A Minnie Victory

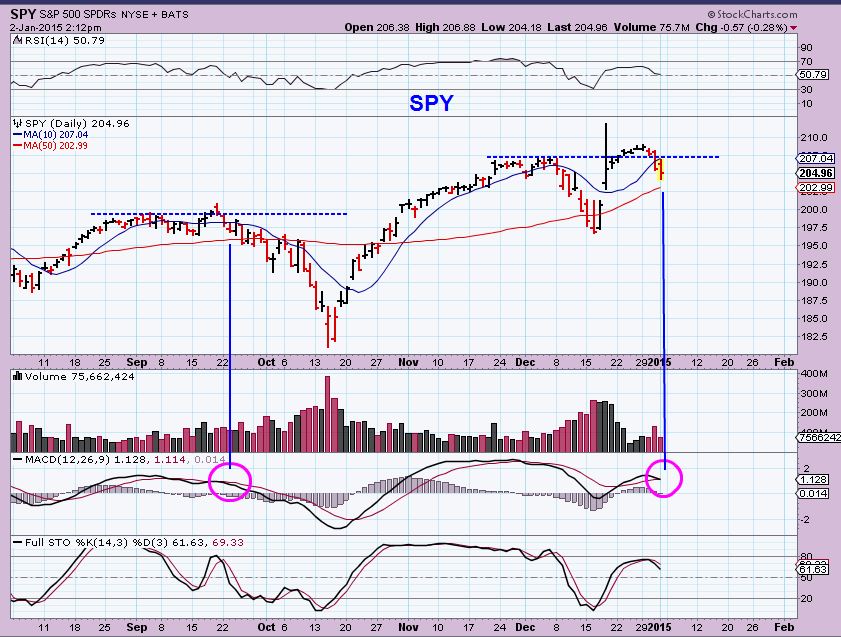

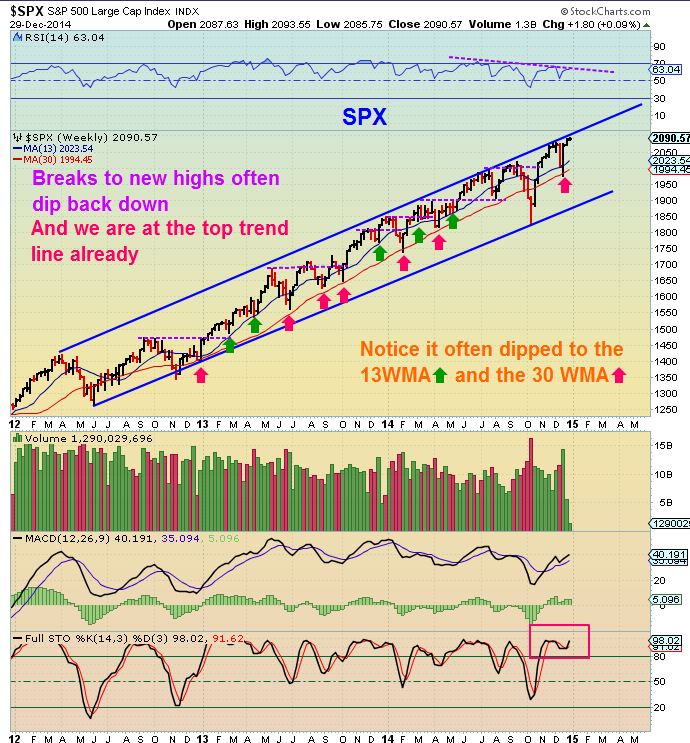

Friday was a Mini victory if you ask me, and I'll tell you why after a brief update of the markets. So far The SPX, Q's and Dow acted just as I thought they would, they have dropped after making new highs (QQQ was likely not going to make new highs, and it didnt ). DEC 30 - I posted this that I'd be watching the QQQ's at the 10sma, it looked weak.

Well, it broke right through the 10sma by the end of Dec 31, so what now? All doom & gloom from here?