Archive for month: October, 2018

Weekend Detective Work

/in Premium /by Alex - Chart FreakI have been digging in this weekend, and looking for more clues within our market sectors. Let's just get right to it, I've stumbled across some rather 'interesting' finds to share with you. We will focus much of this report on the GOLD & MINERS , after reviewing the Big Picture on the General Markets and Oil...

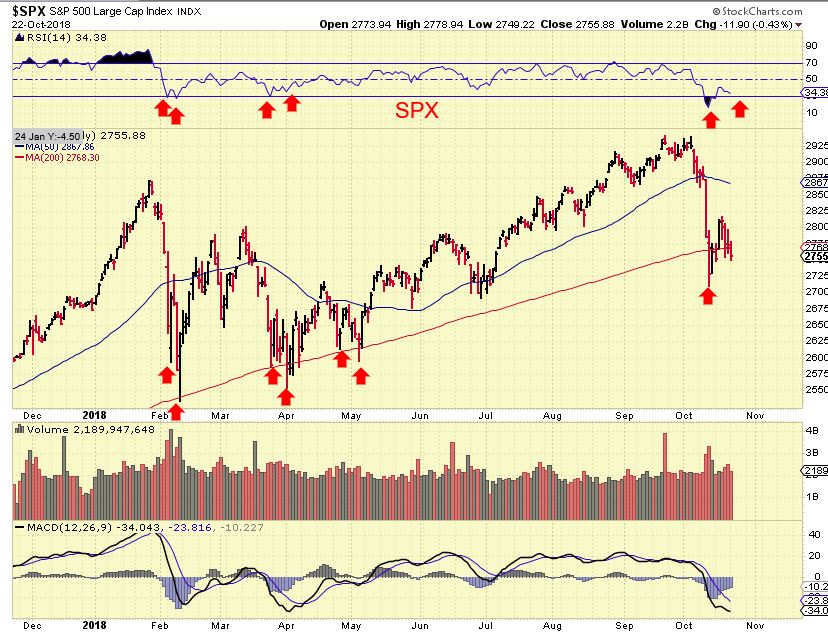

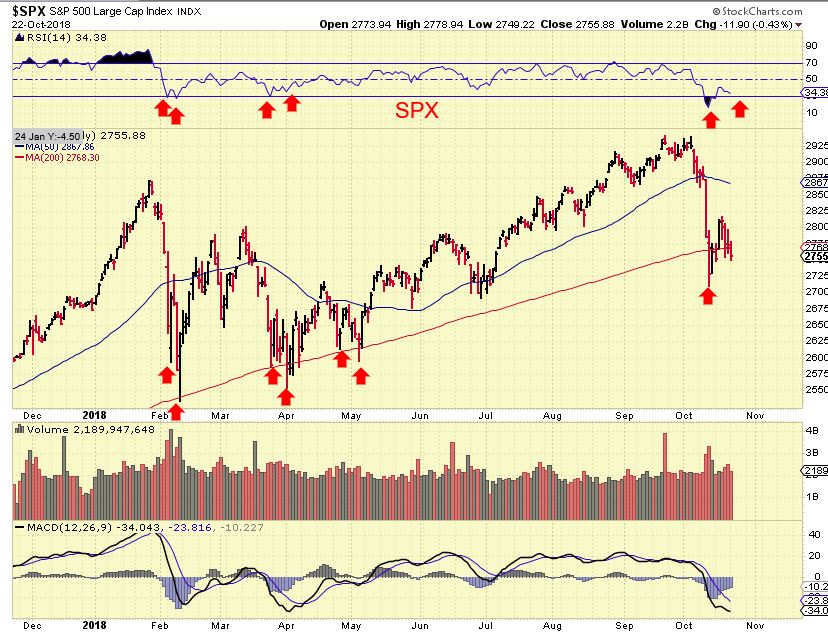

.SPX DAILY - The selling has been relentless and as mentioned, the safer buy would be to wait for a confirmed daily cycle low (DCL). Though we did have a bounce over a week ago, this week we did not have enough buying to push above that 10sma. That said, CYCLE COUNT indicates that we are very close to that dcl. A doji candle formed Friday, a candle of indecision with Buyers Vs Sellers breaking even. THE LOWS ARE DUE.

Read More

Read MoreOctober 26th – Gold Sure Looks Good, Huh?

/in Premium /by Alex - Chart FreakSo we were expecting that the Miners could possibly drop to do a 'back test' of the 50 sma. In fact, I mentioned that in almost every report for weeks. I must admit though, I did not expect it to happen all in one day, but that is pretty much what happened Thursday. Let's take a look...

.This is my GDX Oct 15th chart, showing that that possibility exists for that back test. I wanted us to be prepared for a drop like that, but like I said, I expected it to be more of a normal gradual dip lower.

Just 1 hr into trading, the drop in GDX & GDXJ looked like this, and it closed even lower at $19, just above that 50sma.

On top of THAT, this was Gold and it hardly dropped?

Can we make sense of this? Is this still just the back test of the 50sma for GDX & GDXJ? Did earnings of GG & NEM destroy all hope for Miners? Well, I do have a few ideas that will give us clues to watch for as this continues to play out. This will be a longer Friday report than normal, so let's get right into it...

