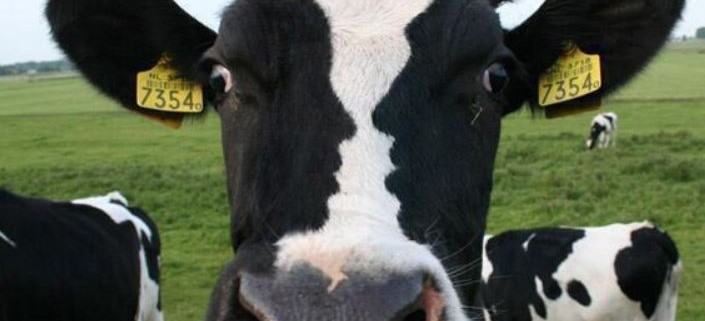

WHAT DO YOU SEE HERE?

APRIL 15 Some see a BULL, but look closely , some see 2 men arguing whether its really a Bull. Well ,if you follow me on Twitter you know that for a short while now I have posted charts calling for a drop in GOLD & especially the Miners GDX/GDXJ. I still think the GOLD Bull is alive, but even strong Bull markets experience healthy corrections to lower sentiment and kick out the weaker hands.

In calling for a drop here, I have had a few Gold Bulls say that we recently had a ‘double bottom’, so another drop here and the Bull could be over. I was also told we’ll crash thru last Junes lows , because “There is no such thing as a double bottom”!

Well, I found something that blew my mind ![]() and I wanted to share it with you. PLEASE STUDY & MEMORIZE THE SHAPE OF THE GOLD (GLD) WEEKLY CHART BELOW. FOLLOW 1-5 on the right hand side, before moving on …(Click chart to enlarge)

and I wanted to share it with you. PLEASE STUDY & MEMORIZE THE SHAPE OF THE GOLD (GLD) WEEKLY CHART BELOW. FOLLOW 1-5 on the right hand side, before moving on …(Click chart to enlarge)

The RUN UP, the TRIANGLE, the false break upward, the drop thru support, the double bottom…

-if we drop again, MUST WE CRASH THRU JUNE 2013 LOWS?

-Is there really “NO SUCH THING AS A TRIPLE BOTTOM”??

It blew my mind when I found this , and of all places , it lies within the Gold Miners market!

Of course, this chart would have GOLD rally up into the $1500 area, and THEN DROP to test last Junes lows. OH PLEASE dont do THAT to us, unless we are on alert to trade it that way. The point that I wanted to bring to the attention of the readers here is simply that …

1. Yes, GOLD can drop here in this pattern and remain bullish long-term. Its not the end of the world or the Bull necessarily.

2. It started as a double bottom , but it D-I-D enter the same area of the lows later (3x) but the big picture became a“W” PAttern . Its not what I would call a triple bottom in the big picture , so we dont want to get tripped up on ideas like “There is no such thing as a triple bottom, so if we drop here, then we must go to $GOLD $1000 or $800.” Lets just try to remain on the correct side of the trade…there will be drops and rallys , and best to just try to lose any Long term BIAS, Up or DOWN , until $GOLD resumes an uptrend ![]() (or whatever ) .

(or whatever ) .

SO with GOLD right now, what can we expect as a “POSSIBILITY”? Well, here is what I have been looking at and tweeted out recently.

YESTERDAY- WAS THIS JUST A BACK TEST OF A BREAK DOWN IN GOLDS CHANNEL??

IS THIS A RISING WEDGE ? IF SO…they break down

I kept mentioning that with GOLD UP last week, and the $USD down for 4,5,6 straight days, the MINERS WERE WEAK

GDX APRIL 14 – possible rising wedge and “TEST” , JDST was the trade to take here, with a stop above this channel. CLICK on the charts if they are too small, this will make it easier to see.

In conclusion: I am a GOLD BULL in the longer term. Removing that BIAS as a potential distraction for short term trading, I had to ask myself. CAN WE DROP FROM HERE? Does it mean “No triple bottom, we must go to $1000?” Is there a prior pattern that shows me what COULD happen? Not what will happen, but what is a POSSIBLE path. We have one in the HUI to look at if needed.

If the C.P.I. #’s come out and GOLD flies like an Eagle straight up, we’ll lose this idea and flip to whatever the MKTS tell us they want to do too. ALSO, with the recent sell off, I Tweeted this chart (QQQ) saying that it looks trade-able. On April 14 QQQ hit 84, and thats a good place to take a stab at a long trade, but just stay nimble when the markets get whippy. HONOR YOUR STOPS.

I also posted on APRIL 7 that for our ENERGY trades , I was looking for a test near that 88 area on XLE, Tweeted this chart. That “TEST” looks to have completed Friday.

I AM STILL BULLISH ENERGY (See my Energy report listed on the home page)

Thanks for reading and I hope this helps you in your trading in one way or another.

excellent article.

thank you, sir!

Thank you Roger , appreciate the feedback

excellent article.

thank you, sir!

Thank you Roger , appreciate the feedback

Another fine post. Wicked charts, Alex. The charts in your tweets today were great too.

Thanks Rob, I’ve found that posting the meat here and using twitter for posting a quick idea work best for me. Thx for following.

Another fine post. Wicked charts, Alex. The charts in your tweets today were great too.

Thanks Rob, I’ve found that posting the meat here and using twitter for posting a quick idea work best for me. Thx for following.

amazing stuff Alex

PNC – Thanks for stopping by!

amazing stuff Alex

PNC – Thanks for stopping by!

For Readers, it was brought to my attention by my mother (An avid Biased reader) :-] That some may not understand what I meant by the Bulls Pic as my header for this article. Look closely at the Bull…the dark markings on His Face also look like 2 men facing each other , thus I wrote that ‘some see a BULL’ (in the various Mkts) and some do not (they see the 2 men on his face).

For Readers, it was brought to my attention by my mother (An avid Biased reader) :-] That some may not understand what I meant by the Bulls Pic as my header for this article. Look closely at the Bull…the dark markings on His Face also look like 2 men facing each other , thus I wrote that ‘some see a BULL’ (in the various Mkts) and some do not (they see the 2 men on his face).