update this morning too. My weekend report will likely be very much devoted to trying to see through the hazy guess work and find a solid understanding of where we are in this GOLD/SILVER sector.

So for less than the cost of a cup of coffee per day at Starbux or Dunkin’s  you can read any past report, including my thinking in this mornings important Gold/SILVER/MINERS update. Your next trade may make that money back for you quickly.

you can read any past report, including my thinking in this mornings important Gold/SILVER/MINERS update. Your next trade may make that money back for you quickly.

You can cancel anytime ( no refund for the 1st month) if you aren’t satisfied. I will elaborate on my thinking about the precious metals in this weekends report that comes out by Monday morning. If you cannot join us at this time, please feel free to sign up for the email alerts to these public posts, which I send out from time to time.

Happy Trading and have a great weekend!

~ALEX

EDIT: I just finished my weekend report Sunday evening , it has about 40 Charts . Mostly focused on GOLD/SILVER/MINERS.

Quick update for readers here on Gold & Silver.

Read More FED WEDNESDAY came and went and it rocked many of the areas that we anticipated. We have been invested in Energy stocks for some time, so we actually benefited from the upward push that many of the energy stocks received. Along with Energy and a few other areas of interest, we have also recently discussed the precious metals area again, and I sent out an intraday alert on Tuesday regarding the set ups that I had been watching. So why the puppy with the leash? Notice this...

GOLD

You can see that Gold had started breaking upward this week, and Wed it reversed into the close. Now notice Silver...

Read More

Scroll to top