You are here: Home1 / Premium

Today is Friday, the last trading day of the week, and I have quite a few thoughts rolling around my head. One of the biggest is the employment report. Why? The Markets are on fire, The NASDAQ just broke out , following the SPX, DJIA, and RUT - which have been on fire. What if the Jobs report disappoints? What if the hurricane that hit Texas and then another one that hit Florida disrupts the employment numbers and caused more than expected to report that they are not working?

Well, again, it is Friday the last trading day of the week, so lets just look at what is in front of us as of Thursday nights close.

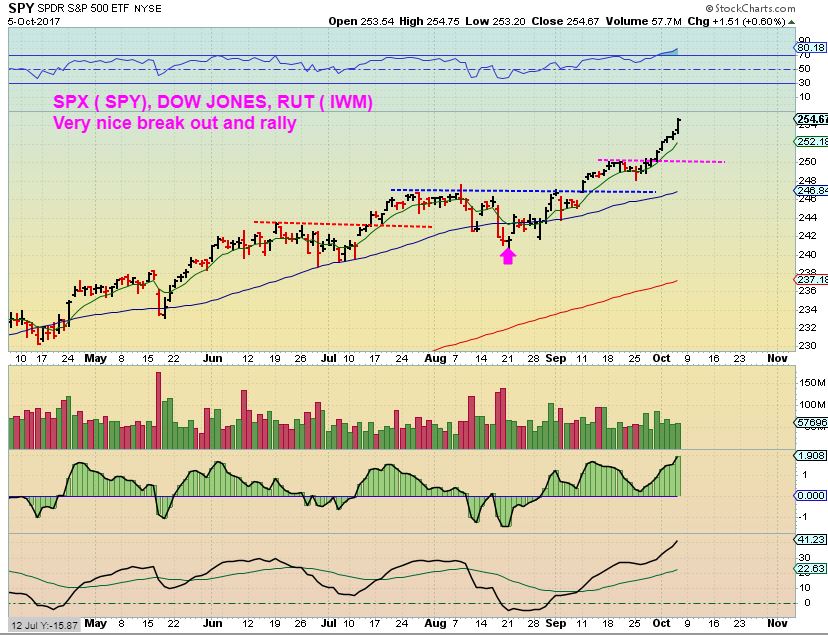

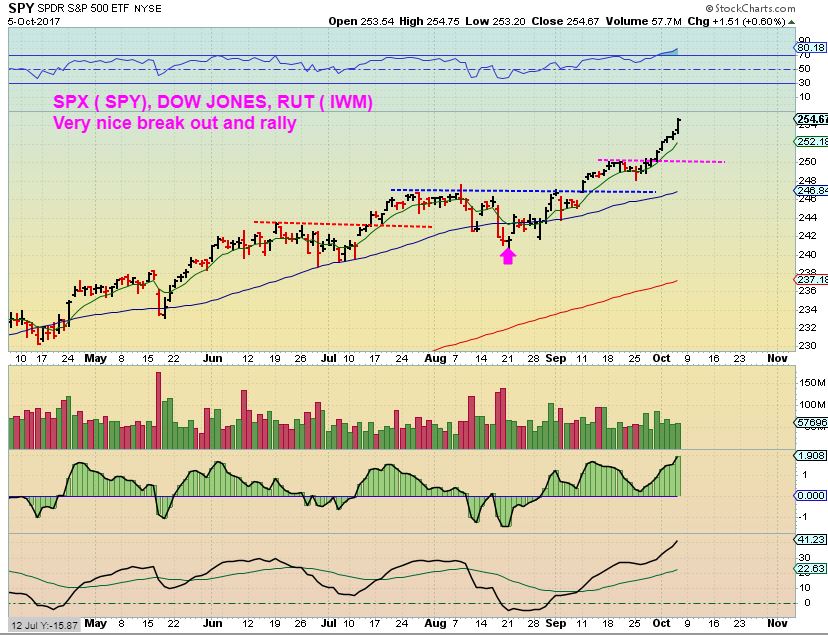

SPY - What a solid run higher after the break out. No change here.

