You are here: Home1 / Exclusive Strategies

This is my "It's Friday and I dont usually do reports on Friday" report. Whenever Thursdays action raises questions that can't wait until the weekend, I do a Friday report.

.

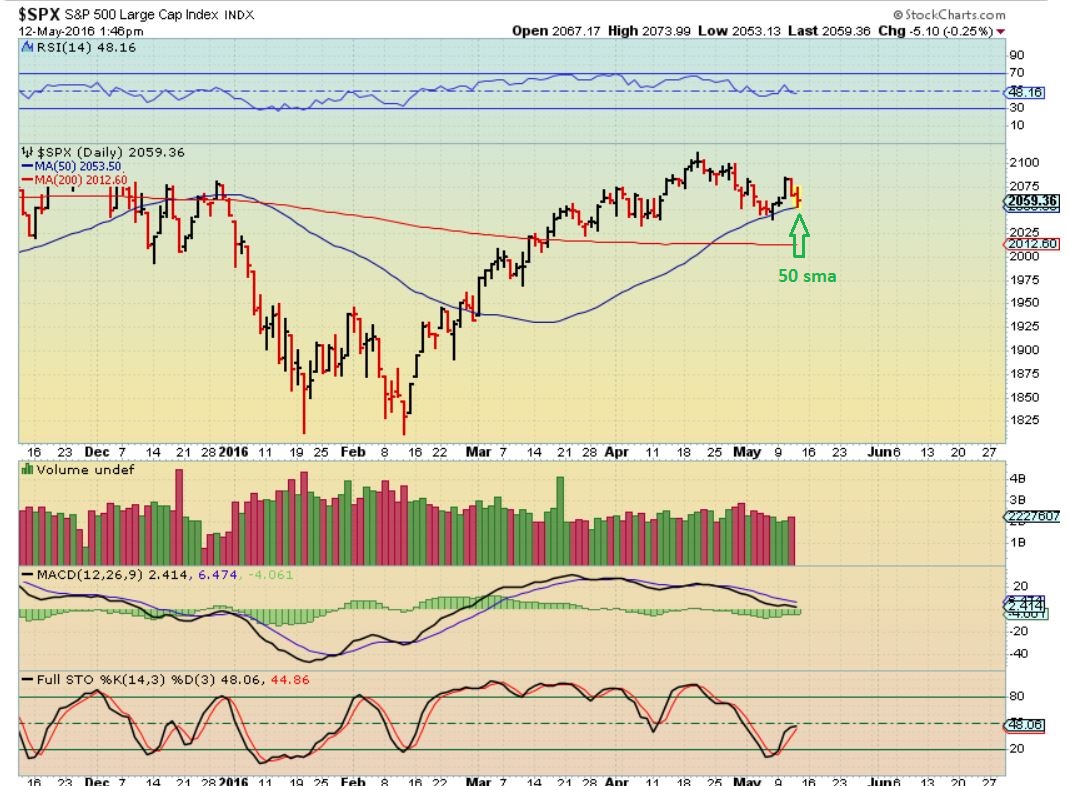

SPX - This was yesterdays chart. We likely saw a DCL last Friday with the reversal at the 50sma. AS LONG AS THOSE LOWS HOLD, the DCL is in place. Even if it goes sideways for days above the dcl, like the red circle that I drew above the Jan DCL, nothing has changed.

SPX Thursday - Nothing has outwardly changed yet, but this is looking weak. Volume increased a bit, the MACD looks weak, and the hrly charts look weak. If this breaks down, that H&S measures a move down to the 200sma. Do I expect that?

Read More

Read MoreAfter a brief market review, I want to point out something that seems to be telling me that now is the time to act. Lets begin...

.

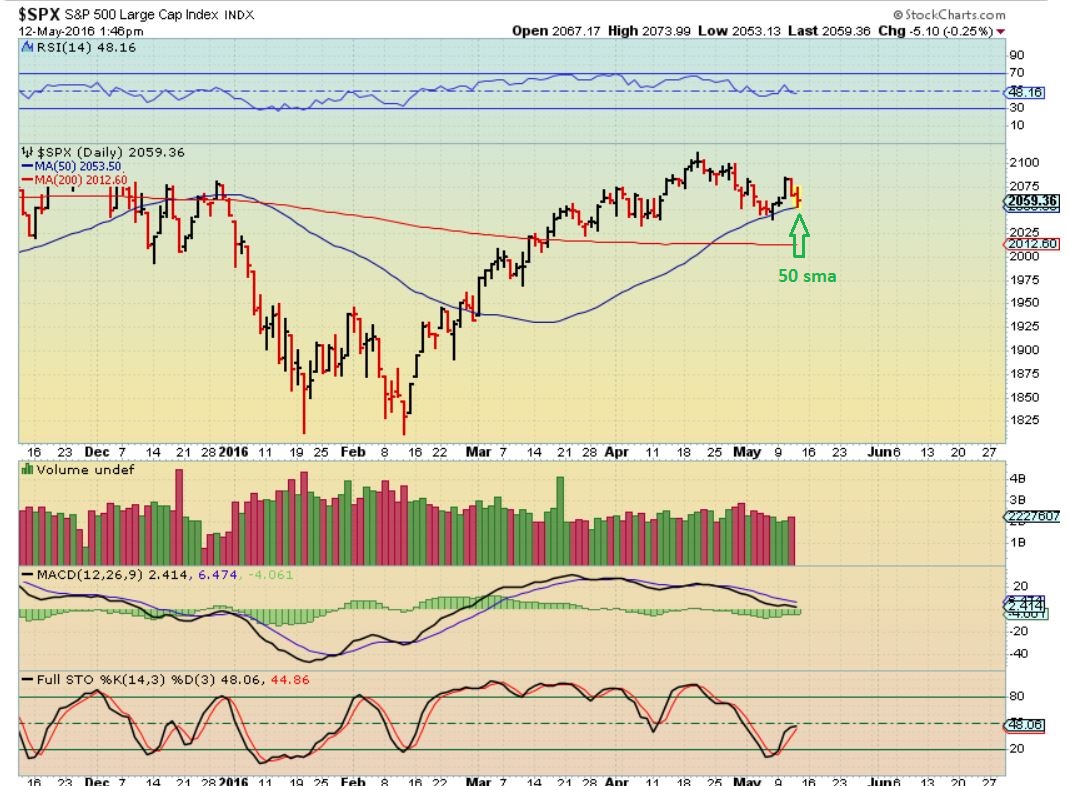

SPX - Price was rejected at the upper trend line, and it dropped down to the 10sma. The Red Circle shows that shortly after prior DCLs, price did the same thing. A drop below the dcl would not be healthy, the first daily cycle would be extending way too far and I would be suspicious.

.

From here I'm going straight to OIL, NATTY, and The CRB...

.

Read MoreHave you ever been thrown off of a Bull? Maybe your stop was triggered only to see that stock turn and move higher. What can you do? We'll discuss that after a quick market review.

.

SPX - This was my May 5th chart. I have been pointing out that the SPX ( And general markets) are due to rally.

SPX as of Tuesday - That is what we see happening as the markets were green for the past 3 days.

Read More

Read More

Scroll to top

Read More

Read More .

.

Read More

Read More