Honestly, there was little permanent reaction when the Fed decision was made known, but we can't say that a lot changed. Expectations remain the same, so lets review these markets....

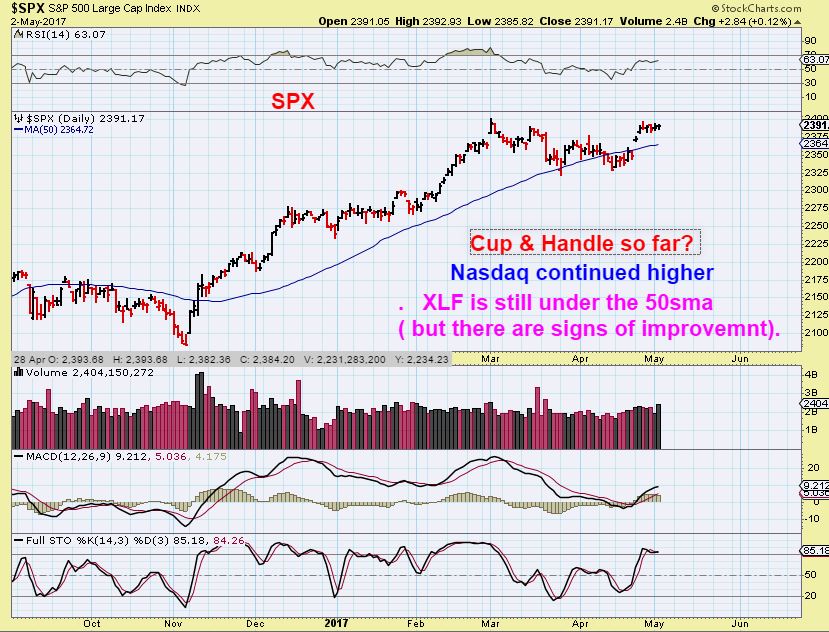

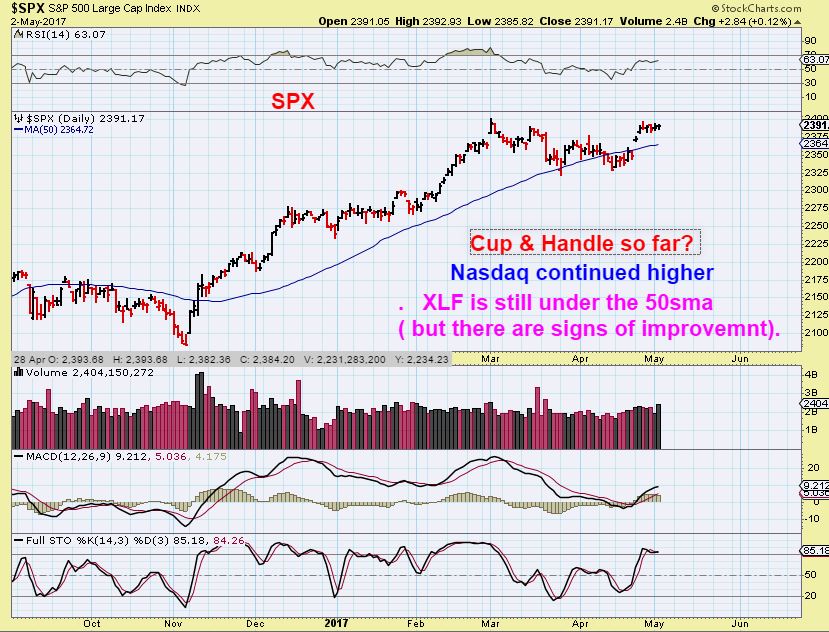

SPX - This was in yesterdays report, please read the chart. Also the signs of improvement in the XLF continued.

DJIA - I expected a dip, but this reversal after the Fed may have follow through upside. This consolidation could be forming an inverse H&S.

Read More

Read MoreAs the Fed Decision approaches, it is expected to be a non-event when it comes to an interest rate hike. It does appear that some sectors are lined up for some changes, however. Let's discuss why.

Read MoreI wasn't really expecting a whole lot of change in the various markets sectors on Monday, Tuesday, and even Wednesday morning, but we do have the FOMC Decision at 2 p.m. Wednesday afternoon, and that may cause some 'changes'. Let's discuss the precious metals markets.

GOLD - We've been waiting for and expecting this drop, so that is nothing new. The stochastics isn't even oversold, so selling can continue Tuesday & Wednesday too.

Read More

Read MoreI received a couple of emails recently from the public readers ( one was an old friend, Thanks Bob C. !) , either asking where have I been when it comes to my public posts, or asking me to review what I have been seeing lately. I've been very busy this spring with the premium reports and a private chat area that we have in there, plus other outdoor activities and responsibilities that I care for every spring, but as for a review? I would be happy to do that. 🙂

The General Markets became choppy in March and I was expecting a drop into a daily cycle low. I estimated that the 50sma would be a good target.

For over a month things were choppy and difficult to trade really, until we got a directional break. The drop was not as sharp as I had imagined, so some of the trades that I was taking were working out, but others lacked follow through, got choppy, and stopped me out. I admit that this was choppy and a difficult environment to trade in.

From April 25 - Currently we see a pattern of consolidation and then moves higher ( With pullbacks along the way). We do have a FOMC MTG this week, and there is a chance that that may cause the markets to dip into a low

Read MoreAnother week has come and gone and the markets have moved closer to the FOMC meeting and other events that can affect the markets. Let's discuss the latest market action and what the plan is going forward.

SPX - This looks like Day24 for this daily cycle and it has a Day 21 peak. We see a swing high in place and this can drop into a dcl. I am expecting some gaps to fill and likely a back test of support and the 50sma into the FOMC MTG Wednesday.

NYA - This looks like a back test so far too, but we possibly have enough time left in this daily cycle to do more than just a back test, so will it bounce around or consolidate?

There is more to this set up than just what was stated above, so let's look at 2 more sectors...

Read MoreGood question, Danny! That is what we will be discussing in the weekend report.

WTIC - Yesterday Oil broke the 200sma and recovered it , putting in a reversal candle.

I have a few thoughts about this...

Read MoreLast week I mentioned that the sideways choppy market action and sell offs that we were experiencing would eventually lead to bullish trade set ups. At this time, it seems that we are starting to see some of those good looking trade set ups. Along with the set ups we are also seeing some follow through on the trades that some of us have already been in. Let's review some of Wednesdays action...

Read MoreNext Wednesday we have the FOMC meeting. These have affected various sectors of the market in the recent past, so it may just be a matter of time before we see a change take place.

SPX - Consolidations build up steam and can make for a lasting run. These markets could run higher into the Fed Meeting next week.

Read More

Read More

After the 1st round of the French Elections Sunday, we saw price break through many of the trend lines that we were watching.

SPX - This chart was from the weekend report showing that trend line resistance for the SPX.

And we had a break out on Monday, even if I use the peak of the spike on April 5ths reversal. We've seen daily cycles run various lengths, see the 2 boxes drawn below, and so this does have the ability to run a bit higher.

Lat's look at the NASDAQ...

Read More The 1st round of the French Elections are being held on Sunday April 23, and that may temporarily shake up the markets, but so far, things do seem to be lining up as expected in various sectors. Let's review ...

.

SPX - On April 19th we saw the SPX continue to be rejected at the 50sma. I mentioned watching that 2322.25, because a break out higher or lower is important.

SPX April 21 - No change yet. The RSI & MACD are improving, but no break out yet.

Read More

Read More

Scroll to top

Read More

Read More