Author Archive for: Alex - Chart Freak

About Alex - Chart Freak

I’ve been a full time trader for well over a decade and began trading in the late 1990s while working in management and sales at a well-known aerospace company. As my style evolved, so did my success, and it allowed me to leave corporate America to pursue my passion and trade full time.

Entries by Alex - Chart Freak

FED WEDNESDAY IS CLOSE

January 31, 2017 /137 Comments/in Premium /by Alex - Chart FreakLet's discuss Monday and keep in mind that we are closing in on the FOMC meeting Wednesday.

.

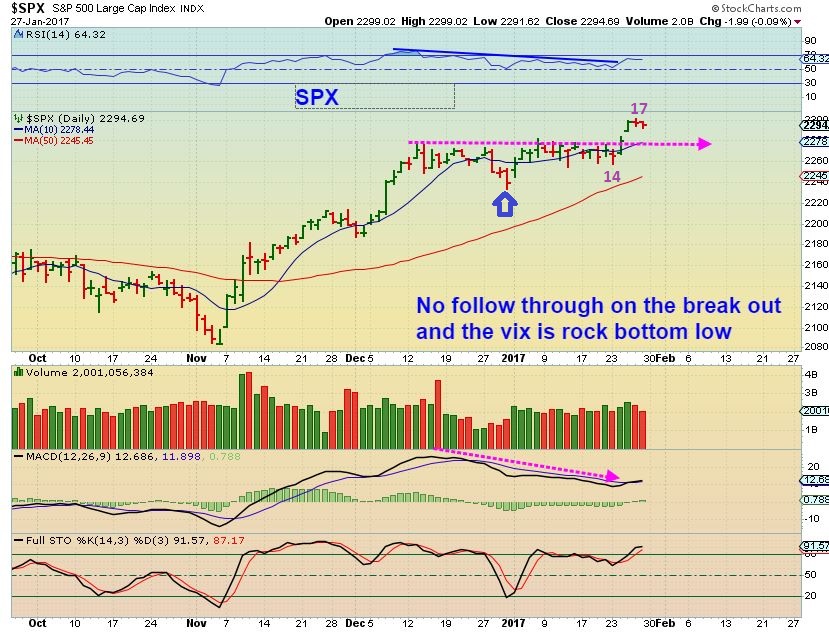

SPX FROM THE WEEKEND REPORT - After the break out the VIX was below 11! I expected that we could get a drop and not a continuation higher for now.

I posted this in the comments section near 11 a.m., the VIX was popping and the markets were dropping. This looked like the markets could be rolling over going into the Fed Meeting.

SPX END OF THE DAY - Then the markets reversed and put in a pretty big reversal candle. It recovered back to the consolidation highs, but it was still down 14 points. The jury is still out, but anyone that jumped in long at the break out or short as the day sold off have both been schooled a bit. The school of volatility.

Weekend Post- Progress Report

January 29, 2017 /38 Comments/in Premium /by Alex - Chart FreakThis is our weekend wrap up, and I really like what I am seeing. This is a long report with a good amount of discussion and about 30 charts, enjoy.

..

SPX - The General Markets broke out as expected, but we have yet to see follow through.

Let me show you something interesting ...

Still On Target

January 27, 2017 /163 Comments/in Premium /by Alex - Chart FreakIt's Friday, the last trading day of the week, and things are continuing to move ahead, right on target. Let's take a look...

.

When I pointed out the USD on Wednesday, we were looking at a new low on day 32, with a peak on day 16.

Thursday January 26th

January 26, 2017 /103 Comments/in Premium /by Alex - Chart Freak

SPX JAN 24th - Tuesday, we were expecting an upside break out, and we also viewed the DOW with a tight bollinger Band squeeze.

SPX - Break out

Wednesday Jan 25th

January 25, 2017 /174 Comments/in Premium /by Alex - Chart FreakSome of our trades are running and others have paused. We'll discuss this as we go through our market review.

.

SPX - This looks like an inverse H&S and looks to be breaking out higher. The SPX and Nasdaq did hit new highs.

Let's look at the Dow Jones ( Dow 20,000?)...

Are They Peaking or Peeking?

January 24, 2017 /97 Comments/in Premium /by Alex - Chart FreakIs what Peeking or peaking? Let's start with the USD-

.

The USD was rejected at the 10 & 50 sma last week, but it is in the timing area for a bounce.

Market Vectors Gold Miners (GDX)

January 23, 2017 /6 Comments/in Public /by Alex - Chart FreakJAN 20 – The SET UPS

January 22, 2017 /119 Comments/in Premium /by Alex - Chart FreakThe weekend report discusses the current set ups in various sectors, with a bit more focus on the precious metals sector.

.

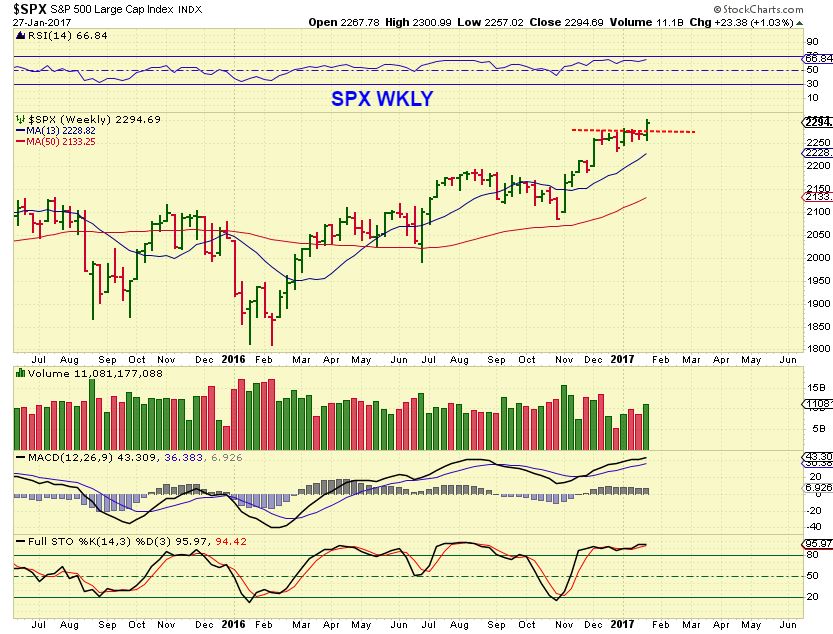

SPX WKLY - I'm not saying that the General markets cannot go higher, this riding along the upper wedge can continue, but this wedge does tell me that I should expect a pull back sooner or later. We'll continue to monitor that as it plays out.

Remember that I mentioned this last week too...

Friday Jan 20th- Think About This

January 20, 2017 /95 Comments/in Premium /by Alex - Chart FreakI wanted to start the Friday report by looking at the HUI in the year 2000, as it began to rise out of the bear market lows. We will also discuss a few other things pertaining to the Mining sector, including GDX and its current run higher.

HUI 2000 - This run higher was so smooth and predictable. Notice how it found support and resistance repeatedly around the 50 & 200sma. This was a very smooth run.

Now I want to direct your attention to Gold at that time...

Contact Us

26 Broadway,

8th Floor

New York, NY 10004

admin@bigleaguefinance.com

admin@bigleaguefinance.com

Latest Blog Posts

accelerator diet pills goji berry diet pills ultra 90 diet pills keto meal replacement bar top weight loss diet pills for thyroid patients where to buy t lite diet pills keto friendly thickener diet fuel diet pills peanuts keto friendly rite aid diet pills that work envy diet pills diet pills for breastfeeding moms belique diet pills perfect slim weight loss pills calories in a bottle of white wine