You are here: Home1 / Premium

Lets take a look at what appears to be some good energy.

.

WTIC -

As expected, Oil is following through to the upside. Sitting near the August highs, it could form a handle on this mini cup , or it may just power higher to the June highs.

Read More

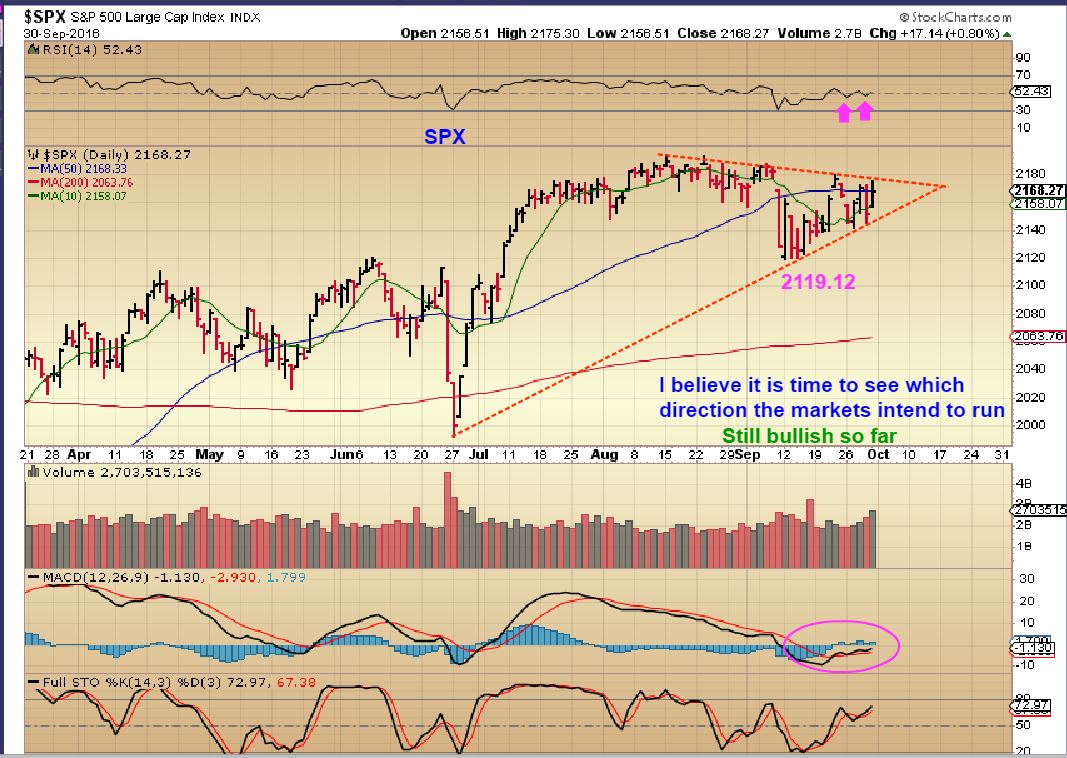

Read MoreOur recent weeks of trading have had a lot of sideways chopping action. My last report discussed how that was ending in Oil, and I think that the choppy action is about to end in the general markets too. Lets go to the charts.

.

