You are here: Home1 / Exclusive Strategies

Wednesday had some action, let's take a look...

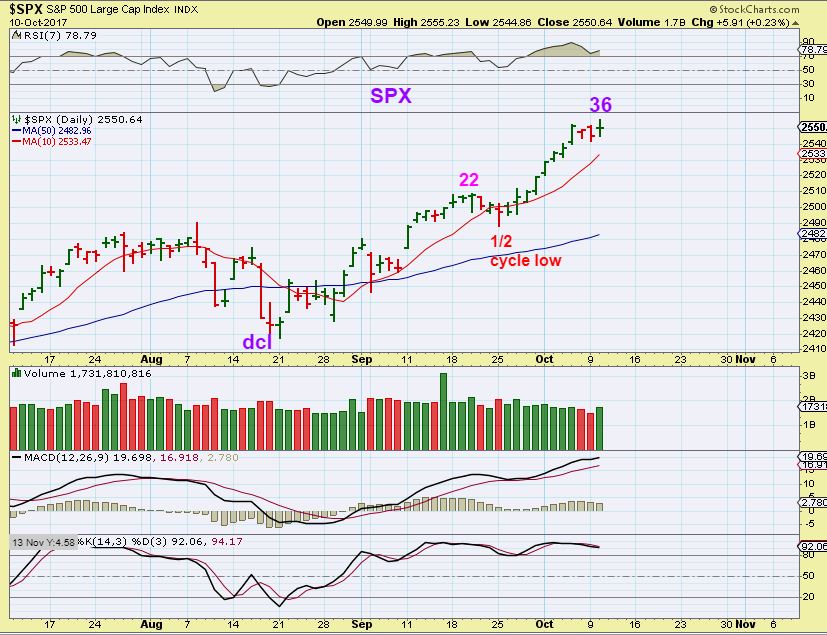

QQQ - I not only feel that we are getting late in the daily cycle, but there are other signs that this has been a good bull move( RSI), but that this also is approaching a top here.

Read More

Read MoreWelcome to Wednesdays trading, please have a seat and we'll start out discussion...

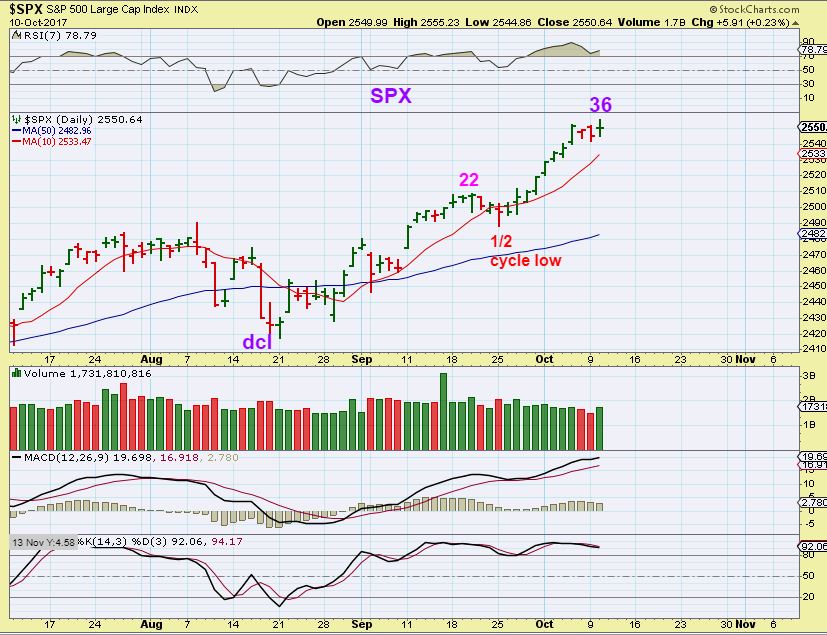

SPX - I believe that this is day 36 and I would expect that the markets can pull back into a dcl at anytime. This remains a strong market, able to peak around day 36 ( R.T. Again).

Read More

Read MoreWe've only had 1 trading day since the weekend report, and things do seem to be falling into place as expected. Let's do a review...

Read More

Scroll to top

Read More

Read More Read More

Read More