IWM - I used this chart in the comments / chat section yesterday to simply show why I would use a 'trailing stop' rather than just selling my position when it gets to a point of 'overbought'. You would not be forced to sell in a runaway move, you just ride the gains until the top is in.

Read More

Read MoreI have given in to the pressure. 🙂 After our normal market review, I will discuss some of the biotech stocks that are a bit higher risk, but have been seeing tremendous rewards (gains) lately.

SPX - The idea of a trailing stop is working well, but we are on day 31, so we are now entering the time for the general markets to begin to seek out a dcl. Lately dips have been sideways and downward as seen on this chart. Since that was an ICL that we just put in place, and this is a R.Translated daily cycle, holding on to anything that is not leveraged may be fine during the dip into the first daily cycle. Some people just ride out the dips.

Read More

Read MoreHonestly, not much is changing from the weekend reports expectations and the Tuesday update. The General markets are moving higher, The USD has put in an ICL, Oil dropped but Oil & Energy stocks are holding rather well, etc. etc., so today I am just going to cover a variety of ideas, including trade set ups and a trading idea that is a bit higher risk ... a real Mixed bag. Enjoy.

Read MoreIn the weekend reports, I like to visit the BIG PICTURE look of various sectors and see if things remain on track with our expectations. Since my day to day reports cover the daily market action and fluctuation, let's take a look at the Big Picture, shall we?

.

SPX - I mentioned in many past reports going back to last spring that if the markets begin to enter a more parabolic move, we will not be able to see the ICLS, based on past parabolic moves.

The highly visible ICLs come from deeper sell offs, but with the recent bullishness and 'buy the dips' that we've seen in the markets, we no longer see the ICLS clearly. The small dip / consolidations that you see above my question marks ( when considered timing -wise ) would represent where the ICLs should be. A Steeper ramp up and less sell offs is a bull run. The big picture simply remains very bullish, until we see a change in character.

Read More

Read MoreI have been bullish on Oil and Recently the XLE or OIL & ENERGY stocks. Well, nothing goes up forever, but a pullback can also be a buying opportunity. I saw a fairly strong looking reversal in UCO & USO midday yesterday and wrote in the comments that this could be a temporary topping candle. That doesn't mean I am suddenly bearish on energy stocks now, so let me just discuss UCO & WTIC first, and then I want to also discuss the Miners.

UCO - Due to the gap open and then the selling, we have what is seen as a bearish engulfing. Look where it happened. Usually price dances or crawls around the 200sma as a resistance point, so I expect some sideways movement or a pullback at this resistance area.

WTIC- Look at Oil however. It already rode along the 200sma, and we have seen many reversal candles in Oil along this run, so we may just get a small pullback and even back test the 200sma. We are seeing a 'peak' on day 19 so far, but this CAN peak even higher. The set up remains bullish.

Read More

Read MoreLast week I pointed out the differences that I was seeing in the General Markets. For example the SPX, NASDAQ, RUT & IBX , XBI ( LABU) were all acting a bit differently. Let's revisit a few of those charts ...

.

SPX - The SPX looks ready to break out higher, but I had mentioned that I felt that the upside is limited, since each prior break out has simply moved up, gone sideways, and then dipped back to the 50sma. I'd still be ready to lock in profits in the near future.

Now let's look at the NASDAQ...

Read MoreMy emails were mostly asking about the Precious Metals and Energy, so that it what I spent my time on.

Read MoreLast week was the week of the September F.O.M.C. Meeting. Let's review how the week played out and ended.

.

SPX - We find the SPX on day 23 and that is within the timing that it could start to seek out a daily cycle low. I am pointing out in this chart that recently when the daily cycle has been in the 20's plus count, it has merely gone sideways, so upside may be limited here.

I did notice a few other interesting things with the General Markets however.

Read More

Scroll to top

Read More

Read More