Author Archive for: Alex - Chart Freak

About Alex - Chart Freak

I’ve been a full time trader for well over a decade and began trading in the late 1990s while working in management and sales at a well-known aerospace company. As my style evolved, so did my success, and it allowed me to leave corporate America to pursue my passion and trade full time.

Entries by Alex - Chart Freak

JANUARY 11 – COPY / PASTE

January 11, 2017 /122 Comments/in Premium /by Alex - Chart FreakAs I was gathering charts for the report, I realized that many of the charts for Tuesday looked just like Mondays. That means there really isn't a whole lot new to say in some sectors, so let's do our review and then discuss some stock picks.

.

From Monday - no Dow 20,000

No big change - Copy / Past

JANUARY 2017 – WHAT TIME IS IT?

January 10, 2017 /1 Comment/in Public /by Alex - Chart FreakIt's time to see what 2017 has to offer us as traders and investors!

We've started the new year and trading has already been very exciting in various sectors that we at Chartfreak have been looking into. So 'What time is it?' It's also time to get on board and make some money in a variety of bullish set ups that are appearing in the markets! This is a glimpse what we have been looking at lately.

GOLD - I love deep sell offs, because they can lead to strong bounces or recovery. We were waiting for a close above the 10sma. Some Miners bottomed first, but Gold needed to close above the 10sma to start a bullish move higher.

January 10th – Additional Thoughts

January 10, 2017 /131 Comments/in Premium /by Alex - Chart FreakAfter our normal market review, I wanted to share some additional thoughts about the Uranium Sector, since it has also been perking up and showing signs of life after a bear market sell off. I don't want this to distract anyone from our current focus and trades, but my pointing out a few things here today allows the readers some time to do a little additional research of their own if they are interested. By the end of this report, you will see why I think this could be worth bringing up.

.

DJIA - No Dow 20,000 yet. This really doesn't seem to be a true magaphone topping pattern, but it is close. A flat top pattern would be bullish, so I'm watching for a break of either blue line.

Weekend Report – Still On Track

January 8, 2017 /182 Comments/in Premium /by Alex - Chart FreakThings are pretty much playing out as expected in the markets, and from what I am seeing in the precious metals sector, things are still on track there too. Let's take a closer look at what last weeks action brought us.

DJIA - 19999.63, are you kidding me? 🙂 A fraction away from DOW 20,000. I feel that we likely just saw a dcl and I would expect a push to new highs soon, so DOW 20,000 should be accomplished in the near future.

There are, however, a couple of other things that I'm noticing in the general markets too.

Don’t Get Too Cute

January 6, 2017 /157 Comments/in Premium /by Alex - Chart FreakFridays report is a preview of what I will be discussing in the weekend report. I want to explain why sometimes traders become victims of getting a little too cute. Let's discuss this a little bit right now...

Ready To Run

January 5, 2017 /120 Comments/in Premium /by Alex - Chart FreakTodays report is simply to discuss stocks that look ready to run. Tuesday, while looking at the S&P 500, we saw a reversal. We also saw a reversal in many of the stocks that I had been eyeing, so let's take a look at the the markets and some of those stocks.

This was from yesterdays report. It was bullish overall, because we were locking in a right translated daily cycle, but I was also expecting a dip into the daily cycle low. In the weekend report, I pointed out the 50sma as a possible target for that drop.

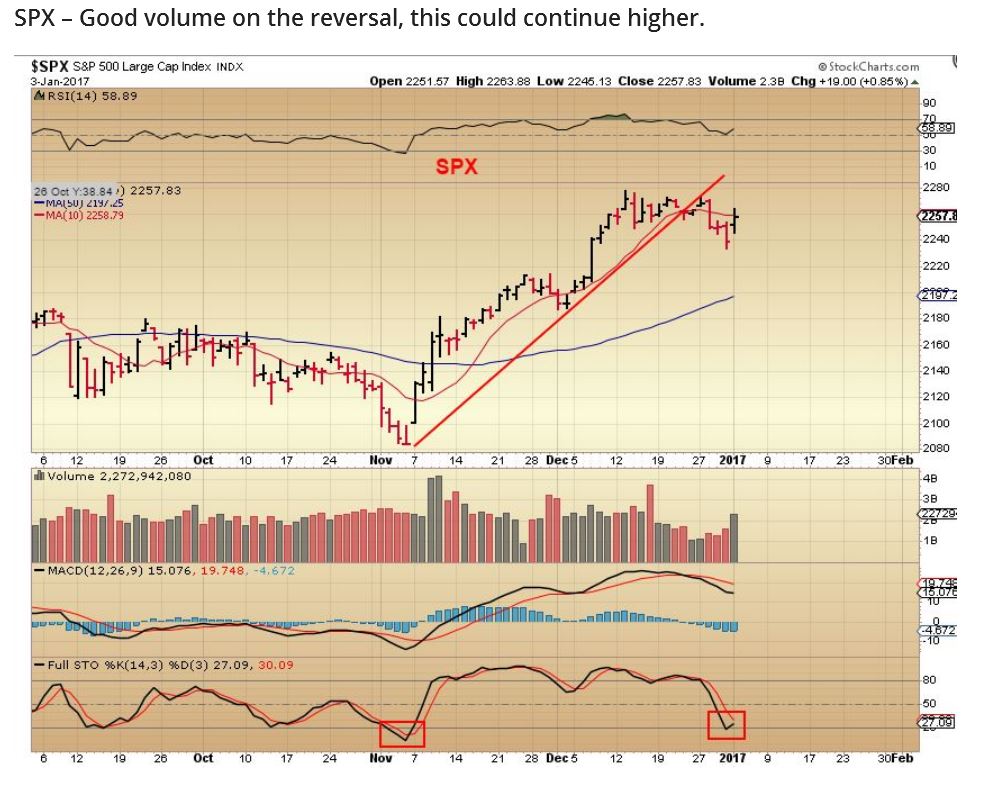

SPX - On Wednesday we saw follow through on the reversal. I do not know for sure if that was the dcl, but these markets look set to go higher.

Looks Inviting

January 4, 2017 /93 Comments/in Premium /by Alex - Chart FreakThere are areas of the markets that are looking quite inviting, so lets review the first day of trading in 2017 and see what we can find.

SPX - From the weekend report, I expected a bit more of a drop.

SPX - Good volume on the reversal, this could continue higher.

Weekend Report- January 1st

January 2, 2017 /188 Comments/in Premium /by Alex - Chart FreakIn my opinion, the year 2016 ushered in a traders paradise. Let's take a look at where 2016 left off , and where 2017 begins.

.

SPX - As expected, the S&P 500 is selling down at this time, possible target shown.

HIGH RISK

December 30, 2016 /129 Comments/in Premium /by Alex - Chart FreakThis is a BONUS report, but please know in advance that this report is not being written to encourage all of my readers to invest in this area. It involves what could be considered higher risk trading, so while I welcome everyone to read it through, please know who you are as a trader / investor and do not take unnecessary risk. Look at that Theme picture again. If that is not you, then please proceed with caution. 🙂

Contact Us

26 Broadway,

8th Floor

New York, NY 10004

admin@bigleaguefinance.com

admin@bigleaguefinance.com

Latest Blog Posts

accelerator diet pills goji berry diet pills ultra 90 diet pills keto meal replacement bar top weight loss diet pills for thyroid patients where to buy t lite diet pills keto friendly thickener diet fuel diet pills peanuts keto friendly rite aid diet pills that work envy diet pills diet pills for breastfeeding moms belique diet pills perfect slim weight loss pills calories in a bottle of white wine