Big Picture Weekend Report – June 8th

.

I am opening up part of the Big Picture Weekend Report to the Public. During the week, I focus my daily reports on daily action in various sectors of the market. I then also may offer some lower risk entry points or buy set ups if they develop during pull backs. In the weekend report, however, I take a step back and focus on the Big Picture , and this is more than of that report. Enjoy!

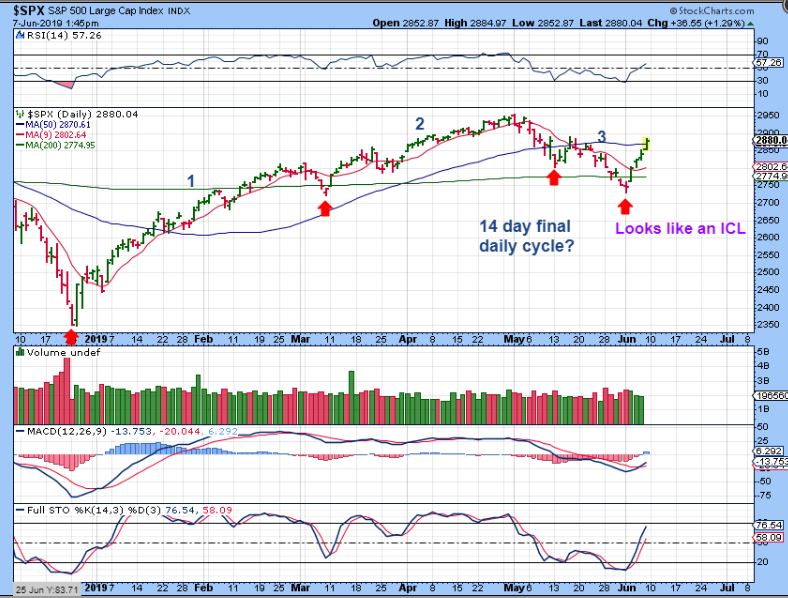

SPX DAILY – Cycle counts. May 13 looked like a dcl, but now this recent dip does too. There have been only 14 days from May lows, and that seems too short to be a complete Daily Cycle, but it may be. Did the change to a Fed Rate Cut program pull in the buyers and extended that 2nd daily cycle? Possibly, but for now, ignoring cycles, I’ve simply mentioned that these lows could be bought with a tight stop and now I’d say that the ‘stop’ could be raised. The FED may not be able to save the markets if the economy slows and we get a rotation from these markets to Precious metals. USE STOPS.

SPX WEEKLY SURGE– It was a big week and it looks very bullish at a glance, but look at this chart. I do have to point out that we also had a Big 2 week reversal on the last drop in October, and that one only lasted 2 weeks and then rolled over again. My point? Be cautious, use stops if you are long, this could roll over even though it looks quite Bullish.

I’m just going to say that I have seen some GOOD earnings and good charts, and I have also seem some Missed earnings and those charts got ugly fast. That said, this run has been short term bullish, but really is a mixed bag at this point in the General Markets. Even GOOG rallied and yet gave up the gains, so I’ll keep watching this sector, but I personally am focused on Miners.

.

WTIC WEEKLY – From my June 6th chart, This seems too short to be forming a daily cycle low at day 21. I Expect a bounce & downside.

WTIC WEEKLY – So while Oil flipped to a reversal at the 200 week ma, This is just too short to be a new ICL in my opinion and the last time it flipped here in November, the selling returned 3 weeks later too. I expect more downside in oil.

USD #1 – I have been watching for this bearish rising wedge to form & play out all year long. This week we got the break down, let’s zoom in…

USD BEAR WEDGE – It looks to be breaking down, and Gold, Silver, and the Miners have reacted as expected- Bullishly!

USD BREAKDOWN – If the USD bounces to a back test in a week or so, Gold could dip to a dcl, but so far the US is just breaking the bottom and Gold has continued higher. Notice: Each peak was Golds ICL.

.

GOLD, SILVER, $ MINERS

.

GOLD BIG PICTURE – I wanted to show you that Recent runs higher from ICLs have been pretty good, but they have only been part of a larger consolidation (a large Base) in Gold. THIS ICL COULD BE PART OF A BREAK OUT, AND YOU DON’T WANT TO MISS IT IF I AM CORRECT. 🙂 Study this chart and then Let me show you more…

GOLD BIGGER PICTURE – THE BIG BASE. Look at the prior runs in this base. This next break out & run can run back to prior highs over time ( I have pointed out giant ‘Cup’ formations to my readers for years). That run could draw in Buyers QUICKLY. I want to be invested before that rally really rips higher, I do not want to be chasing. Read the chart.

To answer the question that quite a few have asked me, ” If the rate Cuts do help push the markets higher, doesn’t Gold drop when markets move higher? CAN GOLD run higher if the Markets run higher?“

.

NOTICE THAT GOLD RAN HIGHER IN 2009 – In the 2008 crash, everything dropped to deep lows. Notice that GOLD bottomed in October and started to run higher for a few years. My point? GOLD RAN HIGHER IN 2009.

SPX RAN HIGHER IN 2009 WITH GOLD – My Point? SPX BOTTOMED in March 2009 & RAN HIGHER IN 2009 too. So we had the SPX running higher with Gold also running higher in 2009 & 2010. It can happen.

.

CONCLUSION : I AM NOT WORRIED ABOUT WHETHER OR NOT THE SPX RECOVERS DUE TO RATE CUTS. THIS GOLDEN BASE IS A BIG DEAL IF IT BREAKS OUT 🙂

.

