Archive for month: April, 2016

We have goals and we want to reach are targets, but often there are obstacles that can pop up along the way. Can we still reach are targets along the way. Yes. Lets do a quick market review and discuss our current trading.

.

SPX - I noticed a couple of days ago that the NASDAQ was selling off, but the SPX & DOW were holding up. Now the SPX started to sell off. The stochastics shows that it can fall for a while. I'm watching a few support areas. We'll discuss this more in the weekend report.

NASDAQ - The downtrend from the MAY 2015 highs is still in place. Lower lows and lower highs so far. On this chart I am pointing out that when the NAZ broke down last fall, it broke through the 200sma, but the 50sma was not violated.

Read More

Read MoreA farmer has to take advantage of the opportunity to make hay when the sun shines. If he has other things to do, they'll have to wait for a rainy day. He cannot make hay on a rainy day. A trader or investor has to invest when the 'set ups' are ready. If the low risk set ups have presented themselves, and he or she decided to pursue something else for a while, by the time they return, the opportunity may be gone.

.

With that in mind, lets make some Hay today.

.

WTIC - Think about this. Last week I pointed out that OIL would move higher, but it is in a resistance area. It could struggle a bit. There is good news with this...

Read More

Read MoreWe are at another Fed FOMC Wednesday. The latest Fed Decision on interest rates will be released today, and usually that means we have to get ready for likely volatility. Today I prepared my premium readers to get ready for the trades that the charts are setting up for. Lets review some of what they saw...

.

Last Thursday I showed how Oil would have to work its way through resistance, but was still going higher.

Read More

Read MoreReady for what? For one thing, we are at another Fed Wednesday. Yes, that's right, the latest Fed Decision on interest rates is released today, and usually we have to get ready for any possible volatility. This time I dont expect much in the way of a surprise there, but we may want to start getting ready for the trades that the charts are setting up for.

.

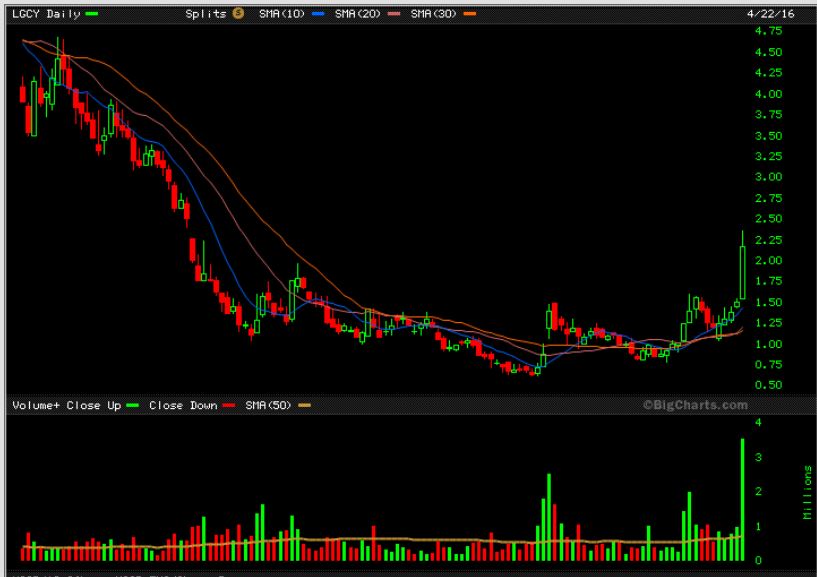

On April 20th I posted this chart of Oil. I've been bullish on Oil since the Feb Lows, and it still wanted to go higher. There is a resistance area in blue, but Oil looks like it wants to move to at least the top of that area for now. I listed many Energy / Oil companies that were set up bullishly.

Last Thursday I showed how Oil would have to work its way through resistance, but was still going higher. You can see last Fridays report for a list of Oil/ Energy stocks that were setting up bullishly.

Read More

Read MoreWhenever we as traders get really really comfortable with our trades and trading, I think it is always a good idea to go back and shake things up a bit, just to keep us on our toes. Since not a lot has changed on the charts from the weekend report through Mondays trading day - I wanted to focus on trading and 'trade set ups'.

Read MoreI just wanted to post this Friday report to mention a couple of things about our trades.

CRB - This was my Tuesday chart of the CRB. Notice the area where it was expected to run to , and then it might hit resistance.

Today the CRB hit the 200sma and turned down. Is the Run complete?

Read MoreThursday - 2 trading days left in the week. Again we have had another great week of trading, but how long will this last? Should I sell my positions? Lets do a quick market review and then discuss positions.

.

SPX - April 18 had the markets Bullishly moving higher.

SPX April 20 - The SPX is almost at the November highs and remains bullishly aligned. This may be an area that gives resistance, or the shorts may pile in and be forced to cover if it breaks to new highs.

Read More

Read More

Scroll to top

Read More

Read More