You are here: Home1 / Premium

Looking forward...

.

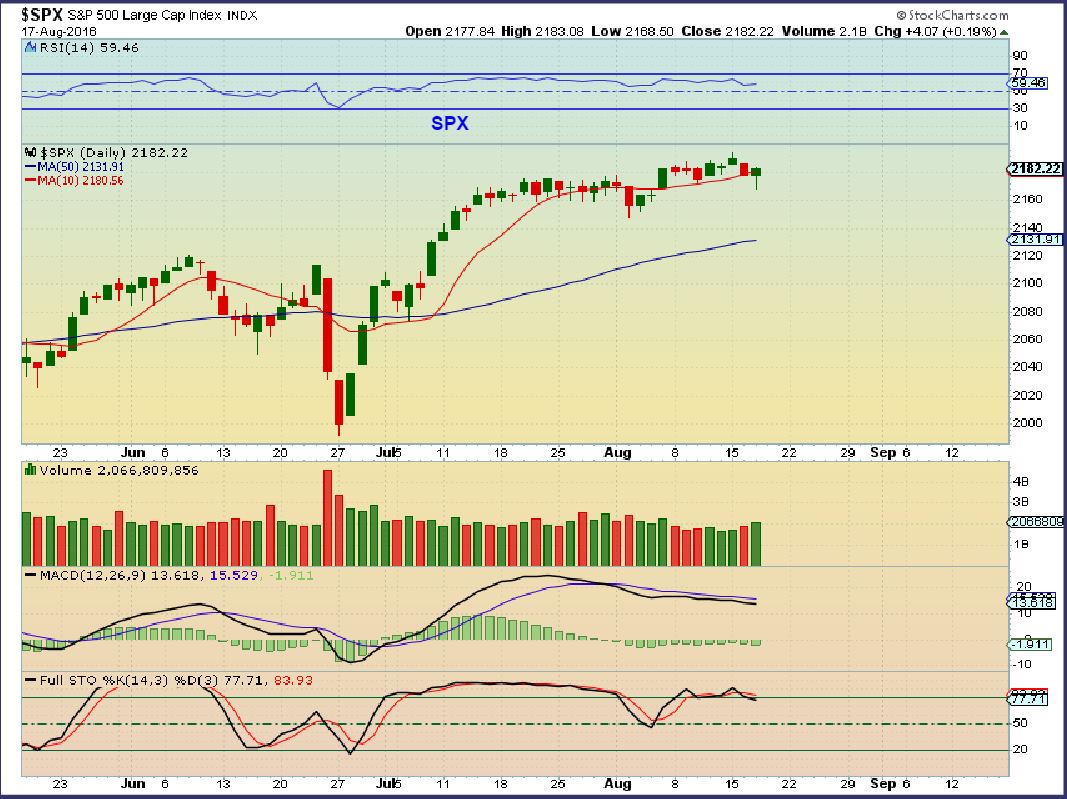

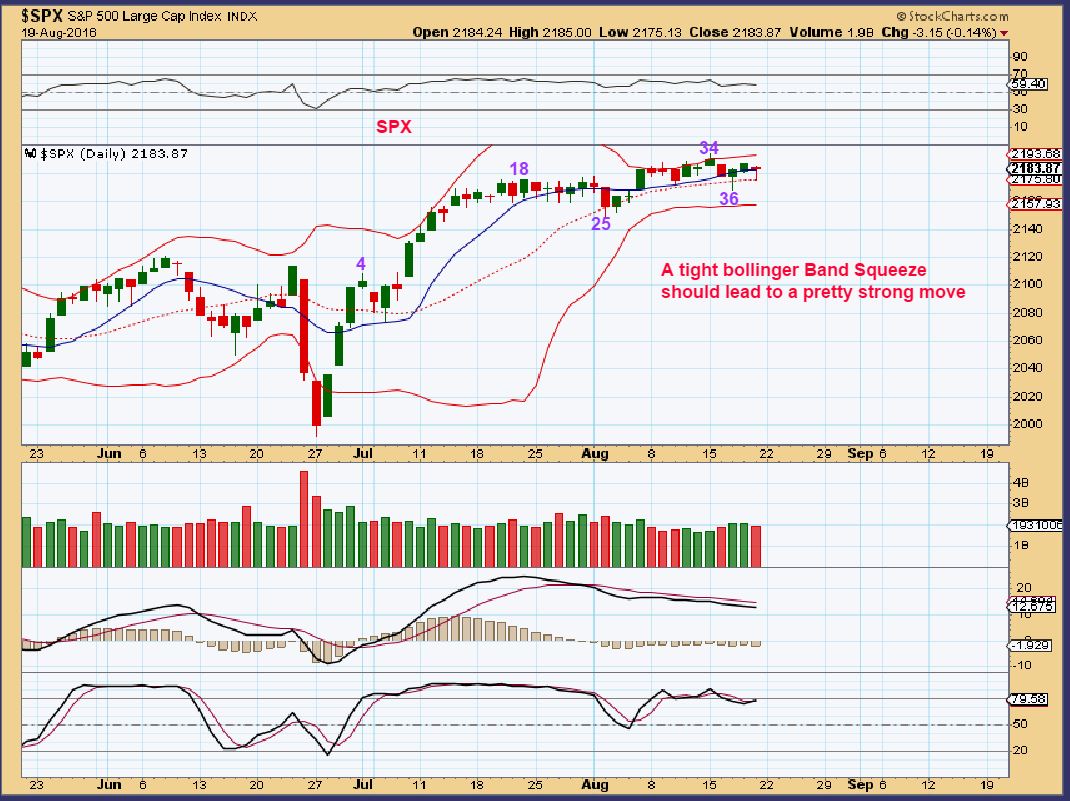

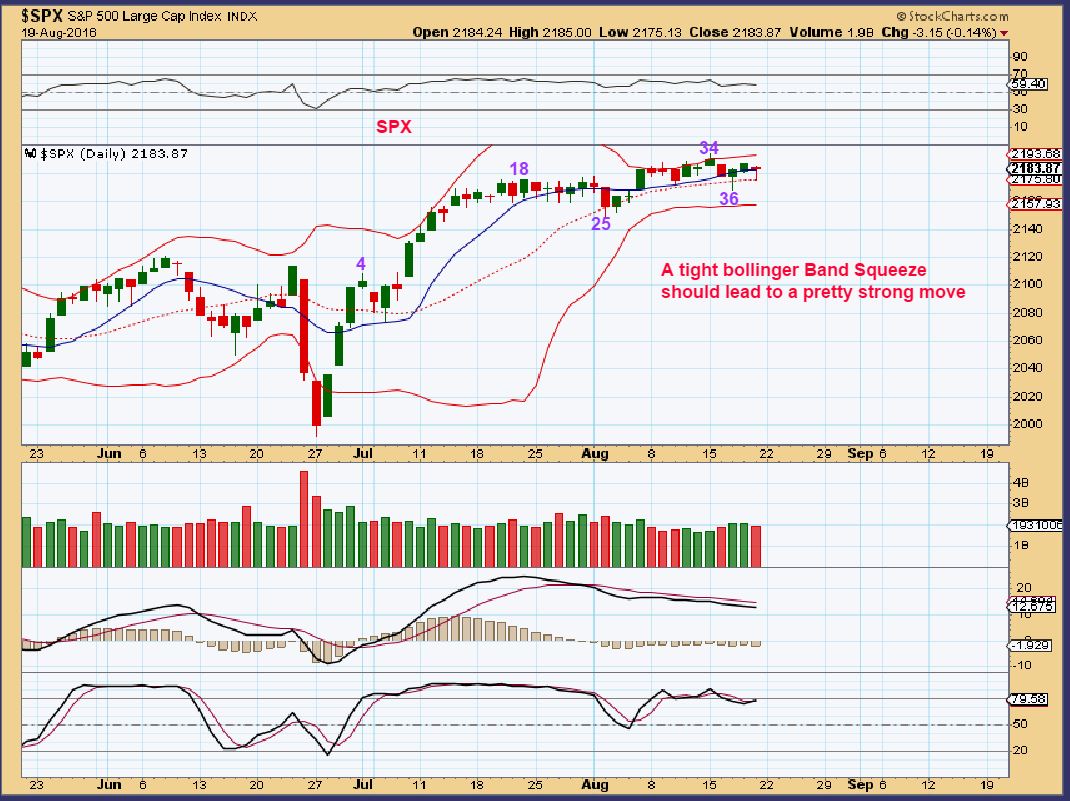

SPX - The squeeze on the Bollinger Bands usually leads to a strong directional move.

You can see that we are consolidating in a bit of a triangle / wedge and heading into the apex. A break out 1 way or the other should occur soon. A break out higher could lead to a runaway move ...

