You are here: Home1 / Exclusive Strategies

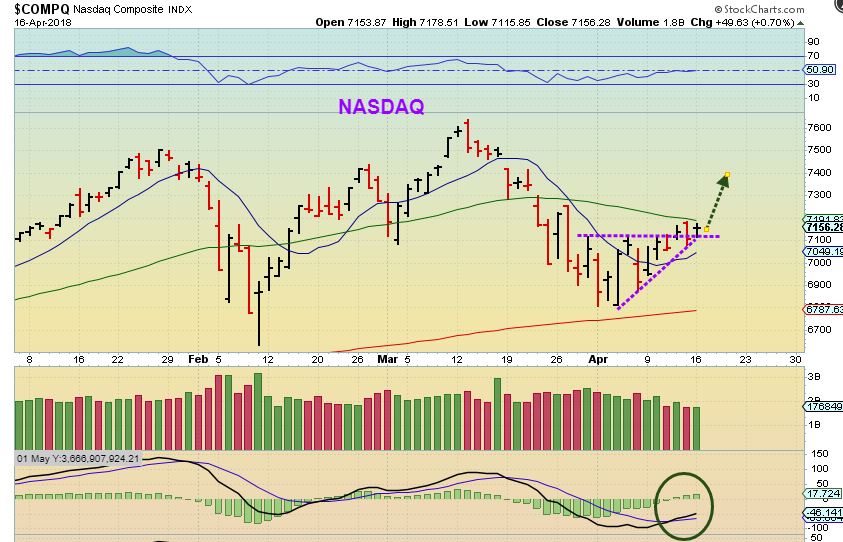

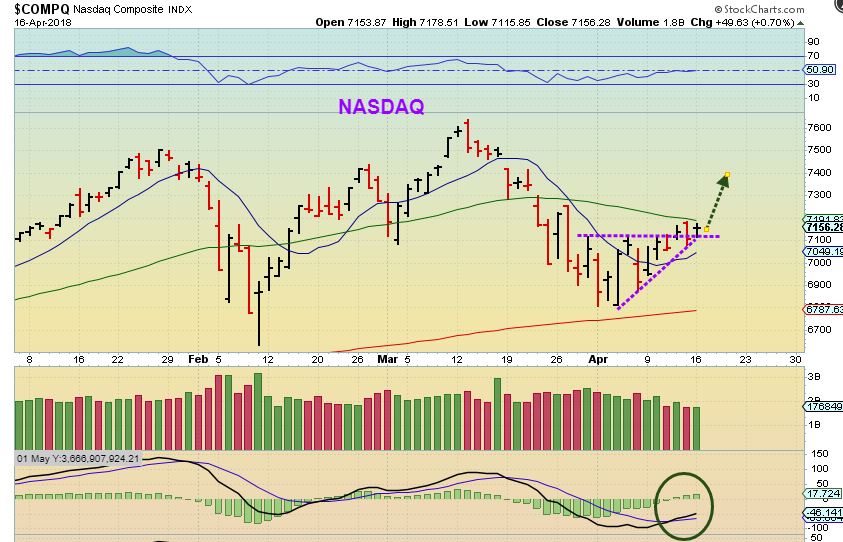

NASDAQ - The general Markets were on day 10 of a new daily cycle Monday. The are pushing against the 50sma as resistance...

Read More

Read More As mentioned in many of the 2018 reports, and especially in the weekend report delivered 2 weeks ago, we are seeing many changes slowly taking place in the markets. Today we will do our very important Big Picture Review, and along the way , I will discuss what I am seeing.

SPX DAILY - So far we still have our low on day 34. The SPX is going on day 10, and we are awaiting an upside break out.

Read More

Read MoreFriday is the final trading day of the week, and usually I do not cover the entire market, just what may be important for Friday. It is enough until we get to the long weekend report.

SPX - Yesterdays chart showed the day count of this daily cycle. We had the low ( DCL) on Day 34, Thursday was day 7, so Friday is day 8, and it is early in this new daily cycle. The chart was bullishly improving internally, as you an see with my indicators on this chart.

Let me show you how they look going into the final trading day of this week...

Read More

Scroll to top

Read More

Read More Read More

Read More