Tuesday Nov 27th

Not a lot has changed from the weekend report, so let's take a look at Mondays action...

.

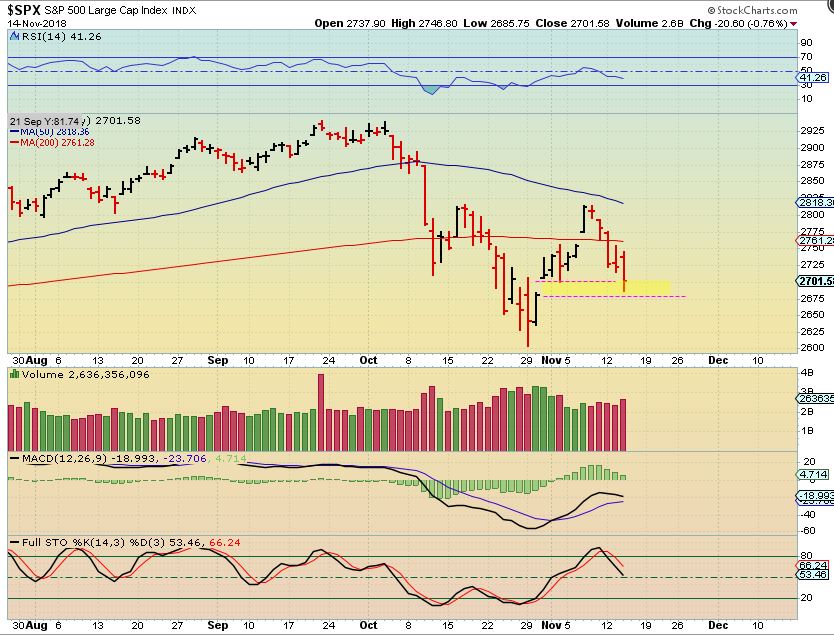

SPX - After breaking above the 10 sma, SPX was turned down at the 50 sma and revisited the lows. The SPX is oversold and the MACD does have divergence so we are at least getting a bounce on day 19.