You are here: Home1 / Exclusive Strategies

Today the Fed Minutes are expected to provide insights into the May 1 central bank meeting. Policymakers decided to keep interest rates steady, and I do have some interesting things to show you pertaining to that. 2 P.M. Eastern Time will be the time that the minutes are released, so set your alarm 🙂 Let's take a look at the Markets.

.

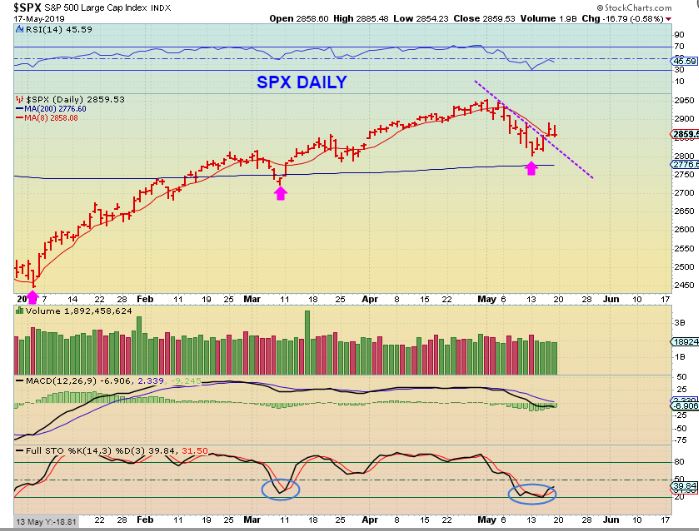

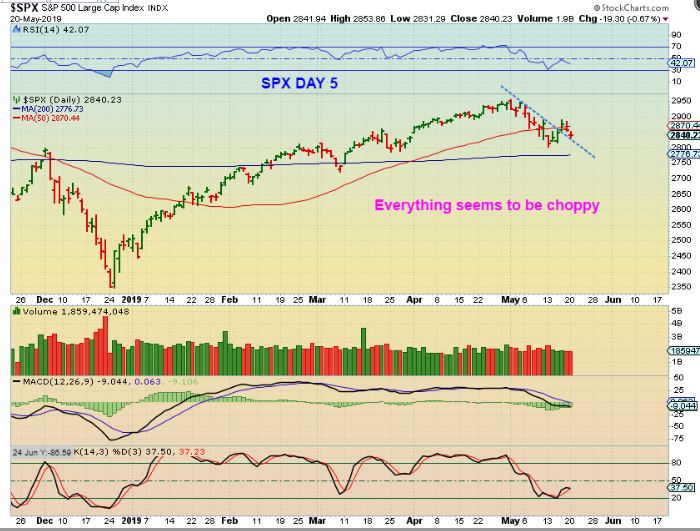

SPX - This was the SPX in yesterdays report, showing a possible back test and the DCL is in place...

