You are here: Home1 / Premium

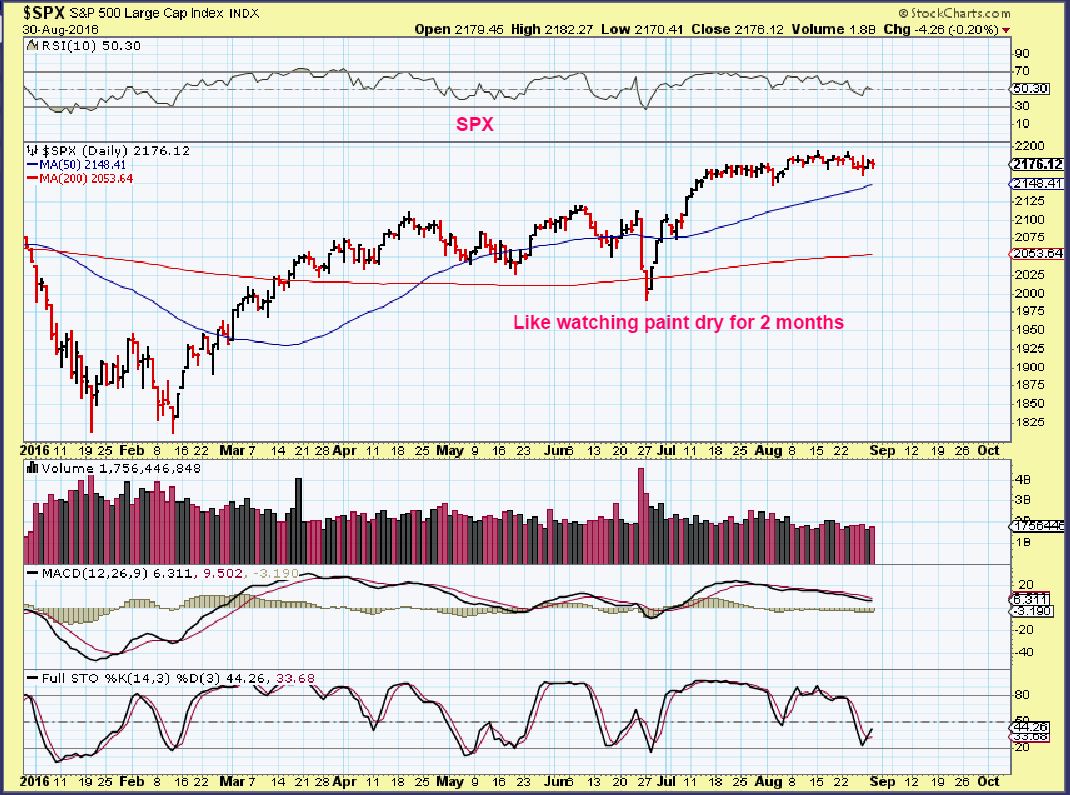

Knowing that my readers are both short term traders and longer term investors, I want to always look at the charts and view them with a long term, medium term, and short term perceptive. At times all 3 views are sunny or all are murky, but in times like these, I also get a mixed bag. Lets review the charts and you will see some good and some questionable things in various sectors. This can help to sort out our short term and longer term investments.

.

