OBSERVATIONS

I have been watching the various markets intently , examining internals and how they've reacted under similar circumstances in the past to try to get an idea of what to expect . I think that I have done rather well with the general markets and Metals and miners, but I must say...there are some extremes in some areas that I have just left alone until I get a clearer idea of how things may unfold going forward. What am I referring to? Well, specifically the ENERGY sector with OIL and NATGAS has been a little tricky, and of course the $USD has been very strong - now even higher than I anticipated. lets take a look at those areas. They that have been difficult to call, for Sure.

I know what I "Guess" they could do, but when it comes to putting advice in my premium reports on these sectors, I have decided to just wait until things clear up , and focus on some other very trade-able areas.

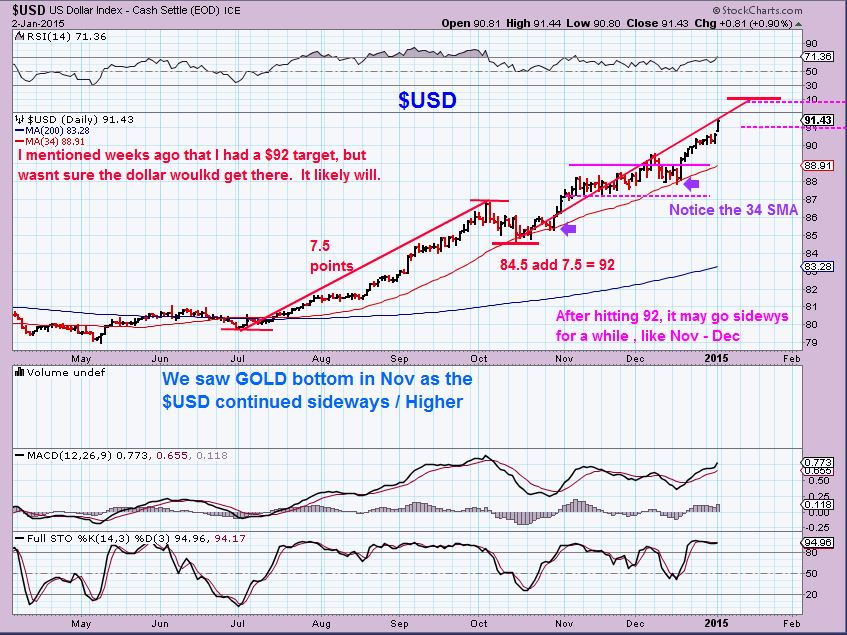

I expected the $USD to stop in the $92 area. ( Actually, I had that as a target, but I thought it may not make it there, I mentioned that it could roll over near 91 because GOLD began completely ignoring the $USD strength. I assumed GOLD was sniffing out Dollar weakening).

I posted this chart Jan 2- $92 target