You are here: Home1 / Exclusive Strategies

After a quick market review, I was to discuss a bit further the risk reward in front of us in the Precious Metals Sector.

Read More

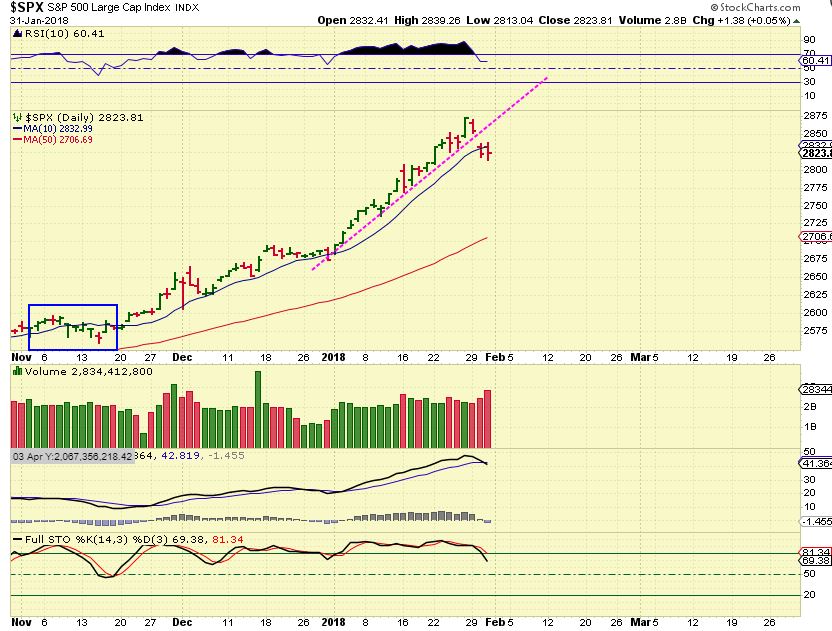

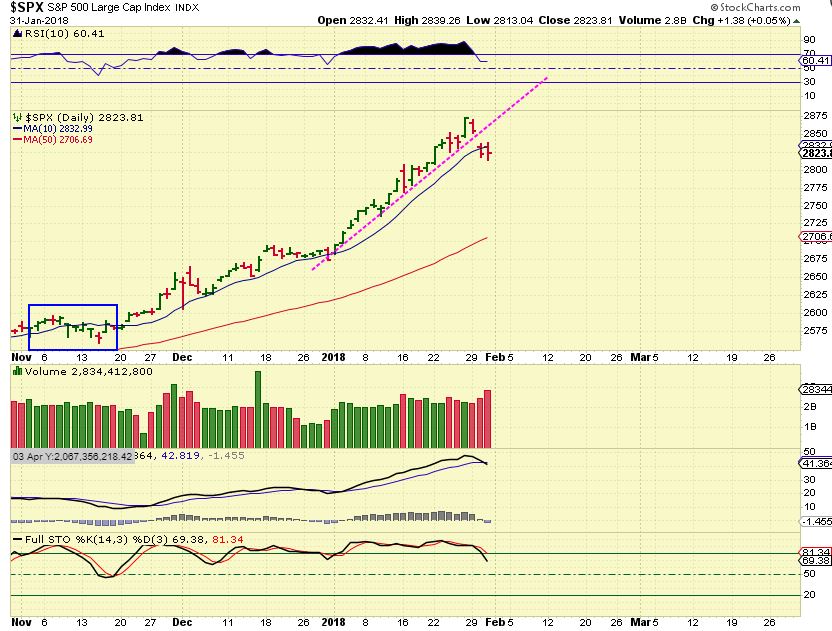

SPX - We are actually pretty late in the timing for a dcl, so even though this drop can meander like the one in November did, it may just be a brief dip.

Read More

Read More Welcome to another Fed Wednesday. Let's review what took place on Tuesday, and then discuss what may take place after the Fed Decision (which is pretty much already baked in).

DJIA - Finally, 2 down days in a row and a close under the 10sma. The DOW has started a drop into a daily cycle low.

Read More

Read More

Scroll to top

Read More

Read More Read More

Read More