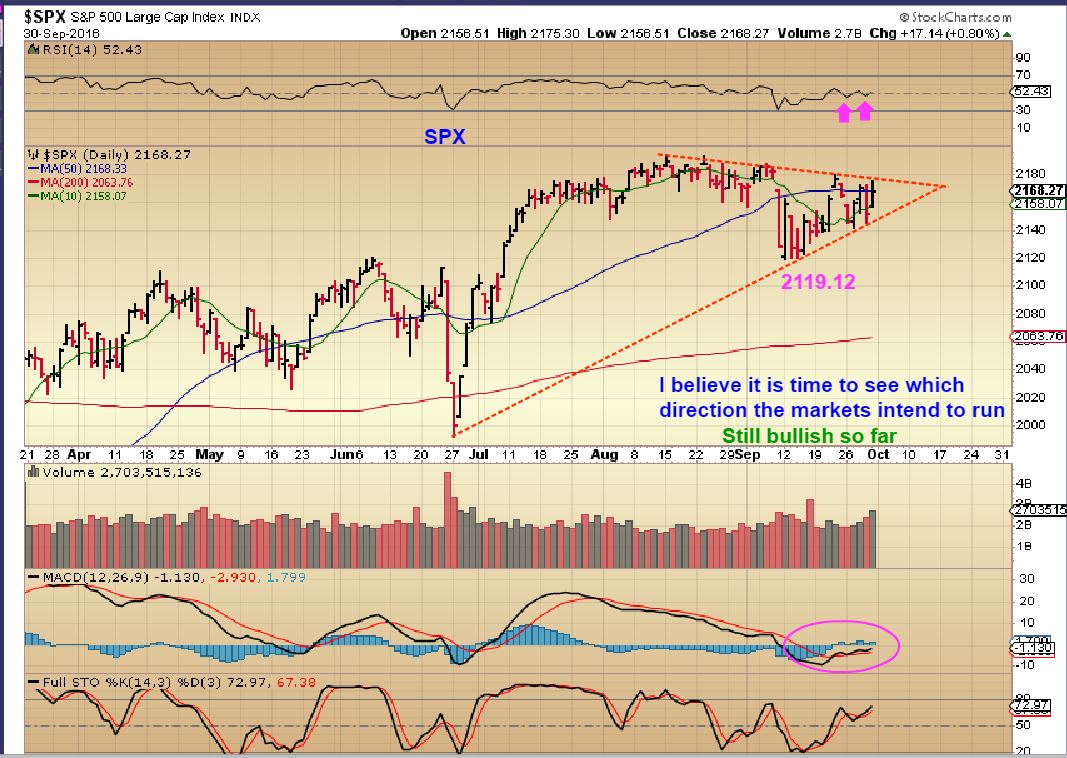

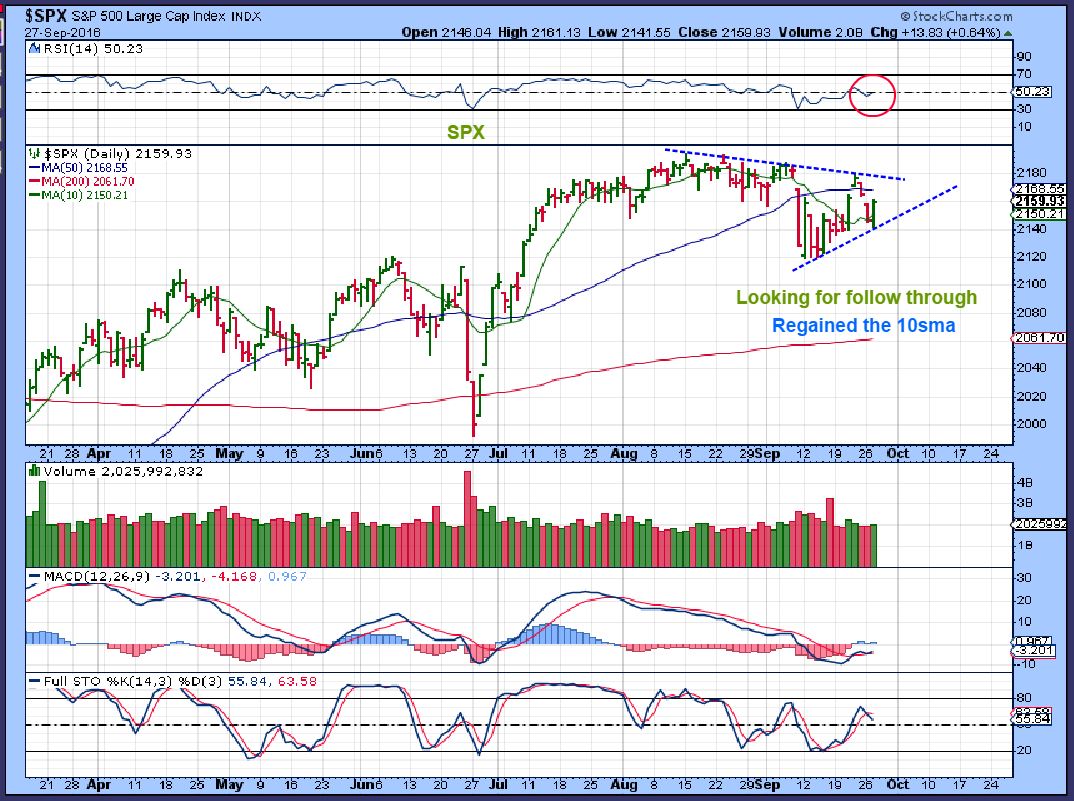

SPX - As price approaches an Apex we should see a nice break out and run. There is a lot of pressure built up in this consolidation. A break down could get ugly fast, but this leans bullishly at this point.

SPX WKLY - This looks similar to the 2011 sell off, break out and back test in 2012.

Read More

Read MoreLets talk about the current window of opportunity

.

