You are here: Home1 / Exclusive Strategies

https://chartfreak.com/wp-content/uploads/sites/18/2016/04/WAKE.jpg

463

747

Alex - Chart Freak

https://www.chartfreak.com/wp-content/uploads/sites/18/2019/11/Chart-Freak-site-logo.png

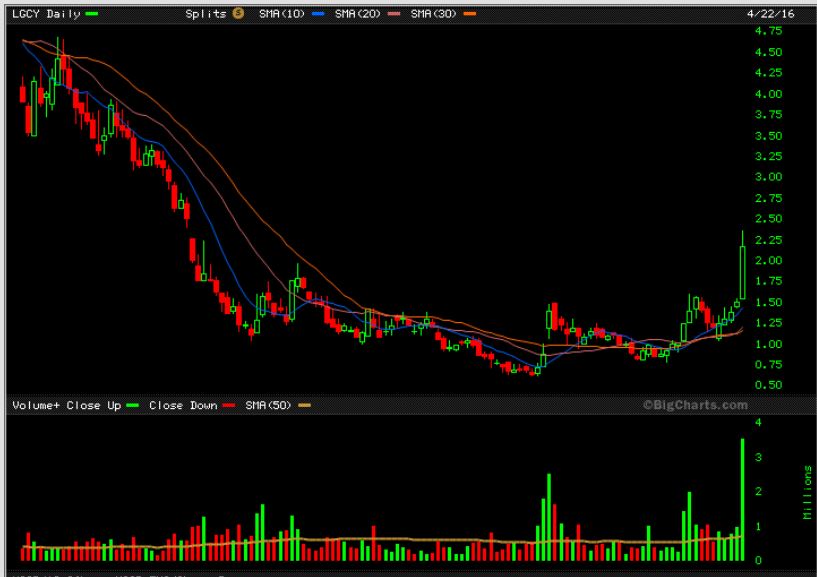

Alex - Chart Freak2016-04-25 10:44:412016-04-25 10:51:46Waking Up To A New Week Of Trading IdeasI just wanted to post this Friday report to mention a couple of things about our trades.

CRB - This was my Tuesday chart of the CRB. Notice the area where it was expected to run to , and then it might hit resistance.

Today the CRB hit the 200sma and turned down. Is the Run complete?

Read MoreThursday - 2 trading days left in the week. Again we have had another great week of trading, but how long will this last? Should I sell my positions? Lets do a quick market review and then discuss positions.

.

SPX - April 18 had the markets Bullishly moving higher.

SPX April 20 - The SPX is almost at the November highs and remains bullishly aligned. This may be an area that gives resistance, or the shorts may pile in and be forced to cover if it breaks to new highs.

Read More

Read More

Scroll to top

Read More

Read More