Author Archive for: Alex - Chart Freak

About Alex - Chart Freak

I’ve been a full time trader for well over a decade and began trading in the late 1990s while working in management and sales at a well-known aerospace company. As my style evolved, so did my success, and it allowed me to leave corporate America to pursue my passion and trade full time.

Entries by Alex - Chart Freak

Friday June 28th – The Bears Are Bored

June 28, 2019 in Premium /by Alex - Chart FreakToday is Friday, the last trading day of the week. So far, the Bears have been a little bored this week when it comes to most of the markets sectors, so let's take a look at our markets...

Thursday June 27th – A few picks

June 27, 2019 in Premium /by Alex - Chart FreakWed June 26th – A Dip?

June 26, 2019 in Premium /by Alex - Chart FreakToday we have a little more to talk about. A Dip. Let's go to the charts...

Tuesday June 25 –

June 25, 2019 in Premium /by Alex - Chart FreakIf you re-read the weekend report, not a whole lot has changed on Monday. The markets actions, especially in the precious metals, does not leave me with anything new to say, except for maybe some stock picks. We have a runaway move that is due for a pull back that will not happen. 🙂 Let's take a look at our markets...

June 22nd Weekend Review- Breaking Free

June 22, 2019 in Premium /by Alex - Chart FreakIn this Big Picture Weekend Report, I am once again going to discuss the importance of recognizing the Precious Metals set up Early...as if BREAKS FREE from a massive base. First we will discuss the other market sectors...

June 21 – On The Run

June 21, 2019 in Premium /by Alex - Chart Freak.

If you like the color GREEN, today was a good day for you to look at the markets, because just about everything was moving higher, except for inverse ETFs and the USD. Let's take a look at our markets...

.

June 21 – The Post Fed Pop

June 20, 2019 in Premium /by Alex - Chart FreakJune 19- FOMC Countdown

June 19, 2019 in Public /by Alex - Chart Freak.

I want to open up a part of the premium report that my subscribers received this morning to the Public. We are waiting on a FOMC Decision and things often get volatile around that time, so I wanted to share some interesting observations that I have with my readers. After discussing the General Markets and Oil, the report continued with these thoughts...

.

USD - My unbiased look at the USD has me thinking that it looks like it wants to go higher short term. If the Fed DOES NOT cut rates, the USD could continue a little higher. However the 50sma could stop the dollars rise because, ...

June 18- FOMC Wednesday 2 P.M. Eastern Time

June 19, 2019 in Premium /by Alex - Chart Freak.

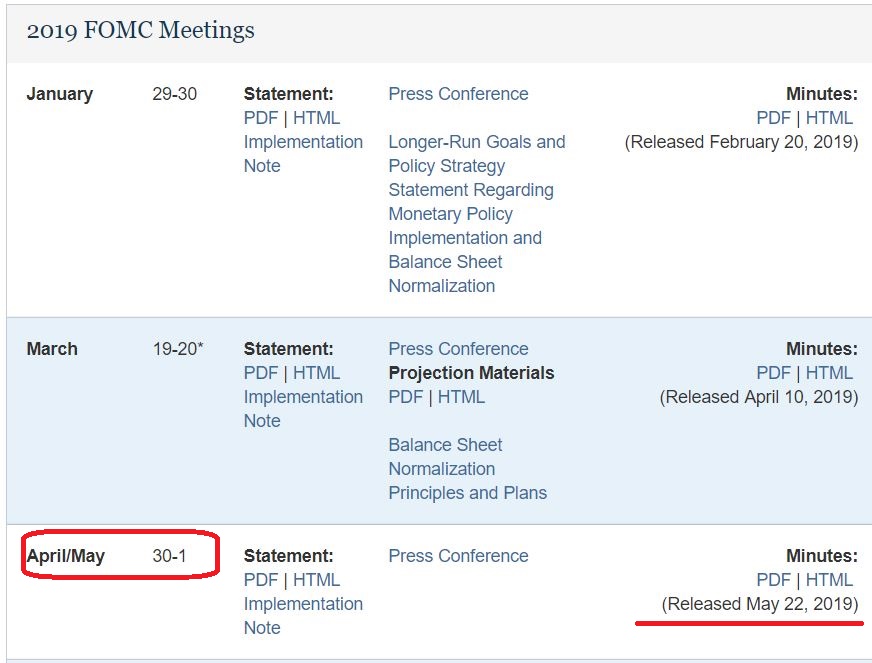

Today I want to run through some interesting reminders, and I will start with this schedule of the 2019 Fed Meetings and the release of the 'Minutes'. Notice that May 1 was a Fed Mtg, and the Minutes were released on May 22.

.

Contact Us

26 Broadway,

8th Floor

New York, NY 10004

admin@bigleaguefinance.com

admin@bigleaguefinance.com

Latest Blog Posts

accelerator diet pills goji berry diet pills ultra 90 diet pills keto meal replacement bar top weight loss diet pills for thyroid patients where to buy t lite diet pills keto friendly thickener diet fuel diet pills peanuts keto friendly rite aid diet pills that work envy diet pills diet pills for breastfeeding moms belique diet pills perfect slim weight loss pills calories in a bottle of white wine