Testing

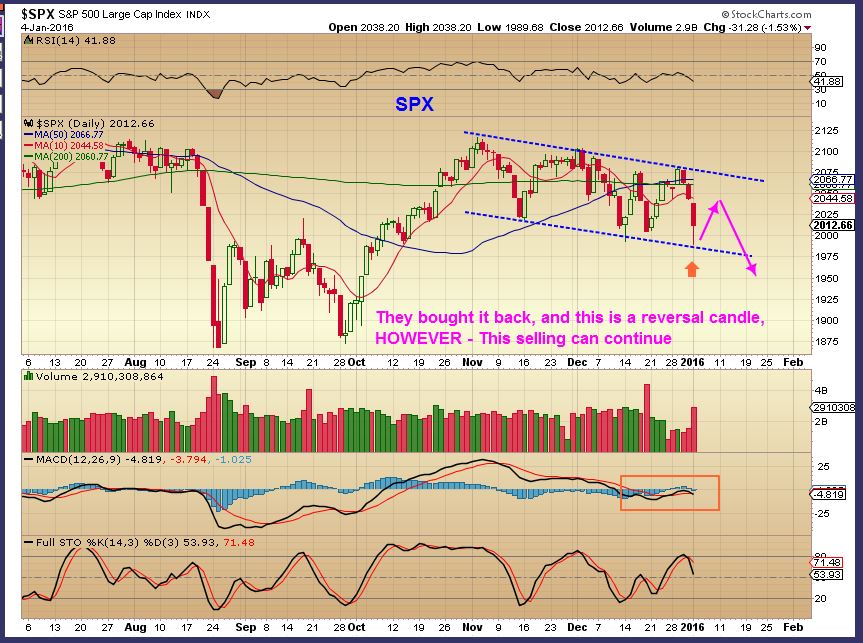

I dont regularly watch CNBC, but I was in the waiting room today and CNBC was on and I actually saw them reporting that North Korea tested a Hydrogen Bomb and caused the markets to sell off. I guess they dont use charts? Was todays sell off sudden and unexpected?

.