You are here: Home1 / Premium

SPX - REMINDER: 2 weeks ago I showed how the Markets can base build after such a sharp drop & added volatility. I mentioned that they may drop to the 200sma in an A-B-C type drop and then even go sideways. SPX actually did drop to that 200sma after I posted this , so this may be base building. See the next chart...

SPX - So far, the above pattern is playing out. Drop to the 200sma and now we wait and see.

Read More

Read More Today is the release of the Fed minutes. At times we get the same reaction that we saw when the Fed Decision was released, and other times we get the opposite, so that is todays question...what will todays Fed Minutes bring? It shouldn't be as bad as THAT guy thinks, but it is worth paying attention if you are rather heavily invested.

.

SPX - The markets pulled back a bit on Tuesday, but after that strong 6 day blast higher, the pull back was minimal.

Read More

Read MoreI have done a little more digging, looking for the best way to answer your questions. I think that you'll be happy with much of what I have found...

Read MoreEarlier this week I wrote a report entitled 'Sprouts', indicating that things were settling down and buying opportunities were sprouting up. Here we are at Friday, the last day of the week, and things are really shaping up now. Let's take a look...

Read MoreWednesdays CPI report showed that inflation came in a little hotter than expected. Hot enough to light a fuse in some cases. Let's review our markets...

Read MoreAfter Monday and Tuesdays trading, we are currently seeing 'sprouts' of growth but we're still also waiting for some stronger follow through, so let's discuss this stage of our growth...

Read MoreMy weekend report was extremely detailed as to what I feel we are seeing. I am going to try to keep todays report a bit more simple, since we have only had 1 trading day since that weekend report. The Theme Picture? What are we looking for, and for some more conservative traders, what are we waiting for...

SPX #1 - Please read the chart. Using cycles, the safer add point is after confirmation since volatility has been so high ( in the blue circle).

Read More

Read MoreIn the recent bull run higher for the General Markets, I advised almost daily using a trailing stop to lock in gains just in case we saw a deeper drop. A deeper drop to an ICL could cost you weeks of gains, a stop would lock in your gains. The goose that laid the golden eggs in the General Markets seems to have been sold on auction (for now). Gains from November forward wiped out in just a couple of days. Let's take a look and see what the markets did this week. This report also takes an intense look at the Precious metals market, and I am encouraged by what I have put together!

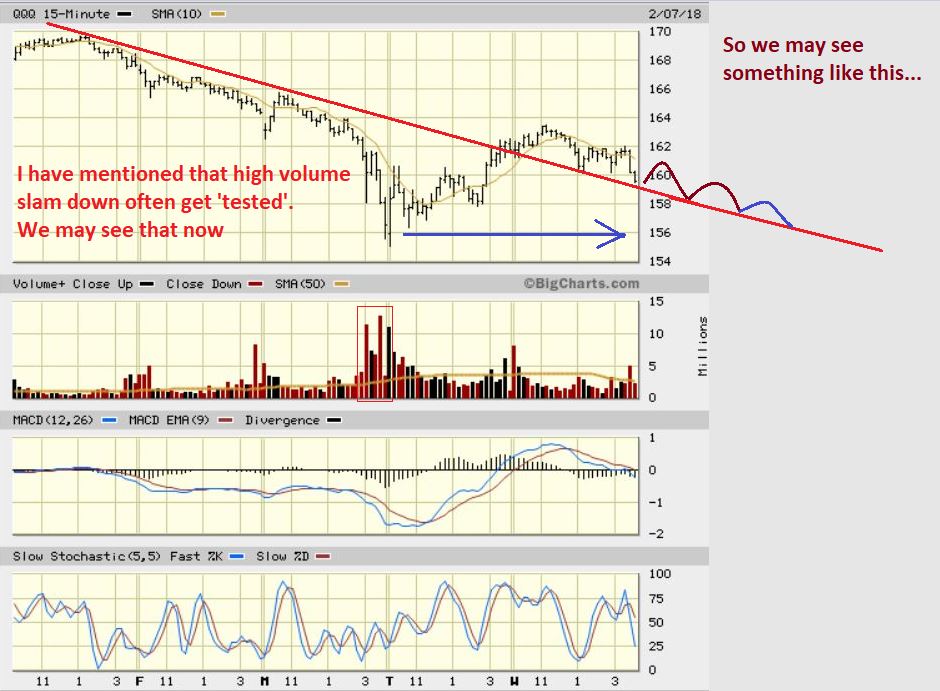

NASDAQ from my last report - The markets could drop to the 200sma as they have done in the past.

I pointed out that prior ICLs had done just that, sometimes even breaking that level.

In a report last week, I mentioned that way too many people were diving back in, it seemed too easy for the Bulls to just quickly 'Buy The Dip' again, so We should expect some volatility.

NASDAQ - 1. Importance of the stop - Notice that all gains from November to now would be taken back without a stop. 2. After such a plunge, Many want to buy the ICL at lows and ride it back up ( I totally get that, I buy reversal candles too). 3. If it rockets up in a V-Bottom, the gains can be very strong quickly, but often for most I advise waiting for a swing low for those looking for 'safe' & less sleepless night investing. Understandably, many tried to buy that 1st reversal despite risk. It failed. Now we have a 2nd reversal, and many were buying that one on Friday too. Again, I often enter on reversals too, but it is higher risk. That said, let's just discuss this so we understand what we are looking at...

Read More

Read MoreWhen the Ice begins to get too thin to support you, you would proceed with caution and maybe even take the safer route. When the markets experience a serious 2 day slam down, it isn't always the best time to just jump ' all in' with leverage. That is a trade that may or may not work out, and so it has higher risk. Leverage has probably robbed more people of their soul than thin ice has. Let's discuss that in todays report after our recent market sell off ...

NASDAQ -I covered the general Markets extensively yesterday, review that report if you need reminders. We had a strong reversal, and it did stall today. It is an unconfirmed swing low.

Read More

Read More

Scroll to top

Read More

Read More