WTIC - Wednesday I said that this break out looked legit.

WTIC - And Thursday we saw follow through, but...

This is what I really want you to see ...

Read MoreAfter all of the sideways chop, I think we finally have something interesting to talk about.

.

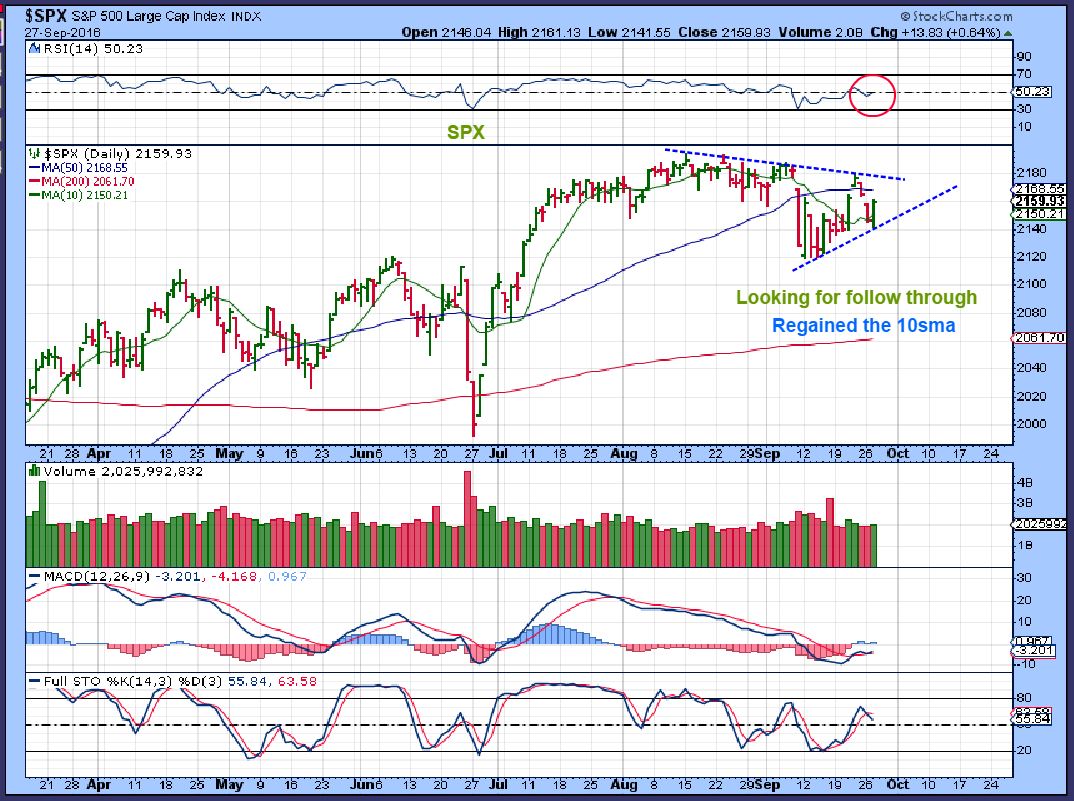

SPX - If Oil could get moving higher, I think we'll see the markets moving higher too. After all of this sideways chop ( in many sectors), this is a bullish set up with todays strong reversal.

