Author Archive for: Alex - Chart Freak

About Alex - Chart Freak

I’ve been a full time trader for well over a decade and began trading in the late 1990s while working in management and sales at a well-known aerospace company. As my style evolved, so did my success, and it allowed me to leave corporate America to pursue my passion and trade full time.

Entries by Alex - Chart Freak

More Of The Same

April 8, 2015 /28 Comments/in Premium /by Alex - Chart FreakThe markets are moving much like I have been mentioning over the past few weeks. Things in OIL have played out as expected , and I believe they will continue to do so. I am seeing some interesting things happening in GOLD & MINERS, I will discus that a bit here, but the weekend report may be quite revealing , since we will see a few more days of trading playing out. Lets just get to the charts...

Shocked

April 7, 2015 /51 Comments/in Premium /by Alex - Chart FreakI was not so surprised to see the Energy sector doing so well yesterday. We've been expecting that next break higher for a while. I will say that I was surprised to see how quickly the markets shook off that jobs report , however. I mentioned in my weekend report that there were many nice stock set ups, so it was puzzling that the markets looked ready to break down. Well, just like that hypnotic dance forward in a conga line, the buy the dips crowd didnt want to skip a beat...

NAZ from my wkend report. I thought a gap down could break this wedge

Yesterday we saw a gap down and then the reversal higher, but I still want to point out this important point ...

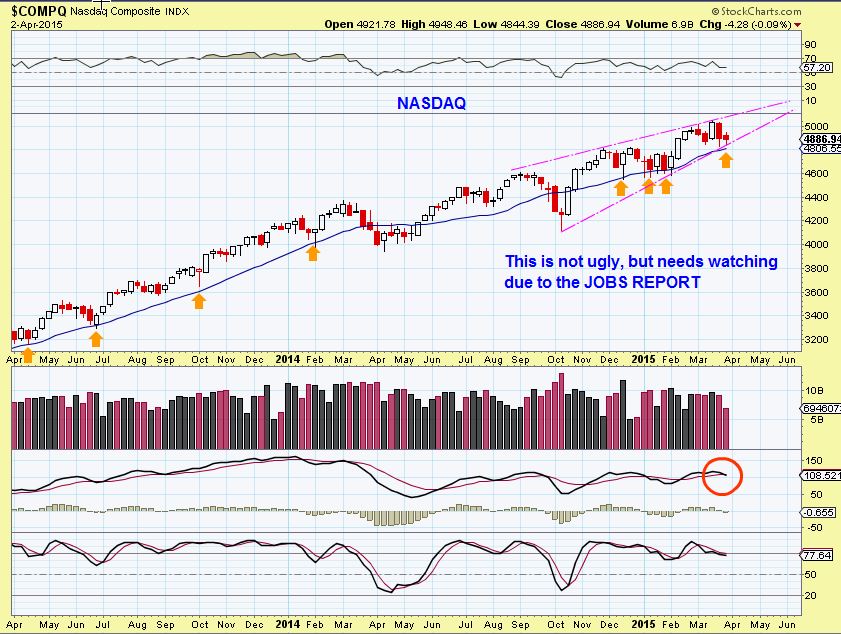

JOBS REPORT AND MORE

April 4, 2015 /24 Comments/in Premium /by Alex - Chart FreakFridays Jobs Report said a lot, and how the various markets react should be quite interesting. The markets were closed Friday , so what will Monday bring? Check this out...

I'll start with the IBB WEEKLY chart. This isnt overly Bearish at this point, its still above the weekly moving average, but needs monitoring.It was last Spring that Biotechs sold off deeply.

Now lets look at the SPX & the NASDAQ, but first let me explain the possible implicaitons of the negative jobs report that came out Friday ...

Checking the Charts

April 2, 2015 /45 Comments/in Premium /by Alex - Chart FreakFriday the stock market is closed , but I have a lot to say after yesterday, so lets check the charts and see whats happening at the end of our trading week...

.

In this chart Yesterday, I had pointed out that the NASDAQ had a gap to fill and support at the wedge, would it hold?

This is the chart from the close Wednesday...

