Author Archive for: Alex - Chart Freak

About Alex - Chart Freak

I’ve been a full time trader for well over a decade and began trading in the late 1990s while working in management and sales at a well-known aerospace company. As my style evolved, so did my success, and it allowed me to leave corporate America to pursue my passion and trade full time.

Entries by Alex - Chart Freak

Post Fed Explosions

March 16, 2017 /122 Comments/in Premium /by Alex - Chart FreakWe got a Fed rate decision, and we got some Fed Decision follow through. It clears things up in the short tern time frame and makes it easier to see what is going on,. Let's see what Wednesday brought our way.

SPX March 9 - I was looking for a shallow DCL The RSI started curling upward while price was dropping...

SPX MARCH 10 - A swing formed and the dcl was due and likely in place.

Now we have a confirmed DCL, as seen here

Fed Wednesday – Business As Usual?

March 15, 2017 /131 Comments/in Premium /by Alex - Chart FreakTuesday 5-14-2017

March 14, 2017 /176 Comments/in Premium /by Alex - Chart FreakThe weekend report said it all, this is just a quick update

March 11 Weekend Report

March 12, 2017 /161 Comments/in Premium /by Alex - Chart Freak"Yes, there are two paths you can go by,

But in the long run,

There's still time to change the road you're on."

Friday March 10th

March 10, 2017 /138 Comments/in Premium /by Alex - Chart FreakAfter a quick market review, I wanted to just briefly touch on the fact that we have 'No Bounce' in the Precious Metals sector.

March 9th – Oil Rolled Over Too

March 9, 2017 /102 Comments/in Premium /by Alex - Chart FreakThe pullback in the general markets remains orderly and rather mild. We are deep in the timing for a swing low dcl.

March 8th –

March 8, 2017 /125 Comments/in Premium /by Alex - Chart FreakThings are lining up as expected now, but one sector may be a little too hot to the touch for non day traders, while others may be looking forward to a fast trade or two. Let's take a look at these markets...

March 7th –

March 7, 2017 /156 Comments/in Premium /by Alex - Chart FreakLet's discuss a little bit of what has happened since the weekend report.

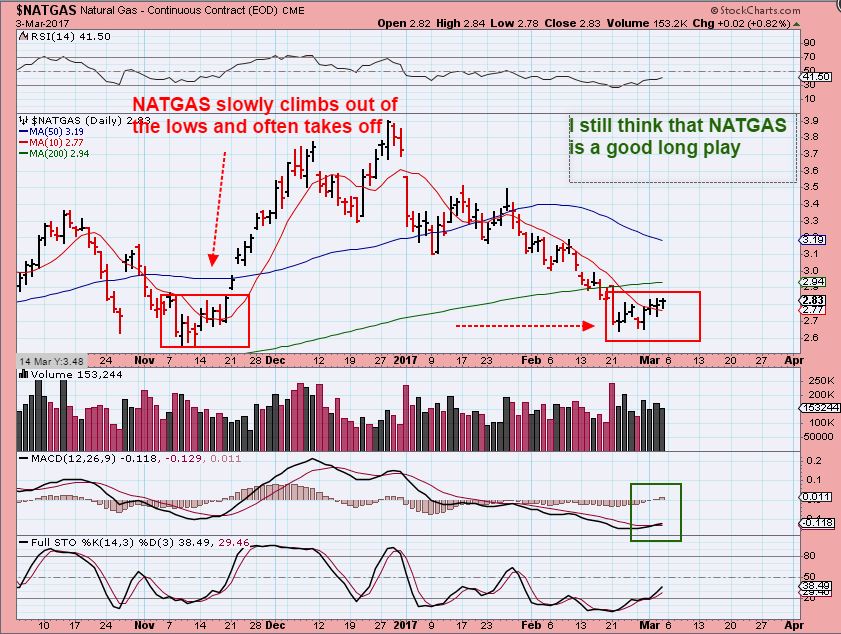

NATGAS from the weekend report. This has been a low risk entrywhen it moved above the 10sma, but there is resistance at the 200sma. Notice how NATGAS started out slow and then rallied strongly out of Novembers lows.

There is one thing that I am considering in the NATGAS area however...

March 3- Behind The Beauty Cracks Appear

March 6, 2017 /157 Comments/in Premium /by Alex - Chart FreakThis week we saw the Markets continue to fly higher and even Gold and Silver were making new highs. What happened to the Miners? Behind all that beauty, cracks appeared, and that is going to be the focus of the weekend report. I have a LOT to discuss, so lets get right into it.

.

SPX - We are very due for a dip into a dcl, but this is strong. Look for a break of the 10sma, please read the chart, I do not think that a dip will mark the top.

Contact Us

26 Broadway,

8th Floor

New York, NY 10004

admin@bigleaguefinance.com

admin@bigleaguefinance.com

Latest Blog Posts

accelerator diet pills goji berry diet pills ultra 90 diet pills keto meal replacement bar top weight loss diet pills for thyroid patients where to buy t lite diet pills keto friendly thickener diet fuel diet pills peanuts keto friendly rite aid diet pills that work envy diet pills diet pills for breastfeeding moms belique diet pills perfect slim weight loss pills calories in a bottle of white wine