WHAT ABOUT SILVER?

.

SILVER -As of Thursday, I wrote that Silver has been breaking out from the apex of a bullish wedge, battling with the 50 & 200sma, so this looked ‘good’,and …

SILVER – Friday it broke free, so now this looks ‘Very Good‘, however…

SILVER – THIS LOOKS EXCELLENT! Step back and there is a much bigger accomplishment in the works. This is just the last 2 ICLs that I have noted, and you an see that this week has been good progress as a break out, but this HAS MUCH HIGHER TO GO. I have been saying, “You want to own a couple of Silver Miners, they will do well over time”. I thoroughly believe that. Wait- there is more…

.

SILVER – This is really an even Bigger Bull Wedge forming. The upside potential is excellent, AND THERE IS EVEN MORE TO SILVERS SET UP! …

SILVER – There is even a BIGGER PICTURE VIEW that looks like a BASE is completing after Silvers parabolic run popped. This gives it the ability to run again, and gains could be incredible.

.

So when you see this SILVER CHART, your mind should be thinking WooHoo

.

I have discussed the MINERS A LOT in past reports,

so this will be a progress report

.

GDX – I POSTED THESE 2 CHARTS IN MARCH…A DROP to ‘2’ & THEN A RALLY

GDX – GDX has now dropped to ‘2’ and This is playing out exactly as I had hoped so far. Notice please, that it is NOT near overbought on the weekly stochastics, and there is plenty of good upside in this chart. I have been saying that You want to own either GDX or GDXJ, or a basket of your own hand picked Miners before this gets too far ahead of us. ( JNUG , NUGT optional) . Though it may get choppy at times, this is breaking higher as expected.

.

It was a good week for the Miners and we should be able to look forward to a nice run out of the ICL. Yes, there could be pull backs and dips, but the lesson below was written to help give us a Bullish perspective on that. Enjoy and most of all, Enjoy your weekend!

.

~ALEX

,

A LESSON TO HELP MY READERS FOR THE CURRENT ICL

.

I will NEVER say that you shouldn’t lock in some gains after a good run. That is often very rewarding for the Mind, but this early after an ICL is really not time to SELL EVERYTHING and wait for a dip. Bulls can run away with surprises to the upside. You want to at least own SOMETHING in Miners. This may help you to see that.

.

GDX – Look at these Dips in the Bull Run. Anyone selling ‘Everything” early in the run, was NOT able to get back in. These can be straight up moves , leaving many behind. The dips , even DCLs (Daily Cycle lows) were Mild.

Do you recall the 4 GDXJ possible paths in the last 2 reports? I did that to show you how, based on past GDX & GDXJ Moves, this could still either pull back or run away. I wanted us to be prepared for the possibilities. I did not want my readers to sell everything & wait for a dip, so I DID post these as 2 of those possibilities. Notice that #4 would lock out anyone selling ‘everything’.

.

GDXJ #3 – We could see a repeat of that small flag ( this time to the 50sma), one similar to the Feb dip. I can see this happening, but so far Buyers keep stepping in. UPDATE: We are now even higher since I wrote this on June 5 .

June 5th I wrote:

.

GDXJ #4 – So the ‘lock out’ runaway move is not out of the question, and that is why I have been saying that you should own a few Miners at least, and BUY & HOLD some Miners for the first couple of daily cycles out of the ICL. Also you can ‘add’ to positions or buy the dips when possible. This chart shows how a CUP, and then a handle can form as the dcl.

GDX CURRENTLY #1– My advice is not to get too hung up on ‘Cycle count’, DCLs, Dips, or choppiness. Some dips can be quite Mild. Don’t view this as looking over-extended at this point, because some then sell out of everything and get left behind.

1. Look at the SEPT ICL. Where was the first DCL out of the lows? Better yet, Does it really matter? If you sold for that dip, where would you get back in? Higher in most cases. If you were in it for the long run, holding at least something all the way through worked out best… Because…

GDX Now #2– It got choppy, but the run was about 6 months long and ended up being quite Bullish. THAT SAID, I expect this current run to be VERY BULLISH if it plays out as I expect…

.

END OF LESSON REVIEW … Where would You have re-entered if you sold early in the first daily cycle on these past bull runs? Look at maybe the 2nd Purple arrow off of the lows – it kept running and never looked back?? My advice has been to try to hold on to at least some small basket of Miners or GDX / GDXJ position.

.

GOLD VS AUSSIE DOLLAR – I posted this chart in the live trading area Friday, this is Bullish and is happening in other currencies too. GOLD is out-performing here.

.

USAS – This Silver stock is riding at the 200sma, so it could be a good place to add to current position before a possible break out. or…

USAS – You could just wait for this base to break out & add with confirmation.

If you think that your trading style would benefit from this type of analysis, or if you just don’t have time to do all the research yourself, why not sign up for a monthly, quarterly , or discounted yearly subscription? We have a live trading area below each report where some of the active traders share ideas too, and I am there to post charts of trade ideas or answer questions during market hours.

Even if you don’t use the live trading area, you may just be too busy with a full time job or other activities to research these fast changing markets daily. I will be doing that for you at a fair price. Each week I have daily reports released around 7-8 a.m. Eastern Time, and a weekend Big Picture report. Try it for a month, and see if you benefit from adding these observations to your market analysis. Thanks for reading along here at Chartfreak.com! ~ALEX

If you would like to find out more about the service or sign up, please click on the ‘ buy now’ bubble for more details.