Read More

Read MoreAnd as predicted, it is a force to be invested in 🙂

.

WTIC - Many doubted that Oil could come back so quickly, some on CNBC were saying that it would not make it past $44. With an ICL in place, there is no doubt that this chart shows us....The Force Awakened.

We have been investing in Oil/Energy since I pointed out some nice set ups over 2 weeks ago. Some of these gains are already satisfying. Is this it? Will Oil only double top like I hear some saying? I will discuss the potential briefly here and in the weekend report.

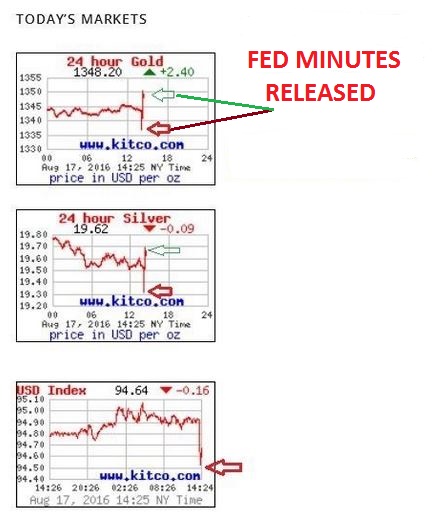

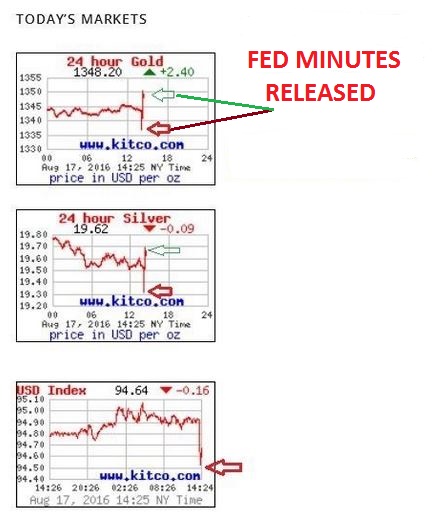

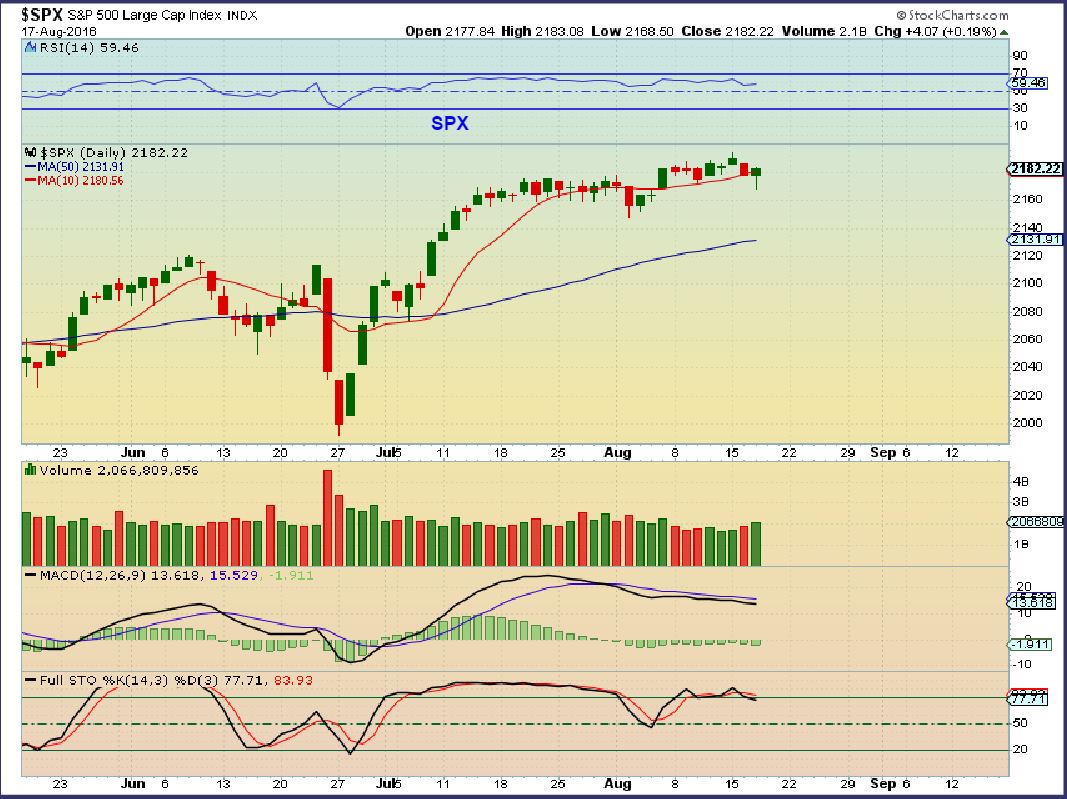

Read MoreToday the Fed Minutes were released. Could you tell?