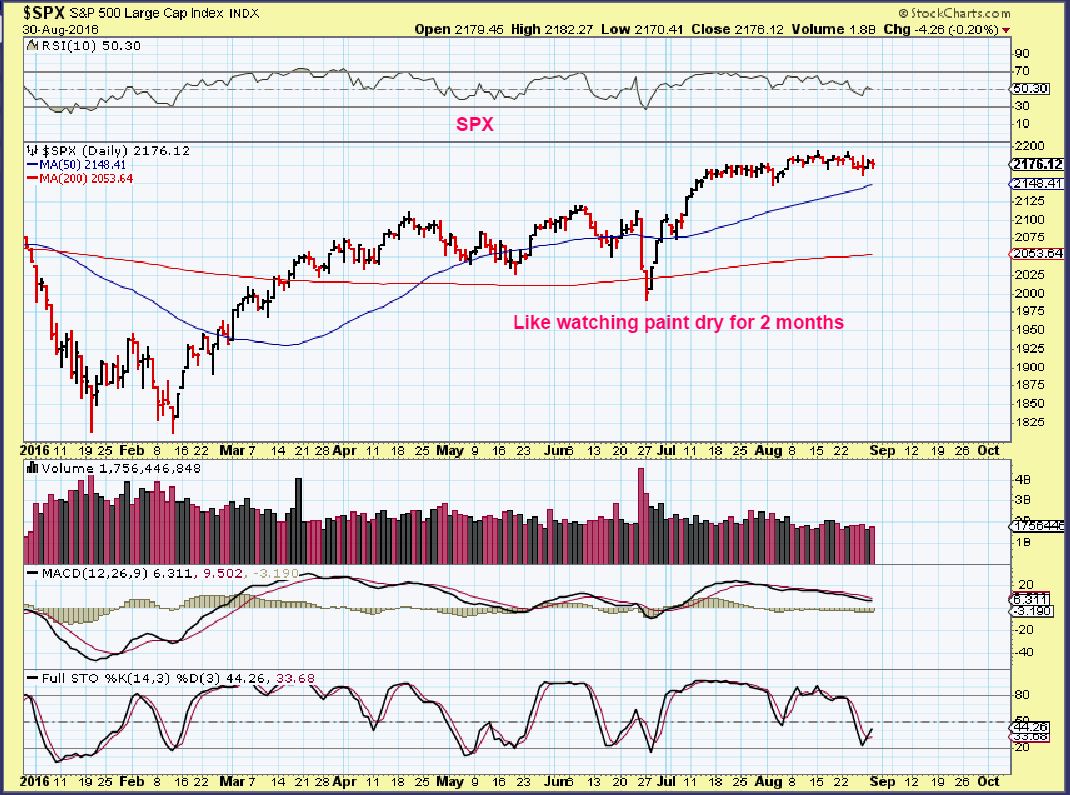

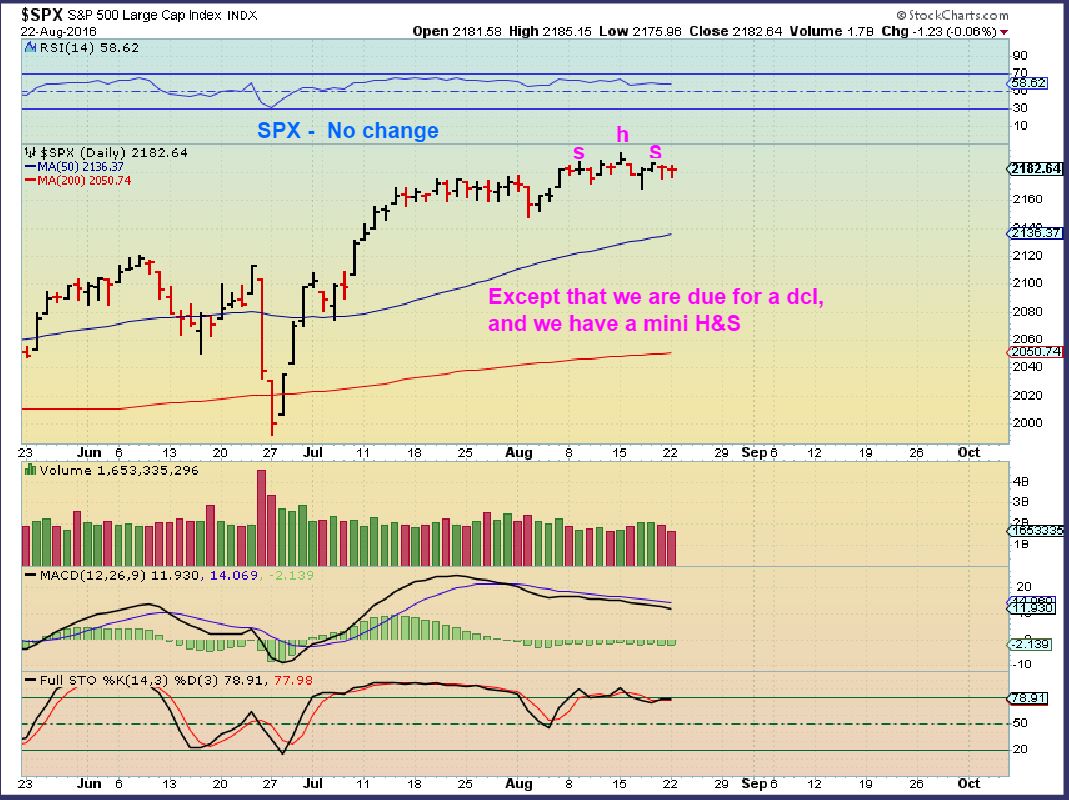

Back before Aug 26th and on this Aug 26th chart, I mentioned that we could see price continue sideways until it tags the 50sma, or maybe even break it in shake out fashion.

