Archive for year: 2015

Have You Been Trading Metals & Miners?

/in Public /by Alex - Chart FreakHave you been trading Gold, Silver, or maybe some of the Miners recently? They have been quite volatile lately, with many good traders being stopped out and frustrated. I was recently stopped out last week, when some miners did a false break higher above their 50sma, only to turn down and close below the 50sma again.

That may cause some to wonder, “Is this a trap?” and “Why does this keep happening?” Others outright scream, “Bear market rally is over, down we go and soon! Go short!” Since anything could happen, I wanted to look at some charts.

ABX – Sure this could break down, but its actually sporting a bullish descending wedge, a rising MACD, and isnt it possible that we are just looking at a bottoming process?

NEM – It is struggling for sure, but is it basing out or ready to break down? It actually looks like a base is building with that divergence in the MACD & RSI. This could be building energy for a break above the 50sma.

I am writing because I do hear many people saying to short the miners for a big drop coming. At this point, I look at ABX and NEM and I see the possibility of an upside pop soon. ABX and NEM are major components of GDX, so if you were thinking of going short , I would say to stay away from JDST and DUST until the true direction of the Metals and Miners presents itself clearly.

Consider this: Not all Miners are at recent lows and ready to fall apart. Take a look at the following charts. These had their lows back in July and are currently holding onto gains. Was this reversal just a stop run?

This was yesterday when Gold was down $15

SO I am watching a number of things , including cycles and other clues to shape my view of what may be going on in the precious metals markets. I will also cover more in the premium report Friday morning. Care to join u for a month? Thanks for being here.

~ALEX

Consider a membership at the Chartfreak…it’s just $95 for three months.

Membership Options >>>> http://www.chartfreak.com/my-secrets/

Got Pain?

/68 Comments/in Premium /by Alex - Chart FreakThe market volatility has been whip sawing people left and right. What used to look like the perfect set up falls apart in just a day or two, so having 'stops' in place has been very important. Lets take a look at the markets and then review some very interesting things that took place in the Metals and Miners area today.

SPX- This bounce was expected.

Read More

Read MoreTime Decay

/125 Comments/in Premium /by Alex - Chart FreakIt's time to discuss decay in the Oil and Metals markets, but first lets do a review of the equity markets.

SPX- This was Sept 15. I have been saying since August that I expect the lows to be tested sooner or later.

We see that happening now, so what next? ...

Read MoreDoes It Fit?

/125 Comments/in Premium /by Alex - Chart FreakCrazy action in the markets today. Some of it was expected, but some of it doesn't seem to fit. Lets take a look.

IBB - Really taking it on the chin lately. This is a weekly chart and todays volume was massive.

Read More

Read MoreHow Are Things Stacking Up?

/53 Comments/in Premium /by Alex - Chart FreakIt would be good to look back at the past weeks activities and see how things are stacking up.

TRAN WKLY - This surely hasn't looked bullish as the trend changed. The Tran was rejected at the 10 ma this week again.

Read More

Read MoreCan We Go Shopping?

/72 Comments/in Premium /by Alex - Chart FreakA quick look at the markets and a brief discussion on shopping

On Sept 22 - I said that I was looking for a possible 'Test' of the break down and then a drop.

SPX - Reversal candle. Maybe that 'Test' comes now.

Read More

Read MoreGold Is Jumping

/in Public /by Alex - Chart FreakYes, Gold is jumping, but we’ve seen that before, right? The question is , ” Will it make it to it’s intended target, or land flat and flounder around like a (gold) Fish out of water?” Here at Chartfreak, we have been waiting for this next leg higher. Lets review some of the charts from recent premium reports…

