You are here: Home1 / Exclusive Strategies

Welcome to another Fed Wednesday. Let's review what took place on Tuesday, and then discuss what may take place after the Fed Decision (which is pretty much already baked in).

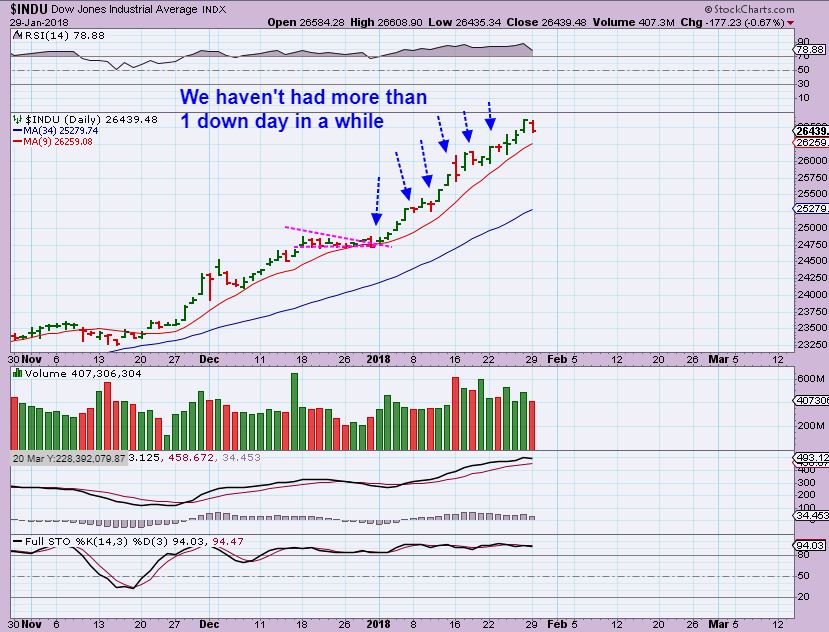

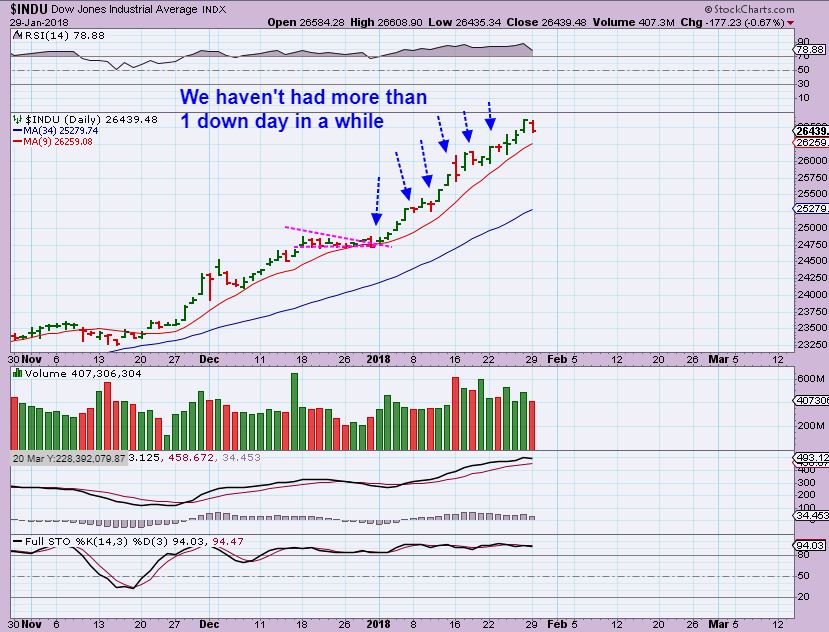

DJIA - Finally, 2 down days in a row and a close under the 10sma. The DOW has started a drop into a daily cycle low.

Read More

Read More

DJIA - Monday was a down day. let's see if we can get 2 days down in a row, since we haven't seen that for weeks. 🙂

Read More

Read More We rode out some choppiness this week, so the weekend report can act as that 'beacon in the storm' that guides us along. Let's review our Markets...

.

SPX WEEKLY #1 - As expected, the General Markets are accelerating and this weekly chart shows the last 4 weeks as strong green weeks. A trailing stop has been very effective for those riding this 'long'.

Read More

Read More

Scroll to top

Read More

Read More Read More

Read More Read More

Read More