From Break Through To Follow Through

/61 Comments/in Premium /by Alex - Chart FreakYesterdays report discussed some break outs that were taking place in various sectors. Wednesday, we saw some follow through in those areas too. Just like a baseball player at the plate, when we get a decent pitch tossed our way, we also need to follow through to be able to possibly score. Some may wait for a pullback or start a small position and add on a pullback later, since it is early in some set ups. Lets review.

.SPX - This is the follow through that we expected. We are only on Day 5 today, of a daily cycle that can last over 30 days.

Read More

Read MoreBreak Through

/70 Comments/in Premium /by Alex - Chart FreakTuesday was a Break Through in a several ways. Let's take a look.

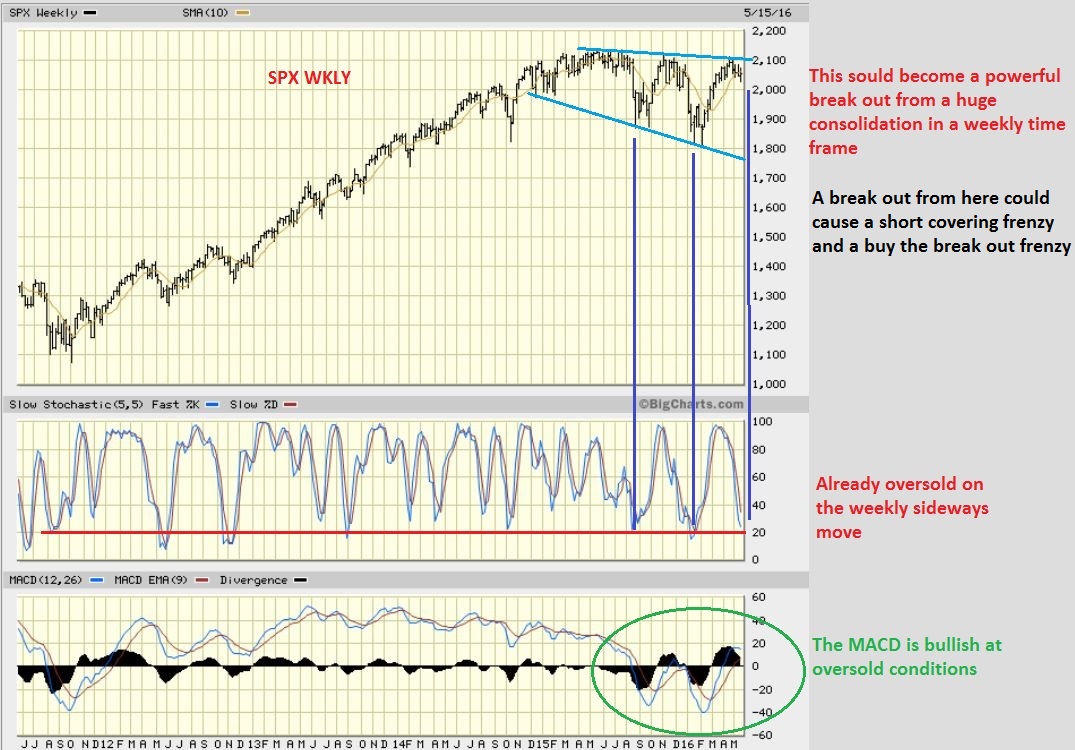

.SPX - From the weekend report. For many reasons, we were waiting for a break out higher ( not lower like many other analysts).

SPX Tuesday- We see a Break through. This is Bullish. Today is only day 3 of the 2nd daily cycle, following a R.T. Daily cycle. That means that we could really see this move higher over time. Picture this : Many were shorting what appeared to be a H&S, and they may now start covering and cause a buying reaction.

And the NASDAQ?

Read MoreSetting Up

/99 Comments/in Premium /by Alex - Chart FreakWe didn't really see a whole lot of change on Monday, but as mentioned in the weekend report, some areas could be setting up. Some setting up for a run higher, others setting up for a fall. To the charts...

.SPX - No follow through yet, but I am expecting higher prices soon.

Read More

Read MoreWeekend Report – Bull Cycles

/68 Comments/in Premium /by Alex - Chart FreakIn this weekend report, I want to review the markets as usual and discuss where they are at. Things look very interesting in many ways. I also wanted to discuss a few things about my personal view of trading around cycles. In my analysis, many are aware that I incorporate a variety of helpful techniques. I Mainly use various forms of Technical analysis, and along with that I add Cycles, Sentiment, a little Elliot Wave and so on. In this weekend report, I want to also briefly discuss a few things regarding Cycles and some of the trading that goes on around them. To the charts...

.SPX - As mentioned in a prior report, for the amount of time that the SPX has rallied out of lows and moved to oversold, it has had a mild pullback. Not even a 38.2% retrace yet.

Read More

Read MoreMay 20 – Friday

/68 Comments/in Premium /by Alex - Chart FreakLets do a market review and then I'll discuss what will be in the weekend report.

.SPX - We've been looking at what looks like a H&S. EVERYONE is looking at it and the group think is seldom correct, so I have to wonder if it'll play out. The reversal could be a DCL and may be setting up for a rally back to 2100.

Read More

Read MoreFOMC AGAIN

/152 Comments/in Premium /by Alex - Chart FreakWednesdays release of the Fed Minutes certainly caused a 'reaction' in the various sectors of the markets. It falls in place with the timing of certain cycles, so lets review the action and what it may mean moving forward.

.SPX - The General Markets sold off with the Fed minutes. They recovered into the close. This still looks like a H&S and has yet to recover the 50sma.

Something that I find very interesting happened on Wednesday, I'll discuss it later in the report.

Read MoreWednesday May 18

/74 Comments/in Premium /by Alex - Chart FreakFOMC MINUTES RELEASED TODAY, that can affect the markets , since they seem to be at pivotal points. I have a lot to discuss for a Wednesday, so lets get right into the report...

.

DJIA- I usually use the SPX, but they are similar right now. POssibly dropping to the 200sma, but 'time' is important here. It really needs to move higher sooner than later cycle -wise.

Read More

Read MoreWaiting For A Sign

/129 Comments/in Premium /by Alex - Chart FreakPatience in the markets can be rewarding and it might come in various forms. Patience is often needed to wait for a pull back to turn into a buying opportunity or a trade set up. It also might come when we are holding positions and we are waiting for price to show follow through. This weekends report showed mixed signals in various sectors and Monday started clarifying a few things, but a little more time might be needed to truly see what is unfolding. lets review...

.

SPX -The general markets showed some upside potential, regaining the 50sma. It looked like the DCL came 7 days ago, so now we need to see some follow through to new highs to avoid having this become left translated and a repeat of last fall.

May 15 Weekend Report

/43 Comments/in Premium /by Alex - Chart FreakWhile looking at a variety of charts for the weekend report, I started to see things give us some mixed signals about he health of various sectors. With that in mind I wanted to do something just a little different for this report.

. Read MoreContact Us

26 Broadway,

8th Floor

New York, NY 10004

admin@bigleaguefinance.com

admin@bigleaguefinance.com

Latest Blog Posts

accelerator diet pills goji berry diet pills ultra 90 diet pills keto meal replacement bar top weight loss diet pills for thyroid patients where to buy t lite diet pills keto friendly thickener diet fuel diet pills peanuts keto friendly rite aid diet pills that work envy diet pills diet pills for breastfeeding moms belique diet pills perfect slim weight loss pills calories in a bottle of white wine