Read MoreBehind The Beauty Cracks Appeared – As Expected

/in Premium /by Alex - Chart FreakHonestly, not much changed from yesterdays report, except for the depth of the General Market selling. Let's review and try to discuss at least a couple of new things.

Read More10-24th – The Latest Developments

/in Premium /by Alex - Chart FreakThe selling continued in the stock market, but there is a recent development that I mentioned we should look for.

.

DJIA - Yesterday I used this chart and mentioned that we could look for a possible double bottom low, or 'W'-Bottom with divergence. You see it at other Lows formed this year.

Tuesday the DOW dropped over 500 points and broke below the 200sma as a possible shake out / reversal.

1. It is safer to buy a swing low confirmed above the 10sma, as you can see, the last swing low 2 weeks ago failed at the 10sma. However...

2. For higher risk traders using technical analysis, That low can actually be bought with a stop below yesterdays lows, but keep in mind...

Read MoreOCT 23rd – Public Market Review

/in Public /by Alex - Chart FreakI am opening up today's report to the public. Enjoy.

.

Nothing has really changed since the weekend report. The markets have been choppy and difficult to record any gains over the past few days, but I do love the way the Precious Metals sector acted yesterday, so let's take another look at what we have.

.SPX - You can see that these types of sell offs into an ICL can lead to a double bottom, and Monday our General markets sold off further.

DJIA - You may want to look for something like this

HOWEVER....

Read MoreTuesday October 23rd

/in Premium /by Alex - Chart FreakNothing has really changed since the weekend report. The markets have been choppy and difficult to record any gains over the past few days, but I do love the way the Precious Metals sector acted yesterday, so let's take another look at what we have.

.SPX - You can see that these types of sell offs into an ICL can lead to a double bottom, and Monday our General markets sold off further.

DJIA - You may want to look for something like this

HOWEVER....

Read MoreOctober 20 Weekend Review

/in Premium /by Alex - Chart FreakDJIA - I can't say with certainty whether this is a long term double top or not, but it has played out as a short term double top. We were expecting this drop into an ICL for weeks . Look at the strong bearish divergence on the MACD & RSI on a weekly basis. I've discuss in my daily reports what to expect going forward.

Read More

Read MoreFriday Oct 19th

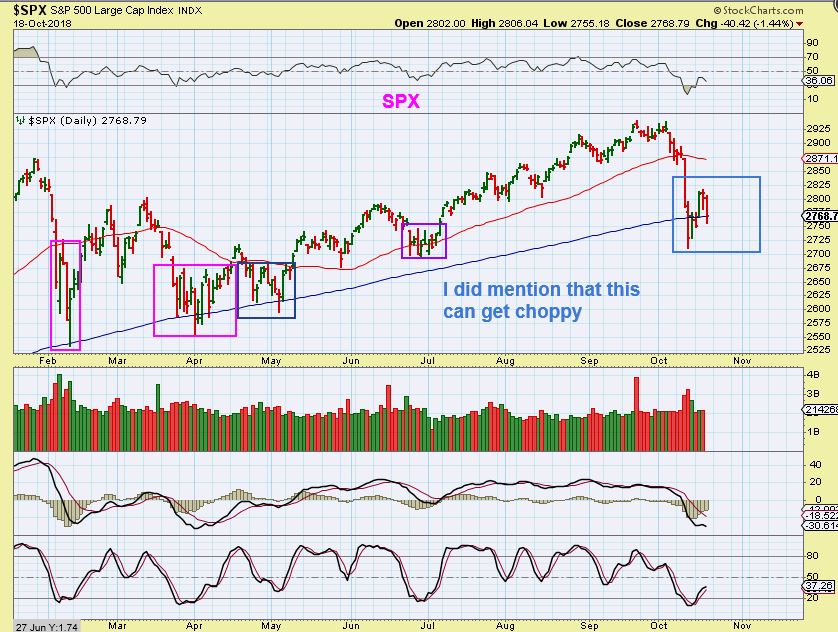

/in Premium /by Alex - Chart FreakI love Rocky Road Ice cream, but Rocky Road Trading? Not so much. My last few reports have mentioned that even though we do have a 'low risk entry' for Buying at a swing low in the General Markets and some other areas, stops are a must. It is not a confirmed swing low, and we have volatility and choppiness, so buying the swing doesn't necessarily mean that it will be an easy ride.

In fact, yesterdays report was entitled : 'It Is Still A Rough Ride.' Going into the last day of trading for the week, lets review Thursday and see if this proved true.

.Yes, it proved true - The Dow was down over 399 points and the NASDAQ was down 184 when I captured this in the afternoon...

.

.

SPX - I also mentioned that similar to February and March, things can be choppy around this 50sma, even with a swing low in place.

Read More

Read MoreContact Us

26 Broadway,

8th Floor

New York, NY 10004

admin@bigleaguefinance.com

admin@bigleaguefinance.com

Latest Blog Posts

accelerator diet pills goji berry diet pills ultra 90 diet pills keto meal replacement bar top weight loss diet pills for thyroid patients where to buy t lite diet pills keto friendly thickener diet fuel diet pills peanuts keto friendly rite aid diet pills that work envy diet pills diet pills for breastfeeding moms belique diet pills perfect slim weight loss pills calories in a bottle of white wine