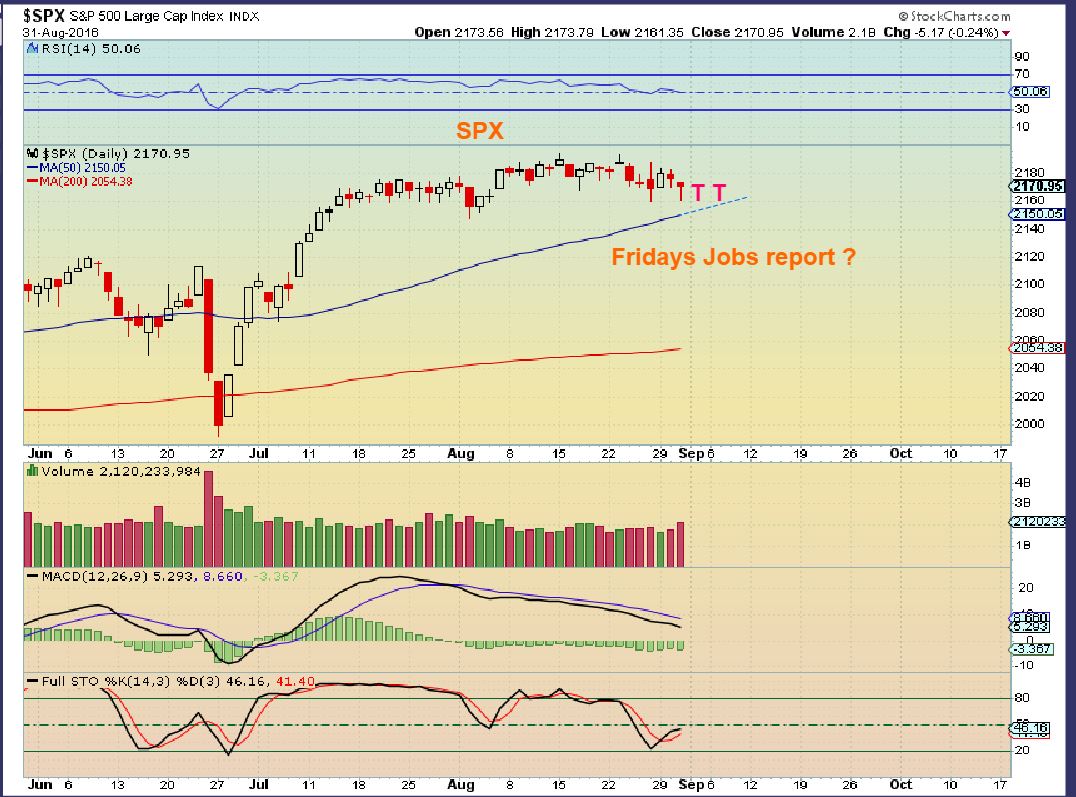

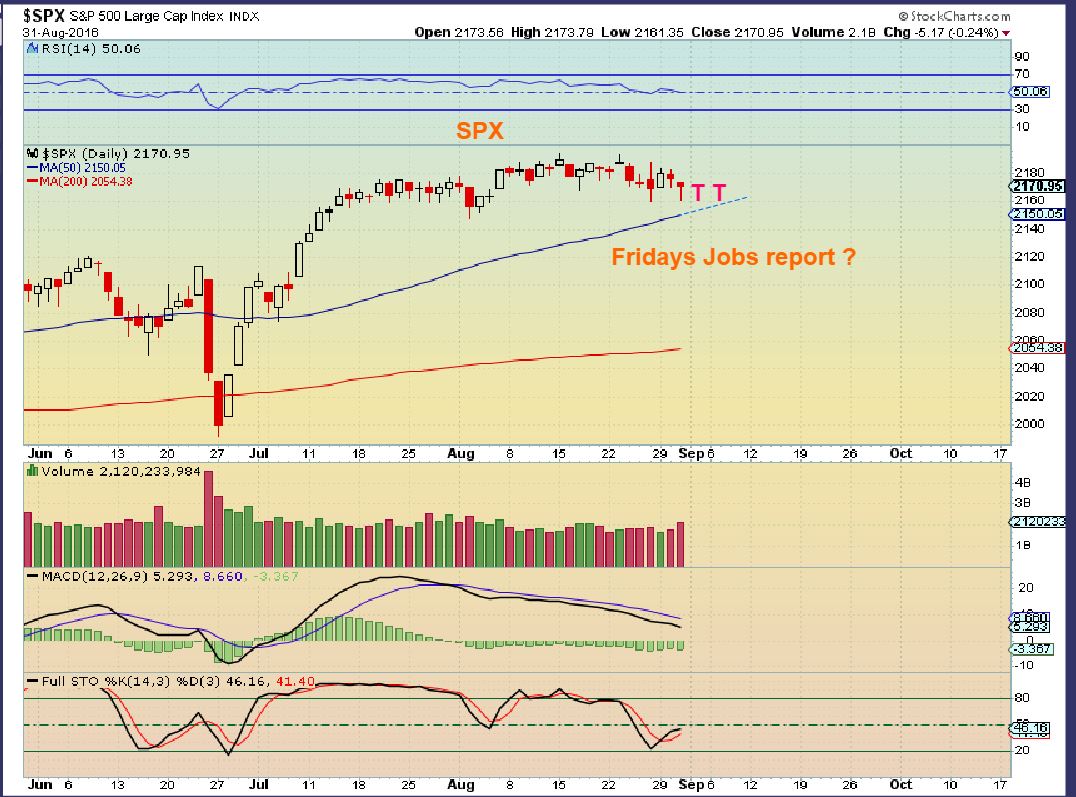

SPX - Each sell off is met with buying reversals, so this reversal with the Jobs Report "might" be enough to put in the daily cycle low. If so, this should break out & continue higher, instead of more of this 2 month choppiness.

Read More

Read MoreFridays jobs report may change a few things, but so far the charts are showing the same old song and dance...

.

SPX - Not much change here (I added a Thursday candle and a Friday candle as a possibility of tagging the 50sma).Jobs report Friday may give us our directional move. Many expect this to burst higher and run, but at this point, the Vix Chart looks rather bullish.

Read More

Read MoreThe theme picture is just a reminder: The markets do not usually go straight up to the top 🙂

.

