You are here: Home1 / Premium

As expected, we have seen quite the sell off in the general markets. Oil & Commodities have been selling off too. Gold , Silver , And Precious metals are holding up, but are they ready to run now, or will they sell off? I actually spent a part of this weekend digging in to older charts and making some new ones, so lets take a look.

.

While digging into older charts, I actually found this warning chart that I posted in April of 2015, when I said I thought we were seeing that rising wedge forming. Also by counting the months of the Bull market, we looked to be late in the bull. I am re-posting it because it had a logical target to me at that time.

SPY - We topped in May 1 month later. Now drop to Test the break out?

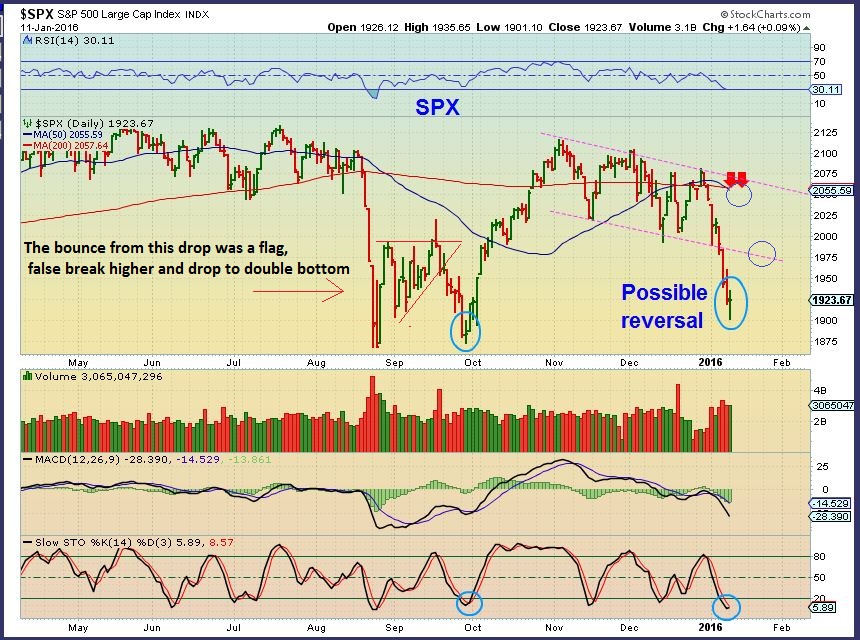

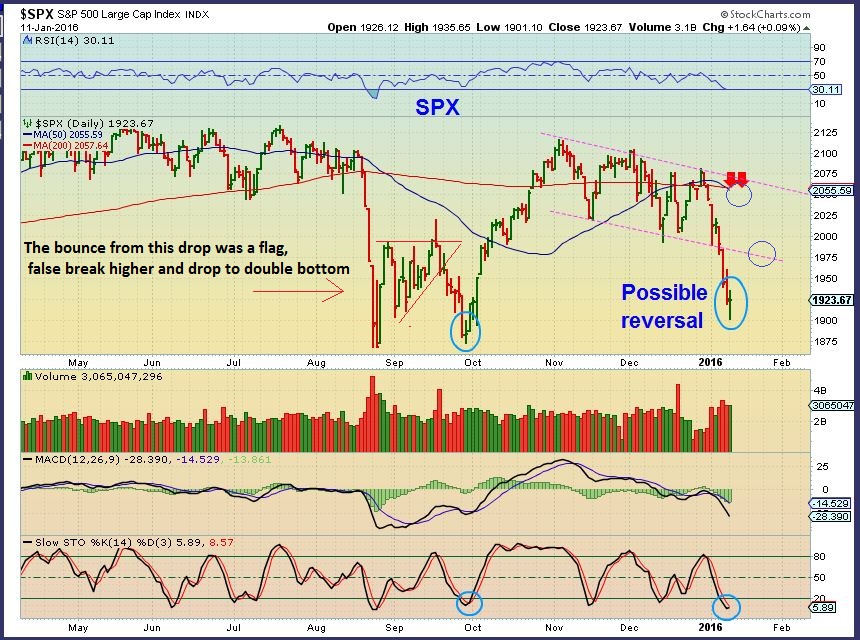

SPX - We broke the Aug lows Friday and recovered. This is a failure, but we can get a solid bounce soon. Lets discuss a couple of possible scenarios . One is a flash crash right now, the other is a believable rally that rolls over eventually.

