You are here: Home1 / Premium

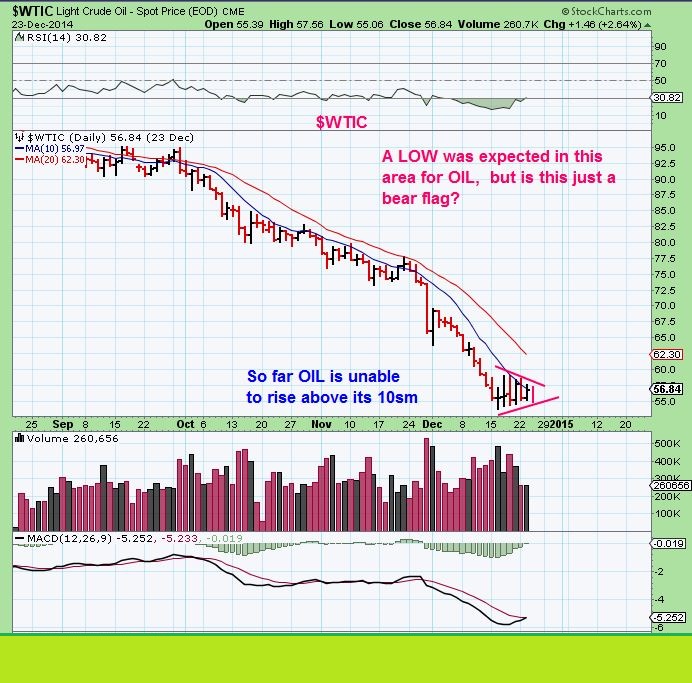

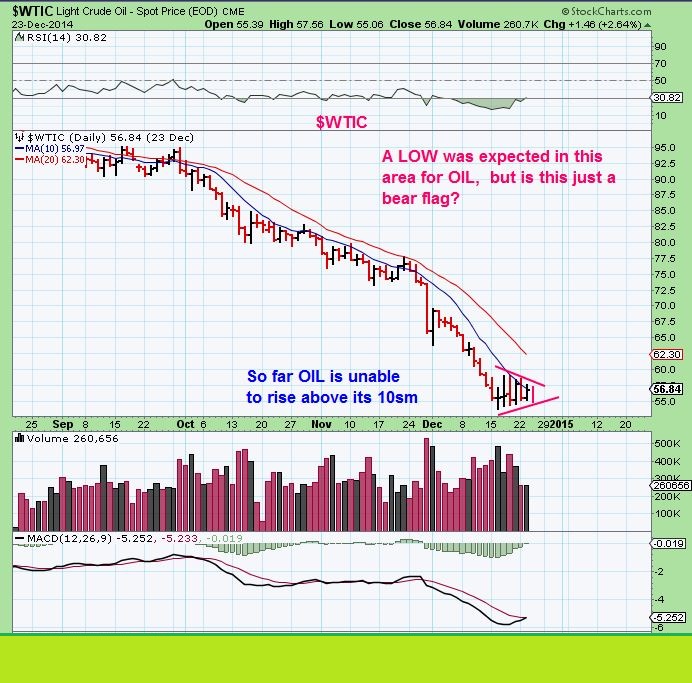

Just a quick post today to show you what I will be watching at the close on this 1/2 day of trading, and also what to look at Friday morning when the markets resume trading. It is noteworthy that OIL sold off again today and OIL is heading back to its lows. Bear Flag?

It's certainly possible that OIL undercuts recent lows. It almost did that today, but notice this ...

Read MoreWe had a little bit of selling & volume in The miners today , so instead of a morning report Tuesday, I wanted to post some thoughts tonight. I started getting some questions about things as the day went forward. Nothing wrong with that, it is expected. I had mentioned possibly seeing light volume holiday trading and by noon, we had some selling in Miners. I posted this chart Mid-Day before the selling really started to escalate, to point out some similarities to a prior sell off .

Selling increased from that point on, so what Now?

Lets take a closer look at all things cycles and technical analysis ...

Read MoreI just wanted to post this before the close

Read MoreThis week is usually a lighter volume / traders going on vacation - holiday week of trading. Not much has changed from Fridays report. Things really have to play out further to confirm our expectations or to change them. In other words...not much has changed. We experienced another peoriod of selling similar to what we had in Oct. Many twondered if the Sell off would end the year ugly and then suddenly , right on time ...

QQQ wkly

Its a strong reversal on a weekly basis and take a look at the next chart...

Read MoreToday is triple witching and that can increase volatility and volumes. The first hour tends to see the volatility, and by the last hour the total day volume increases become evident. If you are long the markets , you'll be happy to know that usually there is a bullish bias to Decembers triple witching activity. Nothing is guaranteed, so We'll have to wait and see.

SPX hit that lower target and reversed as seen here

As shown yesterday on the charts that I had drawn up for QQQ, IWC, IWM, RUT and so on, these markets are being bought at targets as that BUY THE DIPS mantra continues

Read MoreJust as I mentioned in the Wednesday morning report, The Fed Wednesday Storm was enough to more than Rock The Boat. If you watched the action from 2 P.M. to market close , the name of the game was Volatility. Remember though, sometimes the storms wash the landscape clean and we see the light of a new day, and today lets discuss the beauty of what might be...

Read MoreIn the past I have found that either on Fed Wednesday or Follow Through Thursday much of the analysis, whether it's using cycles, Tech Analysis, Fundamentals, etc - is both correct for a short time, then wrong for a short time, then correct again, then wrong again, and then the true direction that is going to hold finally seems to take hold. So for today ....

Read MoreI noticed something of interest in ENERGY today and wanted to try to post here

Read MoreGold started to dip down, rather fast yesterday, but please dont misunderstand. GOLD did not 'fail' in our expectations. It is getting a little whip-saw action pre-Fed, but it hasnt done an epic fail like out friend above. Let me explain.

Scroll to top