Is It Time Yet?

/in Premium /by Alex - Chart FreakTuesday August 6th –

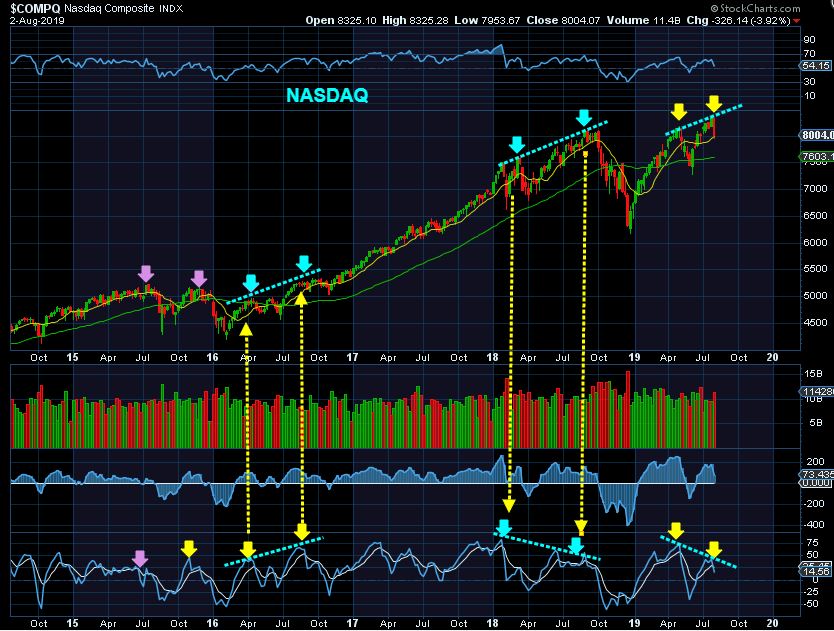

/in Premium /by Alex - Chart FreakThere were many smiling faces on Monday when Gold, Silver, and the Miners took off again ( maybe only until they looked at their IRA, though). On Monday, the SPX, DOW, and NASDAQ took a dive. The DOW was down almost 1000 points at one point, The NASDAQ was almost down 350 at one point, and the 50 sma, which I though might at least hold as a short term support, was sliced through rather easily.

.The first 2 charts below are from this past weekends report, highlighting internal weakness, and then we'll cover the markets with a special section about the Miners.

.SPX WEEKLY – This chart is a sign of weakness at the top. The Markets dropped Post Fed and remained near the lows Friday, the Miners recovered. This may be the start of the big picture trend going forward for the end of 2019. Markets lower / Miners higher.

NASDAQ WEEKLY – The NASDAQ has the same weakness showing up now.

Read More

Read MoreFriday – How Will We Get There?

/in Premium /by Alex - Chart Freak.

Nobody ever said it would be easy, so we just have to try to stay on the path that unfolds before us. Let's review our markets...

Read MoreAug 1 – Who Liked The 1/4 Point Rate Cut?

/in Premium /by Alex - Chart FreakWell, we'll need a little more time to see how the markets play out for the rest of the week, but it certainly looked short term bearish in the initial reaction. Let's look at the charts to see whether the initial move could be a fake out or a warning sign of something bigger?

Read MoreJuly 31 – Fed Wednesday – Sshhh, Just Let Him Sleep

/in Premium /by Alex - Chart Freak.

I love the way Bears look when they are asleep. So peaceful. Let's hope he stays that way. 🙂

Read MoreContact Us

26 Broadway,

8th Floor

New York, NY 10004

admin@bigleaguefinance.com

admin@bigleaguefinance.com

Latest Blog Posts

accelerator diet pills goji berry diet pills ultra 90 diet pills keto meal replacement bar top weight loss diet pills for thyroid patients where to buy t lite diet pills keto friendly thickener diet fuel diet pills peanuts keto friendly rite aid diet pills that work envy diet pills diet pills for breastfeeding moms belique diet pills perfect slim weight loss pills calories in a bottle of white wine