SPX - We broke the Aug lows Friday and recovered. This is a failure, but we can get a solid bounce soon. Lets discuss a couple of possible scenarios . One is a flash crash right now, the other is a believable rally that rolls over eventually.

Read More

Read MoreYesterday I saw a rather bearish development in Miners, so I immediately began doing research to see if what I was seeing was a major concern. I found something very interesting that happened in the past, and I will share that finding with you here, but first let me review Gold here.

.

This was Gold in my last couple of reports, and I expected it to drop down and test the break out. As mentioned, Gold had a very bullish set up, and the C.O.T.remains bullish. Here is how it played out. I expected a back test.

.

We got the back test, but Miners broke down as gold reversed higher. And with Gold then down pre-market, would this pattern hold up?

This was Gold at the close Thursday. We would like to see this triangle hold up, and so far so good.

What about the Miners though? What did I see that was concerning, and what did I find that I thought was important to share with you?

Read MoreI had this chart in my weekend report. After this weeks selling, it looks more and more like a reality, and not an illusion.

SPX CURRENTLY - I expected a bigger bounce this week, but the 2 day bounce was sold off yesterday. This is a break down and a back test.

Read More

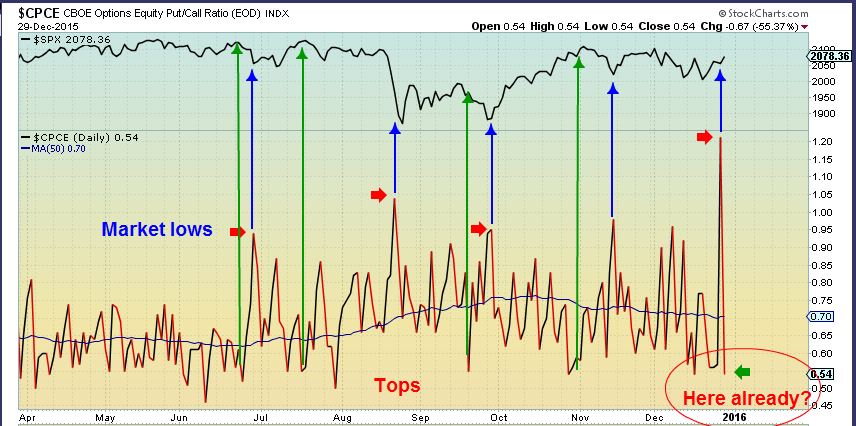

Read MoreSPX - Yesterday I was pointing out the reversal candle and we were expecting a move higher, but would it be just a bounce?

SPX - We will get follow through, so traders can trade it, but at this point I do not expect a return to the Bull run. (See the weekend report for the big picture). Strong overhead resistance is pointed out, if the markets can make it to that area.

Read More

Read MoreWe know that sooner or later the markets will bounce, but what should we expect? A recovery or just a bounce? Lets check out the charts...

.

SPX- There are points of resistance to be watched along the way. Look at the Aug - Sept 'bounce'. That first month was rather lack luster, but the surge in October was brisk. With a reversal on Monday, we may get out move higher immediately.

Read More

Read MoreAs time goes by, it certainly seems like the pieces of the puzzle are coming together to reveal the Big Picture that I have been discussing for months. 2016 could be a great year for some, painful for others if this continues. Lets review.

SPX WKLY

.

RUT - NOT VERY ENCOURAGING IF WE DONT GET MORE THAN A BOUNCE SOON

Read More

Read MoreMiners are moving higher as expected. Granted, they aren't exactly acting like the above picture, but lets look at some charts and see where some opportunities may be.

EGO - After basing in a tight inverse H&S type base, EGO is just breaking out above the 50sma now.

Read More

Read MoreI dont regularly watch CNBC, but I was in the waiting room today and CNBC was on and I actually saw them reporting that North Korea tested a Hydrogen Bomb and caused the markets to sell off. I guess they dont use charts? Was todays sell off sudden and unexpected?

.

