PUBLIC POST – WAITING ON THE FED?

We are at another Fed FOMC Wednesday. The latest Fed Decision on interest rates will be released today, and usually that means we have to get ready for likely volatility. Today I prepared my premium readers to get ready for the trades that the charts are setting up for. Lets review some of what they saw…

.

Last Thursday I showed how Oil would have to work its way through resistance, but was still going higher.

OIL is breaking higher and I think it’ll just run to that next resistance level. We are on day 15 of a daily cycle that can run 40+ days, so I am still bullish on Oil & Energy stocks for a while more. Have you been invested in Energy?

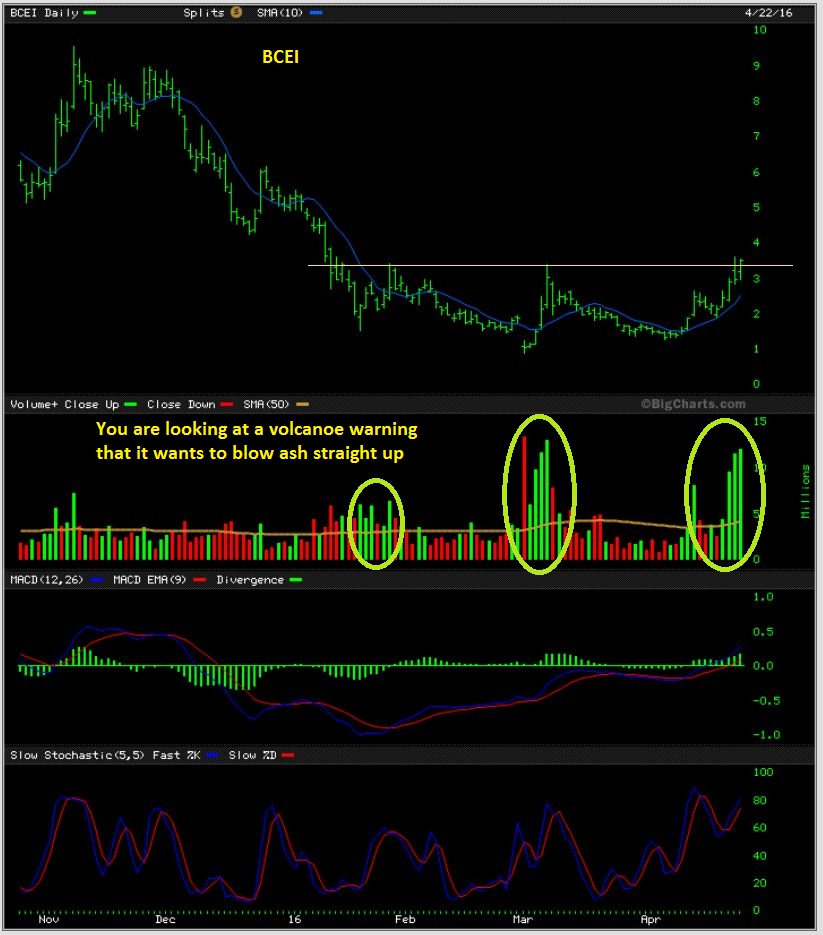

Last week I listed quite a few trade set ups that included OAS, MRO, SWN, SN, SM, etc. The LGCY trade obviously exploded and is a bit more risky at this point, but I still like BCEI and quite a few others longer term.

BCEI – For example, this chart was from April 19. It was a BUY on the tag of the 50sma Under $2.00 . I still like it, but it has run to over $4.00 . ( Yes, another 100% move) .

.

BCEI – I showed that it has a solid base. IF the company recovers, I still think it could run to $5 quickly and even $9 over time. Earnings are to be released on MAY 9th, so we keep that in mind too.

.

ENERGY & COMMODITIES ARE SETTING UP AGAIN

I have been saying ( Here in the Public Posts and in my premium reports) since January and February that I expect Precious Metals , Oil and Commodities to BOTTOM and be some of the best trading around %-Wise. So far, we have seen spectacular gains in these areas. Readers have told me that their accounts have actually doubled and tripled in 4 months! How? Possibly good options trades, leveraged ETFs, but also notice this…