GOLD,SILVER,& MINERS

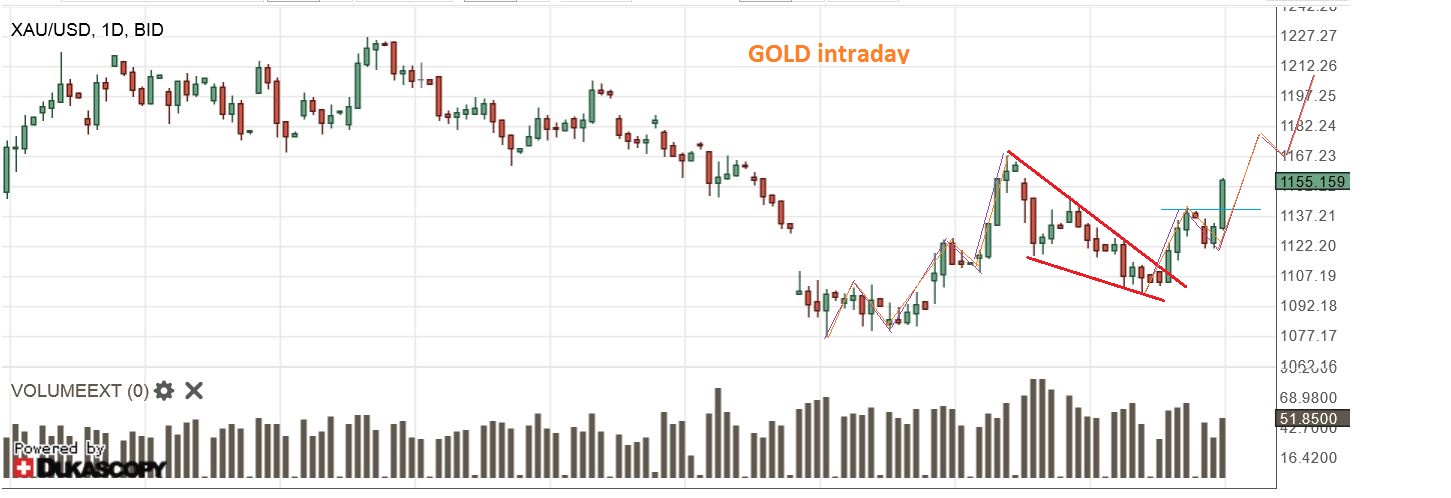

GOLD SEPT 22 – Looks great on day 7. The first run up went from $1072 to $1169. It could pull back even further and still look very Bullish, but it doesn’t have to. We are in our second daily cycle and I expect that Gold could run to at least $1200. We will monitor it along the way.

Silver – pretty big 1 day drop, but it has not moved down with Gold on the last 2 days, so it is not a broken chart by any means. Notice similar 1 day drops in July and August that had no follow through. I wanted to see those moving averages hold, and I am also watching the trend lines drawn.

GDX – Yes, GDX fell more than I expected. I was looking for the 10 SMA to possibly hold as support. The chart is not broken and I’ll show you why…

GDX (2)– Looking back at last Nov-Dec when we were dropping into a 2nd daily cycle (RED ARROW) . We took off and curled back down to the lows again ( 2nd red arrow) before a nice blast off higher into January. We could be seeing that here, thats why I say the chart is not broken.

Some were not happy with the action in GDX (understandably) , so As a reminder , I posted this in last nights premium report.

Here is a close up of that period last Dec 2014. GDXJ popped and dropped to shake out weak hands. This looked exactly like what we were seeing now. Compare these 2 charts below together. The 1st is last Dec and the 2nd is today. Twins.

What happened next? This is the same chart of last December as the anticipated run started. The red arrow points to where the first chart above ended.

Conclusion: We were in the 2nd daily cycle and a rally should begin soon unless something is very wrong. I also looked at the 2 charts below and declared them bullish, to further the case for a bullish move in the near future. They are larger components of GDX. Bullish descending wedges.

Today we have this (Click to isolate)

GDX 2 hrs into trading

I have been calling for another leg up, but many were growing weary (understandable with that GDX drop) . The above analysis was designed to help my readers to see the possibility and likelihood of the coming move higher. We saw dips like that before, right before a rally. It’s time to go shopping friends. Find your favorite Miners and gather a basket, start small if you have your doubts. Were you confidently expecting a move higher in Gold? Do you still have doubts? Though we saw weakness in Miners, we were still expecting a move higher in Gold , and we were watching for the Miners to get on board. Today we are seeing positive follow through.

I will be covering some set ups in future premium reports, and also navigating this move forward, since I believe we have started the next leg higher. Why not try a 1 month sign up? Thanks for being here!

~ALEX

Clear As Mud

/94 Comments/in Premium /by Alex - Chart FreakWhenever we get mixed signals in the markets, it may take time to allow things to clear up. We are seeing that with the divergence between Metals and Miners right now, but until time resolves the differences, we can also look for clues. We'll do that here, but first lets review a few other sectors.

NASDAQ - We got the back test that we expected and then the drop back down. I expect the Aug lows to be tested or broken, but you can see that volatility has kept things from being a smooth move. We may bounce around inside this down channel too.

Read More

Read MoreWatching

/98 Comments/in Premium /by Alex - Chart FreakWe are still keeping an eye out for various signs in these markets. Lets take a look...

TRAN - I posted this wdge as a warning in Monday nights report

TRAN - There was some follow through.

The selling was not on very heavy volume, so I am starting to think this move is going to drive longs and shorts crazy, here is why -

Read MoreContact Us

26 Broadway,

8th Floor

New York, NY 10004

admin@bigleaguefinance.com

admin@bigleaguefinance.com

Latest Blog Posts

accelerator diet pills goji berry diet pills ultra 90 diet pills keto meal replacement bar top weight loss diet pills for thyroid patients where to buy t lite diet pills keto friendly thickener diet fuel diet pills peanuts keto friendly rite aid diet pills that work envy diet pills diet pills for breastfeeding moms belique diet pills perfect slim weight loss pills calories in a bottle of white wine