SPX - We've been discussing it for months here at Chartfreak. This Dec 31st chart showed that the SPX hit the top of its trading range, lost the 50sma, and was likely heading lower into 2016.

Now lets take a look at potential targets...

Read MoreThough the long term views remain the same here at Chartfreak, the short term views do get a bit hazy at times. For Shorter Term Traders, we look for immediate low risk trade set ups, but some shorter term things are a tad unclear. I will show you what I am thinking is likely, but please remember that in times of uncertainty, cash may nor be NOT a bad thing. Patience may even save funds for future trades. 🙂

SPX - As mentioned yesterday, we could be at support but this remains weak looking and even with a bounce we see overhead resistance that should be noted.

Remember that in the NASDAQ I pointed this out...

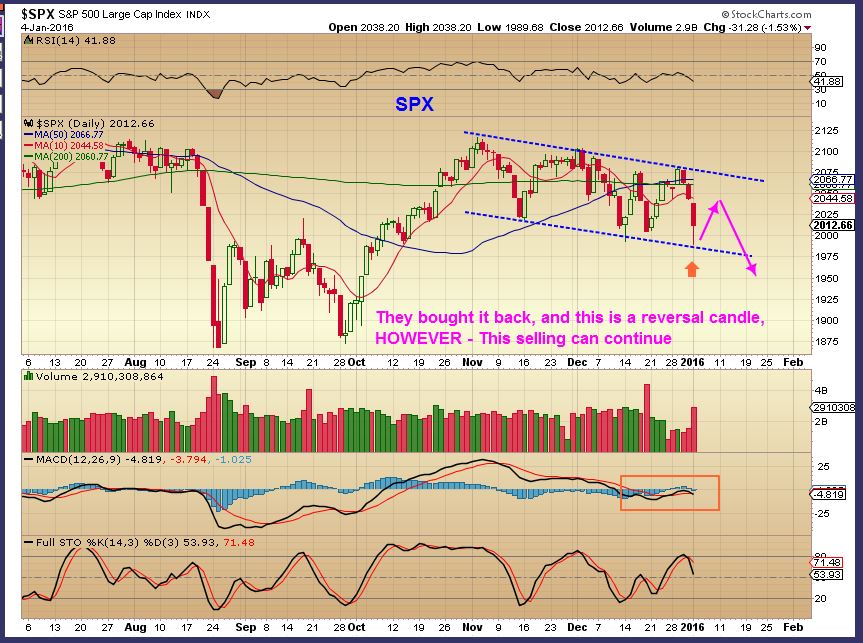

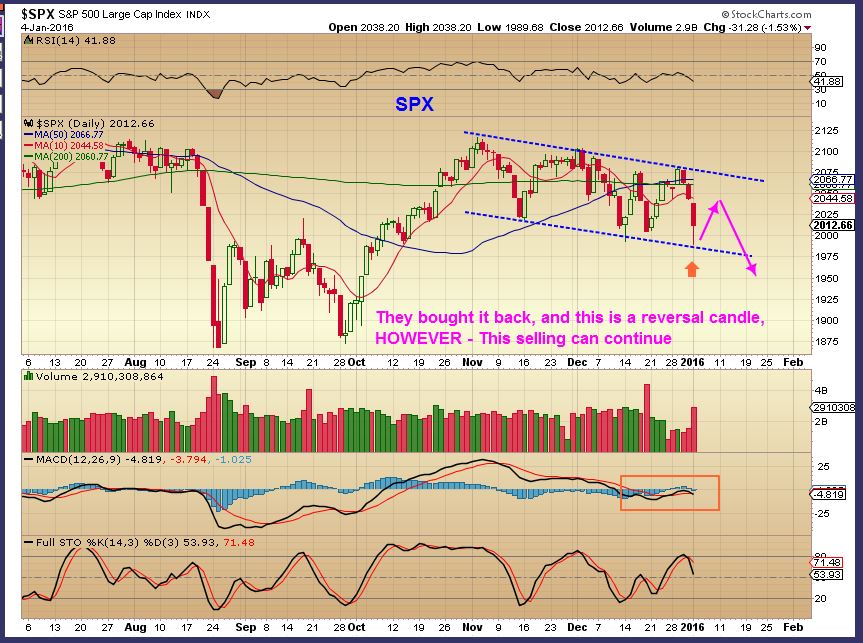

Read MoreDay 1 of 2016 was actually what we have been expecting. The question is , will there be follow through?