The SPX sold off and then recovered the 10sma.

Read More

Read MoreFed Minutes are released today. We have seen a few sideways moves in various sectors, maybe this will be a catalyst for a directional move.

.

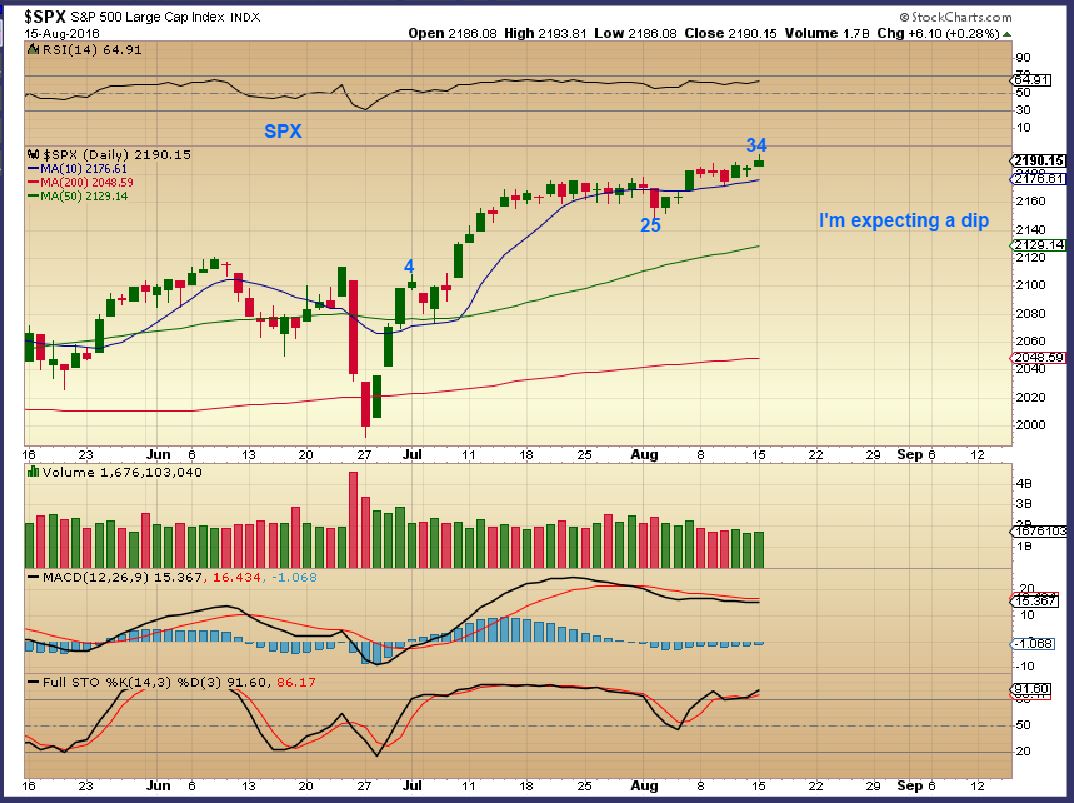

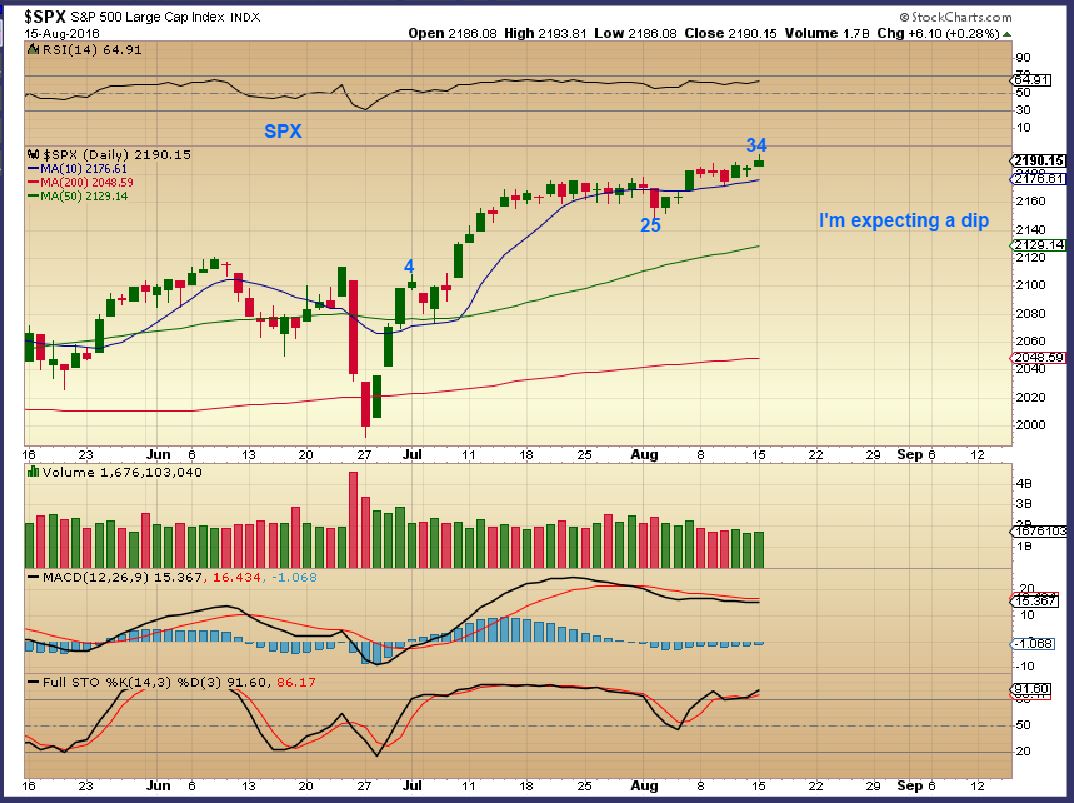

SPX - If you re not long or short, don't jump the gun. After a long consolidation, the move can be prolonged, and I have actually been expecting a dip into a dcl. I dont think that the early Aug dip on day 25 was enough.

Read More

Read MoreNot much has changed since the weekend report, and we are still seeing once semi-ugly charts becoming diamonds in the rough. Let's review...

.

SPX - I personally took a long trade after calling the ICL in June ( And pointing out the 3 white soldiers very bullish pattern), I didn't stay long during the long sideways move started getting drawn out. I still expect a dip soon into a dcl, though this break out does have an occasional pop higher out of the sideways consolidation. I think you are looking at 1-2-3-4-5 completing for now. It may become a buy the dip in the future.

Read More

Read MoreThe past few weeks of trading have been very good. Active traders have been able to find set up after set up, especially in Miners and now Energy. Some that Bought Miners in late May and Early June are still reaping rewards, and we have been looking at Energy trades for the past 2 weeks too. I am just a little torn about what I am seeing in some areas. For example, The General