Author Archive for: Alex - Chart Freak

About Alex - Chart Freak

I’ve been a full time trader for well over a decade and began trading in the late 1990s while working in management and sales at a well-known aerospace company. As my style evolved, so did my success, and it allowed me to leave corporate America to pursue my passion and trade full time.

Entries by Alex - Chart Freak

March11th – Weekend Wrap Up

March 11, 2018 /89 Comments/in Premium /by Alex - Chart FreakIf you have clocks that are not automatically calibrated ( Cell Phones and Computer clocks are, microwave oven clocks and wrist watches may not for example), You want to turn your clocks ahead 1 hour this morning 🙂

SPX - The expectation on a possible a-b + c-d extension is shown in green. The pull back into a dcl and further upward gains is a possible cup & handle, but this is just one idea going forward.

This would follow what we have already seen with SOX & NASDAQ

FRIDAY March 9th

March 9, 2018 /105 Comments/in Premium /by Alex - Chart FreakFriday, the final day of trading before the weekend.

SPX - So far the SPX has not been able to push above the 50sma yet. A day 11 peak would not be a good sign for the General Markets, but I do think that this should be able to get above day 11, because...

March 7th – After The Storms

March 8, 2018 /65 Comments/in Premium /by Alex - Chart FreakThe markets have been choppy lately, and early February was really a bit stormy, but after the market storms clear away, opportunities often present themselves in the manner of trade set ups. We have been taking advantage of many of those lately.

I guess that we can't really call yesterdays Gap down a storm of its own. Yesterday I pointed out that this is where the markets were set to open ( Purple square). Would they continue to sell off, or would they be bought back up?

SPX - You can see that the gap open did not sell off further, but steadily climbed through out the day. Adding in this area with a stop below March lows is reasonable. The SPX looks to be crawling under the 50sma, and this is common, but ...

After Hours Drama

March 7, 2018 /84 Comments/in Premium /by Alex - Chart FreakJust when you thought that it was safe to get back in the water, Gary Cohn, one of Trump's top economic advisors, resigns. As the news came out, it spooked the markets and the Futures dropped pretty sharply. They remain down as I write this on Tuesday Night.

Usually these news events that sharply affect the markets do not leave a long lasting impression, so is this just light volume trading that is easily moving things around? Knee jerk reaction? Or is there going to be some follow through after the markets open, dropping us down to a higher low double bottom over the next couple of days? We'll know soon enough. For now, we'll take a look at where we were at the close on Tuesday.

SPX - The SPX remained under the 50sma, but as I mentioned yesterday, the TECH stocks were stronger at this point. The BOX gives you a visual of where 'SPX down -30' would open.

March 6th – Progress

March 6, 2018 /147 Comments/in Premium /by Alex - Chart FreakSPX - Day 15 for the SPX and it is making slow progress to come up and either tag or break back above the 50sma.

However, The Tech Sector is ahead of the SPX & DJIA ...

March 3rd – Where Are All The Bulls?

March 3, 2018 /126 Comments/in Premium /by Alex - Chart FreakAlmost all of the Markets have become choppy over the past few weeks, so what happened to all of the Bulls? We have found a few Bulls that seem to be moving forward, and I will discuss those in the report. The others may need to be coaxed out of the fields of consolidation, before they can enjoy a nice solid run again. Let's take a look at what happened last week?...

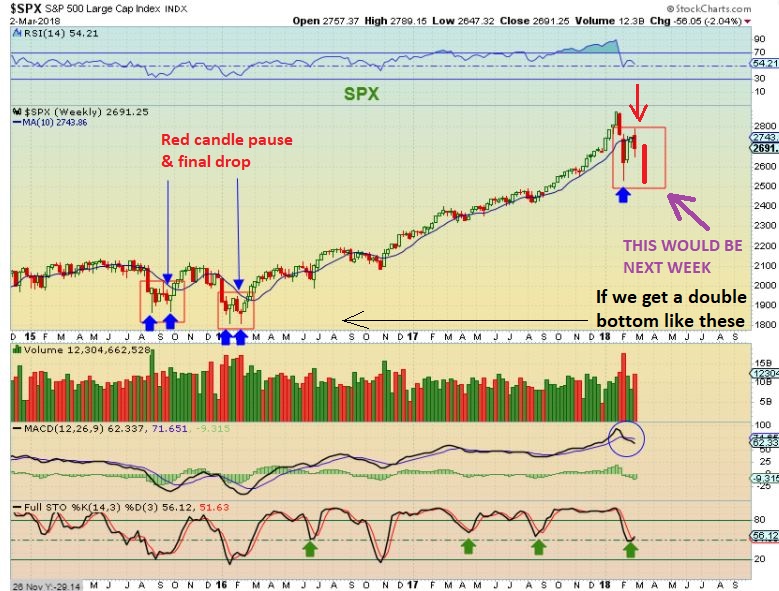

SPX WEEKLY - Here we see that the bounce of the past 2 weeks has curled up the stochastics, so maybe the selling is done, but I have been expecting a test of the lows. Compare last weeks drop to what we saw out of the lows in 2015, the bounce also looks very similar, so ...

SPX - If we are due for a double bottom low, next week could be another down week, as shown here where I drew in an extra candle. This would match the 2015 double bottom lows. Read the chart.

Lets take a look at the flip side.

Friday March 2

March 2, 2018 /136 Comments/in Premium /by Alex - Chart FreakThis content is for members only

March 1 – Choppiness

March 1, 2018 /55 Comments/in Premium /by Alex - Chart FreakThe choppiness continues, let's take a look at what we have.

.

This is a pre-market snapshot, it contains quite a bit of red so far...

.

SPX - The SPX broke below the 50sma & Volume increased, so this needs to be watched carefully. Yesterday I reminded readers of my weekend reports 'lessons' section at the end, it is worth keeping in mind or re-reading. Day 12 peak so far.

Feb 28th – Reminders

February 28, 2018 /62 Comments/in Premium /by Alex - Chart FreakMarket chop, Pop & Drop. Let's review the markets with an occasional reminder thrown in there too...

SPX - These markets may eventually "get over it" , but so far they seem to have something against the New Fed Chairman. It could be his discussing 3-4 interest rate hike plan for 2018. Read the chart. So far this is a day 11 gap fill above the 50sma, let's look at the NASDAQ...

Contact Us

26 Broadway,

8th Floor

New York, NY 10004

admin@bigleaguefinance.com

admin@bigleaguefinance.com

Latest Blog Posts

accelerator diet pills goji berry diet pills ultra 90 diet pills keto meal replacement bar top weight loss diet pills for thyroid patients where to buy t lite diet pills keto friendly thickener diet fuel diet pills peanuts keto friendly rite aid diet pills that work envy diet pills diet pills for breastfeeding moms belique diet pills perfect slim weight loss pills calories in a bottle of white wine