You are here: Home1 / Exclusive Strategies

Wednesdays release of the Fed Minutes certainly caused a 'reaction' in the various sectors of the markets. It falls in place with the timing of certain cycles, so lets review the action and what it may mean moving forward.

.

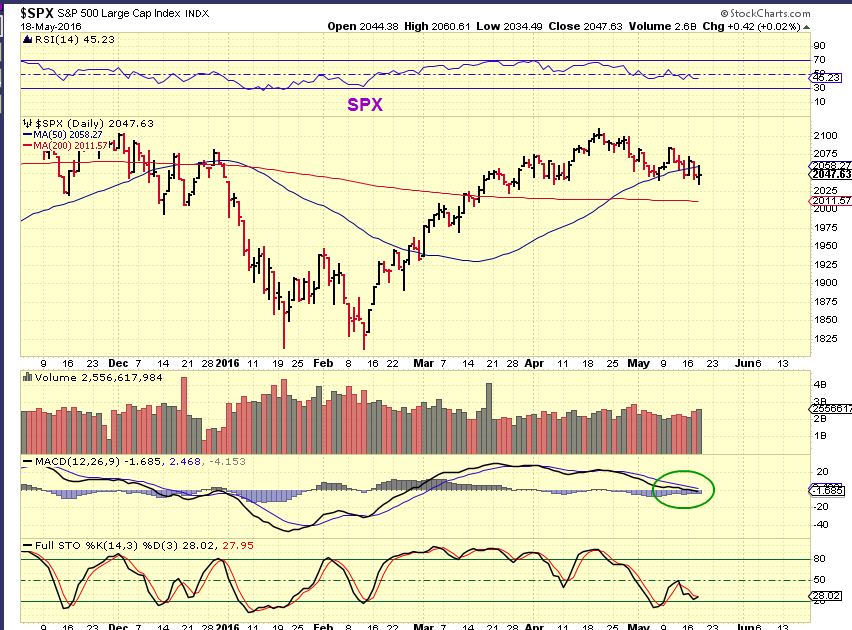

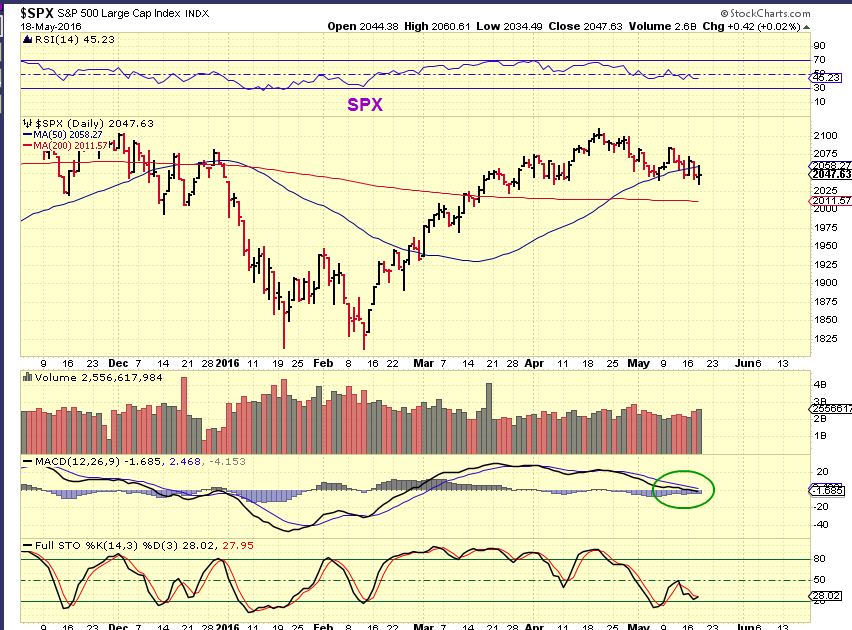

SPX - The General Markets sold off with the Fed minutes. They recovered into the close. This still looks like a H&S and has yet to recover the 50sma.

Something that I find very interesting happened on Wednesday, I'll discuss it later in the report.

Read MoreFOMC MINUTES RELEASED TODAY, that can affect the markets , since they seem to be at pivotal points. I have a lot to discuss for a Wednesday, so lets get right into the report...

.

DJIA- I usually use the SPX, but they are similar right now. POssibly dropping to the 200sma, but 'time' is important here. It really needs to move higher sooner than later cycle -wise.

Read More

Read MorePatience in the markets can be rewarding and it might come in various forms. Patience is often needed to wait for a pull back to turn into a buying opportunity or a trade set up. It also might come when we are holding positions and we are waiting for price to show follow through. This weekends report showed mixed signals in various sectors and Monday started clarifying a few things, but a little more time might be needed to truly see what is unfolding. lets review...

.

SPX -The general markets showed some upside potential, regaining the 50sma. It looked like the DCL came 7 days ago, so now we need to see some follow through to new highs to avoid having this become left translated and a repeat of last fall.

Read More

Scroll to top

Read More

Read More