Markets broke to new highs and consolidated, but the VIX is very low. Also I've mentioned the lack of follow through in Golds Pop at the open for the last 3 days, etc. Lets go through our weekend update and review our weeks activity.

.

SPX - After a long sideways consolidation, we had a pop and basically more consolidation.

The Markets should have a strong move after such a long consolidation, but so far they are just continuing sideways and the VIX is at a point that usually ushers in a temporary top. Cycle-wise, we are due for a DCL soon, so I'd expect that we get a drop soon.

.

SPX WKLY - That drop could back test the break out or the 10ma.

Read More

Read MoreI wanted to share a thought on Gold, Miners, and Oil

.

WTIC - Oil remained bullish with the bullish follow through on Day 6. There may be resistance at the 50sma, but so far this looks good.

Read More

Read MoreWe were expecting the start of a pull back, so I posted this NASDAQ chart along with the Vix and a few other charts

Now lets look at the latest developments...

Read MoreAlong with our market review, I want to discuss some of the selling we saw in Oil and Energy stocks Tuesday. What are we looking for in the pull back that we see? Should we be scooping them up, or not? Lets review our markets...

Read MoreI am seeing step by step progress in the areas that we discussed in the weekend report, so I am going to go right there.

.

This was my weekly Oil chart

Read More

Read More

Scroll to top

Read More

Read More