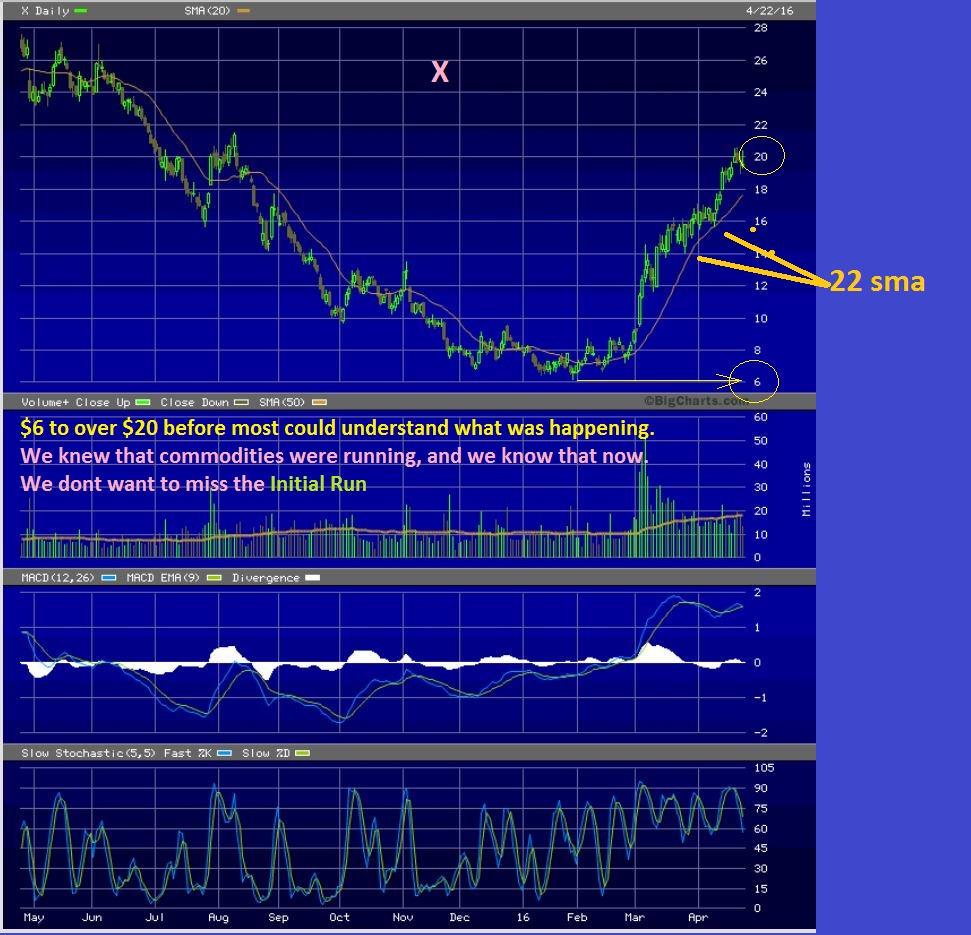

X – look at US STEEL for example. $6 to $20 if you were made aware of the commodities bottoming early in 2016, this trade tripled.

Many commodity trades and our trades in Miners Jan through March were huge %-Gainers. Is it over? We have seen a pause in some areas of Energy, Steel, Aluminum, etc, but these consolidation periods often lead to another run higher. Lets look at some commodity stocks that I have been discussing in the premium reports to prepare my readers .

.

AA – The first run higher was roughly $6 to $10. Then we see a consolidation that formed a Bullish pattern called a cup & handle. Mondays dip ‘tested’ the break out and Tuesday AA burst higher. Volume actually closed at 27 million ( I captured this before the close). This stock was ready to go and could easily run 50% or more.

CENX – This was April 22. I was mentioning how this could drop to $7.75 and seem scary , but it is a very bullish set up. It is another Cup & Handle pattern. These are formed from Buyers supporting each sell off / accumulation.

CENX – Tuesday it dropped to almost $7.50 all in one day and reversed higher to $8.50. THAT is bullish action when buyers that big quickly scoop it up on a sell off. It is a BUY right here. Where does CENX want to go?

CENX could easily double from here. This just ran from $2 to $9 in 2 months in the first leg higher. If you bought CENX in January at $2, you quadrupled your investment. I pointed it out around $3, so we would only have tripled our investment 🙂

.

FCX – FCX ran from under $4.00 to $12 in only 2 months To be honest, I personally ‘traded it in and out’. I didnt ride this whole run, but some of my readers may have. I recommended it in Feb.

.

FCX – has now formed a small cup & handle in the recent consolidation too. They had their earnings release and look at that drop to the 20sma and then it recovered. Were you ready for this?

.

HBM WKLY – Another Copper / Gold company. This weekly chart still has the inverted H&S pattern and the volume characteristics are bullish. Is this a buy here?

Those reversals in AA, FCX, CENX were very bullish if you ask me. I see many more and shared some with my readers, but this is enough for a Fed Wednesday. You may see volatility after todays Fed Decision and into the close. Lets see how things play out after the 2 p.m release and into the close. In Thursdays premium report, I will cover more buying opportunities and chart set ups if they present themselves.

.

If you like to go out for a good meal, you probably spend more in 1 evening than you would for a 1 entire month subscription to my reports ( $48.95). Lately, having a subscription to my reports has more than paid for itself with 1 trade. Why not give it a try?

.

To Sign up here, click and scroll down

.

Have a great day trading!

.

~ALEX

The usual warning always stands. Buying a small basket of stocks is far better than buying too much of one or two stocks. The risk is that some bad earnings or news in a beaten down sector could adversely affect ANY companies stock. Look up a stock on YAHOO.COM FINANCE and read the news headlines. Find out when they release earnings, due diligence is important, etc 🙂

Hey Alex – when you get time, can you tell me your thoughts on ATW? Thanks in advance!

Alex, I know we’re focused on trading and energy…but any thoughts on UA here for a longer hold? You had mentioned it in previous reports but been quiet on it for awhile. Thx muchly!