Author Archive for: Alex - Chart Freak

About Alex - Chart Freak

I’ve been a full time trader for well over a decade and began trading in the late 1990s while working in management and sales at a well-known aerospace company. As my style evolved, so did my success, and it allowed me to leave corporate America to pursue my passion and trade full time.

Entries by Alex - Chart Freak

The Runners

October 6, 2015 /84 Comments/in Premium /by Alex - Chart FreakYesterday we saw some of the Energy and Mining stocks running swiftly. There are some small bases that have formed in the past few weeks, and now they may be starting a small leg up. Some had Gains of 20 % in one day, which could just be a mix of short covering and a little buying, but they may still continue higher. We'll take a look at some individual stock set ups like the one below.

SGY - A break above the 50sma, we see a possible Inverse H&S forming.

The Real Deal?

October 5, 2015 /69 Comments/in Premium /by Alex - Chart FreakWe discussed abnormal cycles in the markets in the last 2 reports, and I want to finish that discussion in the Gold report today. First lets review the other sectors and then we'll see whether or not the moves in Precious Metals are likely to be a few more false starts, or closer to the real deal.

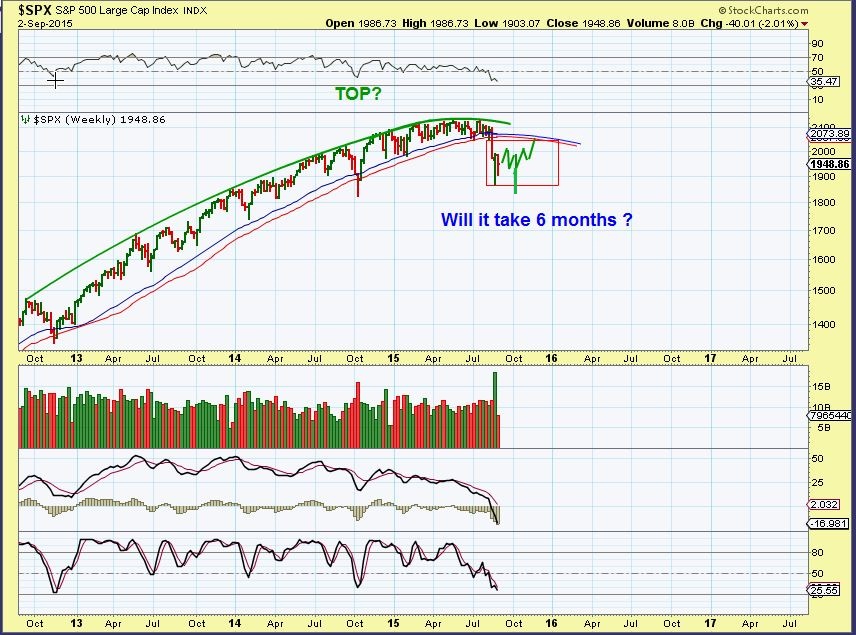

My SPX chart from over 1 month ago is playing out nicely. I expected a test of the lows and a test of the break down as shown here.

SPX - Sept 29 we got the test of the lows as expected. Now we should see a reversal higher.

SPX WKLY - We got that reversal as this week ended and I expect the SPX , DJIA, QQQ, etc to run higher.

This is what I'm expecting next...

Abnormal Cycles Part 2

October 2, 2015 /19 Comments/in Premium /by Alex - Chart FreakPart 2 of this mornings Gold report. I'll start with 2 charts that I pointed out recently in premium reports and in the public post yesterday, indicating some bullishness in the miners...

Sept 30 - GDX buy above the blue line and confirmation above the green dotted line . We are currently seeing that today ( we need to close that way)

Why was this important? Using only Cycles, the volatile movement in Gold and the Miners was causing concern and looked ready to fail. While using some of the indicators that I have developed to monitor internals at the lows, I was still seeing bullishness in a number of ways and technical analysis was also leaning toward bullishness, as seen above. I dug a little deeper to try to reconcile the differences and came up with this...

Abnormal Cycles

October 2, 2015 /34 Comments/in Premium /by Alex - Chart FreakThis report will only cover Gold, Silver, and Miners

Have You Been Trading Metals & Miners?

October 1, 2015 in Public /by Alex - Chart FreakHave you been trading Gold, Silver, or maybe some of the Miners recently? They have been quite volatile lately, with many good traders being stopped out and frustrated. I was recently stopped out last week, when some miners did a false break higher above their 50sma, only to turn down and close below the 50sma […]

Got Pain?

October 1, 2015 /68 Comments/in Premium /by Alex - Chart FreakThe market volatility has been whip sawing people left and right. What used to look like the perfect set up falls apart in just a day or two, so having 'stops' in place has been very important. Lets take a look at the markets and then review some very interesting things that took place in the Metals and Miners area today.

SPX- This bounce was expected.

Time Decay

September 30, 2015 /125 Comments/in Premium /by Alex - Chart FreakIt's time to discuss decay in the Oil and Metals markets, but first lets do a review of the equity markets.

SPX- This was Sept 15. I have been saying since August that I expect the lows to be tested sooner or later.

We see that happening now, so what next? ...

Does It Fit?

September 29, 2015 /125 Comments/in Premium /by Alex - Chart FreakCrazy action in the markets today. Some of it was expected, but some of it doesn't seem to fit. Lets take a look.

IBB - Really taking it on the chin lately. This is a weekly chart and todays volume was massive.

How Are Things Stacking Up?

September 28, 2015 /53 Comments/in Premium /by Alex - Chart FreakIt would be good to look back at the past weeks activities and see how things are stacking up.

TRAN WKLY - This surely hasn't looked bullish as the trend changed. The Tran was rejected at the 10 ma this week again.

Contact Us

admin@bigleaguefinance.com

Latest Blog Posts

accelerator diet pills goji berry diet pills ultra 90 diet pills keto meal replacement bar top weight loss diet pills for thyroid patients where to buy t lite diet pills keto friendly thickener diet fuel diet pills peanuts keto friendly rite aid diet pills that work envy diet pills diet pills for breastfeeding moms belique diet pills perfect slim weight loss pills calories in a bottle of white wine