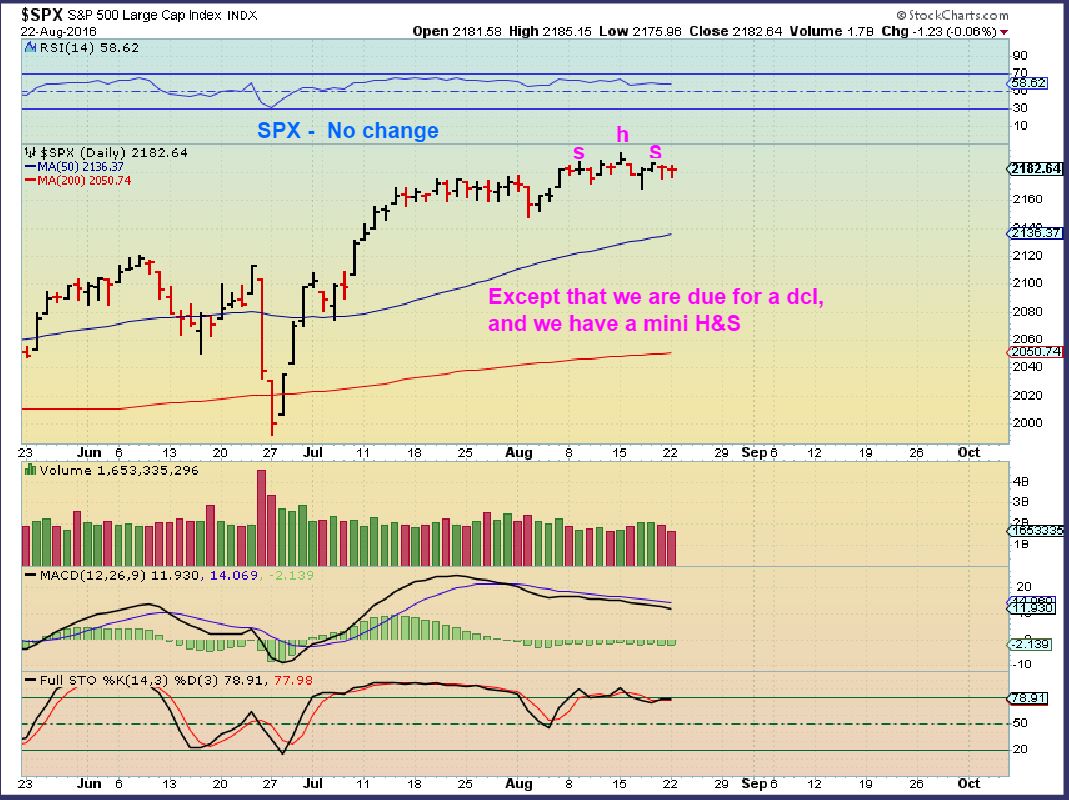

SPX - No change

Read More

Read MoreMonday didn't bring a whole lot of change since the weekend report, but there are few interesting things to discuss.

.

DJIA - The general markets continue the chop, and as they become oversold, the 50sma continues to rise under price as possible support.

Read More

Read MoreIt was a week of activity capped off with some Jackson Hole volatility. Lets take a look...

.

SPX - 2 months of sideways should produce a strong trending move. A dcl could shake traders out first.

SPX WKLY - The weekly shows that we are on week 8 out of the recent lows. The prior move did top on week 10 and dip for weeks before surging and making new highs on week 17, so these markets can be tricky, even when bullishly set up.

Read More

Read MoreWelcome to Jackson Hole Friday, please make yourself comfortable, we may experience some volatility. 🙂

.

DJIA - I still think that we should get some downside, as we are expecting a dcl.

Read More

Read MoreThe Bullish love for Miners over the past few months took a bit of a drubbing Wednesday. We didn't see the sellers using the gentle cycle to try to wash away the sentiment, it seems that they may have pulled out that wash board and vigorously scrubbed away at it. Many seemed to be heading for the exits. We'll discuss this further, but first...

The General markets sold down a bit, but we are still within the same consolidation that I've been pointing to for weeks. Any further selling should seek out the dcl that we have been expecting now.

SPX -

.

Read MoreTuesdays markets sparked my interest in a few ways. Let's get to the charts...

.

SPX - We've certainly seen this before. Frustrating the longs and the shorts, the sideways move continues.

Read More

Read MoreAs mentioned in a few prior reports, we are riding through a consolidation zone in some sectors, and now Oil and Energy are experiencing a slight pull back. In Bull Markets, these are healthy events and over time we eventually see higher lows and higher highs. Understandably, these periods where gains are given and then taken back get frustrating for some, especially if they last for long periods of time. With that, I wanted to re-post this recent report from Aug 12th to help us to maintain an unemotional perspective. Please read the article with the link below again, or just skim through it if you have time.

.

CHOPPY WATERS

.

SPX - The set up is bullish, but I am expecting a cycle dip into a dcl, so I am viewing it this way for now. There is a possibility that these markets just remain supported and head upward into a runaway type move. The dips are very muted.

Read More

Read More

Scroll to top

Read More

Read More