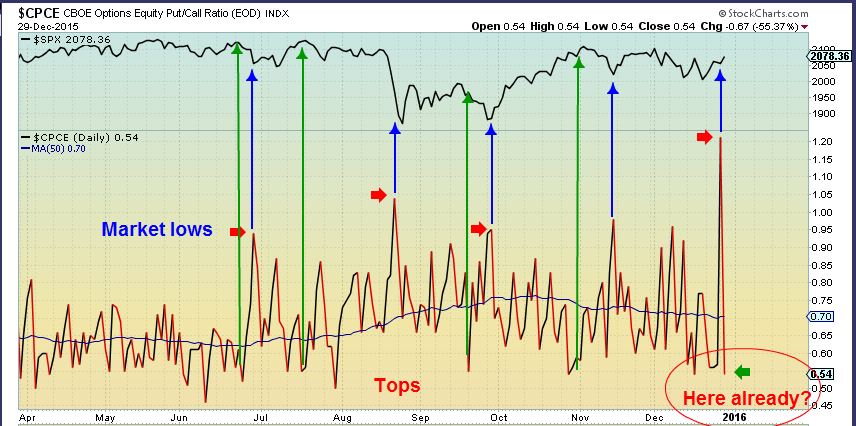

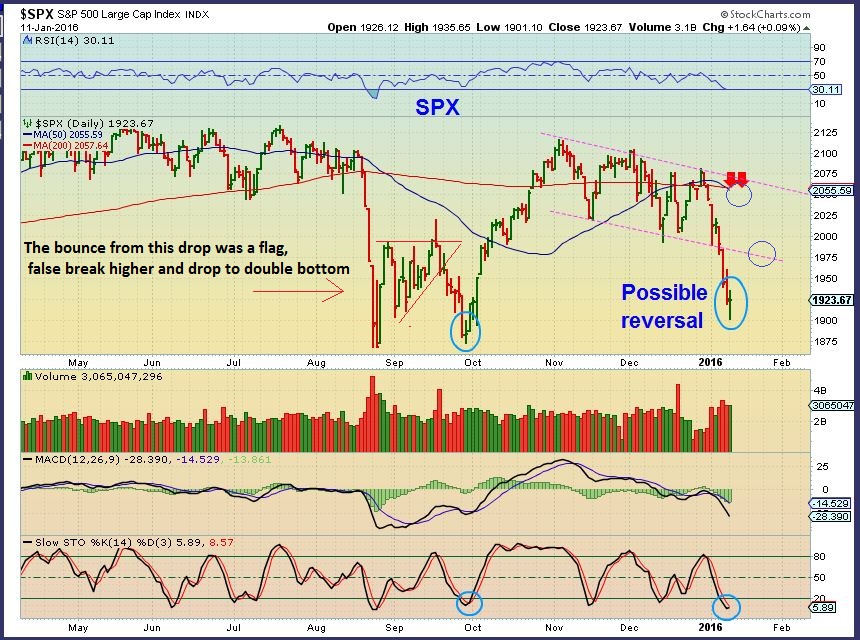

On Dec 30th , I showed this chart to point out that I had expected a drop in the markets. Look how rapidly the CPCE dropped ( bearish). After yesterdays drop in the markets, the CPCE currently reads .80 - so that can be close enough for a bounce, but the CPCE also could move higher as seen on this chart. That means further downside is also possible today. Lets look at more charts...

SPX - Yesterdays drop did rebound a bit near support, so we may bounce, but this can keep selling off.

Overall this looks weak...

Read More

Scroll to top

SPX - We broke the Aug lows Friday and recovered. This is a failure, but we can get a solid bounce soon. Lets discuss a couple of possible scenarios . One is a flash crash right now, the other is a believable rally that rolls over eventually.

SPX - We broke the Aug lows Friday and recovered. This is a failure, but we can get a solid bounce soon. Lets discuss a couple of possible scenarios . One is a flash crash right now, the other is a believable rally that rolls over eventually.  Read More

Read More