Read More

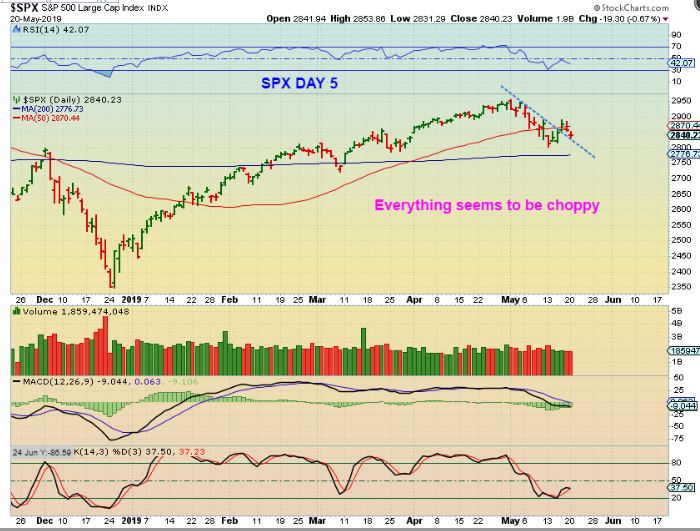

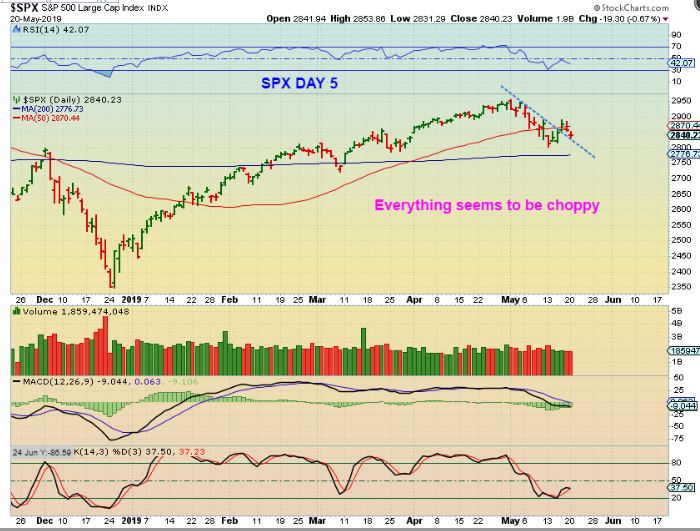

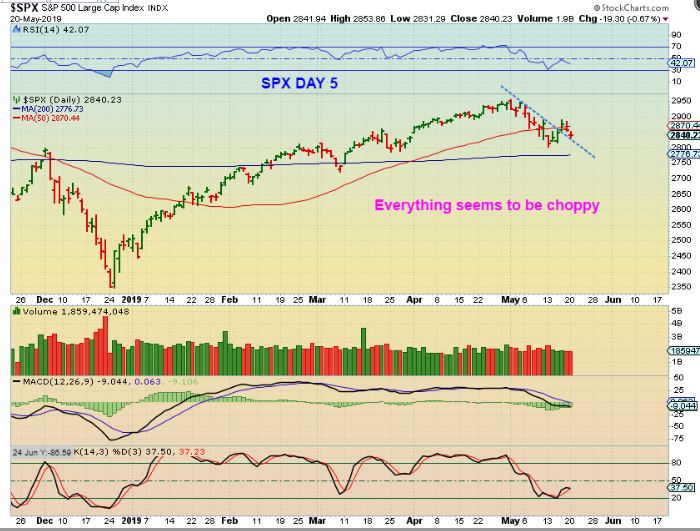

Read MoreOne thing that the markets do not like is indecision, and lately with the China Tariff 'cause and effect', the Markets are having a tough time gaining traction. I believe we also get the release of the Fed Minutes this Wednesday, so it seems like we are in for some more choppiness. Let's just take a look at what the week started off like...

.

SPX - We had the break of the short term downtrend recently, but the upside follow through has been lacking. The SPX lost the 50sma, but this may just be a back test of that trend line. We'll see if we get a bounce Tuesday.

Read More

Read MoreFor our Weekend Report, we'll take a look at the changes that took place this week, and see how our Big Picture Views are shaping up. I think that you that you are going to love this report, so please take your time with the precious metals Sector and enjoy...

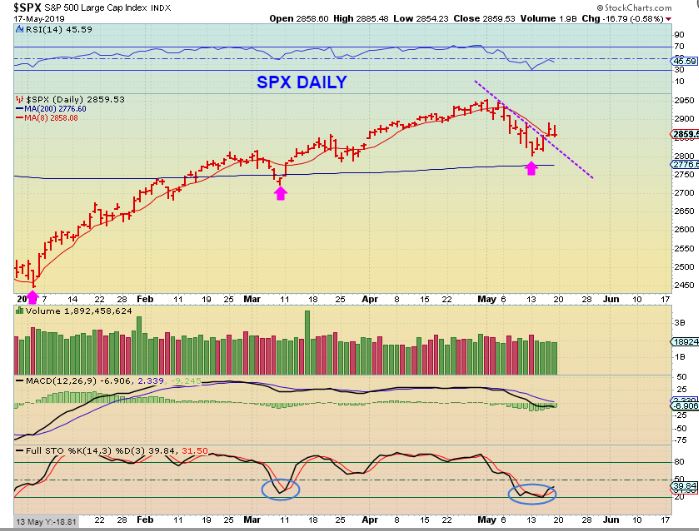

SPX - The General Markets are due for a dcl, and this looks like day 4 even though it sold off Friday. I wanted to start with the DAILY Chart, because the weekly alone would look less like a DCL formed.

Read More

Scroll to top

Read More

Read More Read More

Read More