Hanging In There

April 1, 2015 /29 Comments/in Premium /by Alex - Chart FreakNot a whole lot has changed in the markets since yesterday, but you'll see that they are still "hanging in There' for now in many ways. To the charts...

NASDAQ remains in a range-

The SPX actually looks a bit different ....

Market Observations

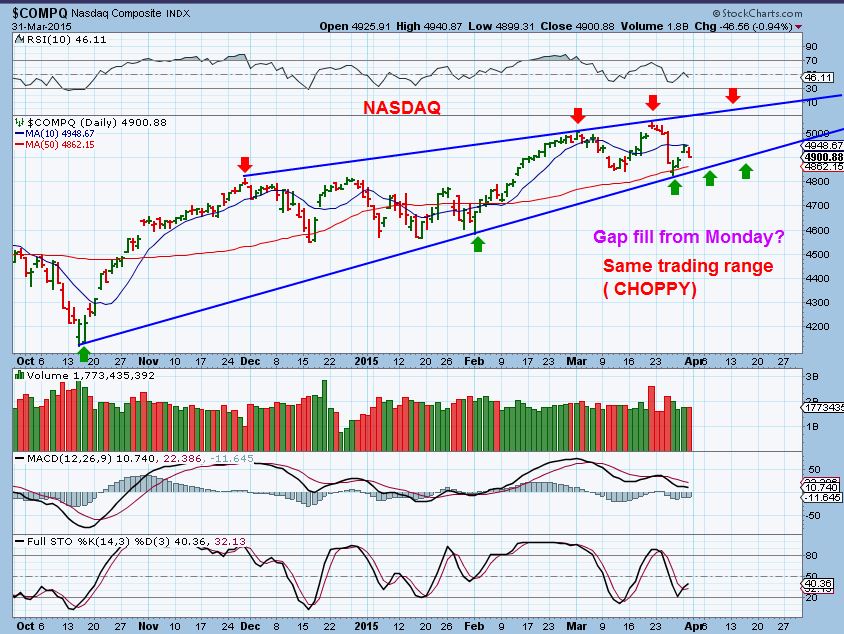

March 31, 2015 in Public /by Alex - Chart FreakI wanted to take this time and just share a few charts that I have presented to my premium members in various premium reports last week. Of course as time moves forward , charts can morph and change , so we keep our eyes on things as they unfold. Currently, however, things are still playing out as expected.

March 24 NASDAQ - I was pointing out a wedge pattern. They are bearish if they dont surge higher and break the pattern before reaching the apex.

Click to read more of this report

Stacking Up

March 31, 2015 /25 Comments/in Premium /by Alex - Chart FreakI really like the way things are stacking up, it seems that some nice opportunities are approaching. Lets look at some charts and you'll see what I am talking about.

Unanswered Questions

March 30, 2015 /25 Comments/in Premium /by Alex - Chart FreakThings seem to be playing out as expected, but that still leaves a few unanswered questions longer term. Lets look at some charts...

$USD - the pullback has acted exactly as expected (So far)

The weekly chart of the Dollar has been very strong...

Observations

March 27, 2015 /10 Comments/in Premium /by Alex - Chart FreakOften my Thursday report covers Thursday and Friday, leading into the Big Weekend Report, but a lot happened today, so I wanted to put out a Friday report. After a large drop Wednesday in SPX, DJIA, NASDAQ, IBB, etc , I felt we were right on target with the series of charts showing the Wedge Pattern, but were we about to slam right through it and break down? It looked it ...

Today, we saw this in many markets...

Contact Us

26 Broadway,

8th Floor

New York, NY 10004

admin@bigleaguefinance.com

admin@bigleaguefinance.com

Latest Blog Posts

accelerator diet pills goji berry diet pills ultra 90 diet pills keto meal replacement bar top weight loss diet pills for thyroid patients where to buy t lite diet pills keto friendly thickener diet fuel diet pills peanuts keto friendly rite aid diet pills that work envy diet pills diet pills for breastfeeding moms belique diet pills perfect slim weight loss pills calories in a bottle of white wine