Read More

Read MoreI've seen choppy markets before, but it seems like Oil and Gold are up one day, down the next , up one day, down the next. It can be very difficult to navigate the choppiness, but Cash is also a position until we get a nice trending market. Other trade set ups are an option too. Lets take a look at the charts.

.

SPX - Short term I see a choppy triangle forming, and the larger picture might be forming a rising wedge. We can look for follow through with a break down or a break out.

Read More

Read MoreI just want to get right to the point here, lets look at the charts.

Read MoreI mentioned in a few of my August reports that things could remain a bit choppy going forward, especially if we are entering the timing for an ICL in Gold & Miners. We saw this in both OIL and Precious Metals markets in the past, and I will again point that out in this report. That type of price action can be frustrating, because the trade set ups quickly break down and the price action becomes more or less sideways. Lets take a look at what we currently see and discuss what we could expect.

.

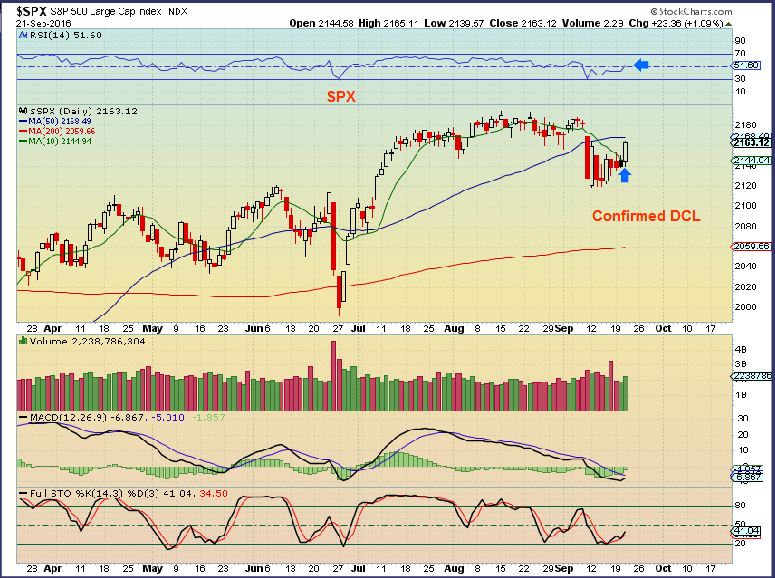

SPX - Our daily chart had a possible Island Bottom Reversal, but the gap closed and it lost the 50sma. This is not overly concerning at this point, but I liked the idea of an island bottom.

SPX WKLY - This still looks like a great weekly set up.

Read More

Read MoreWhat are we watching on Friday?

.

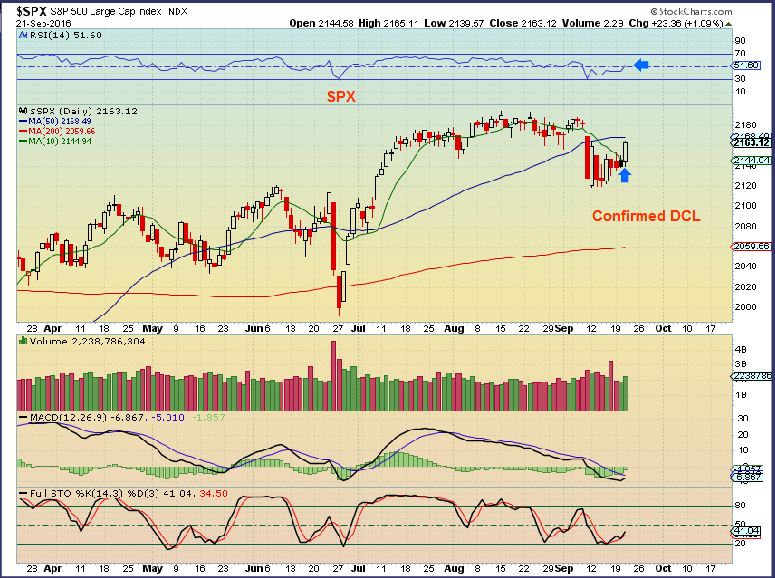

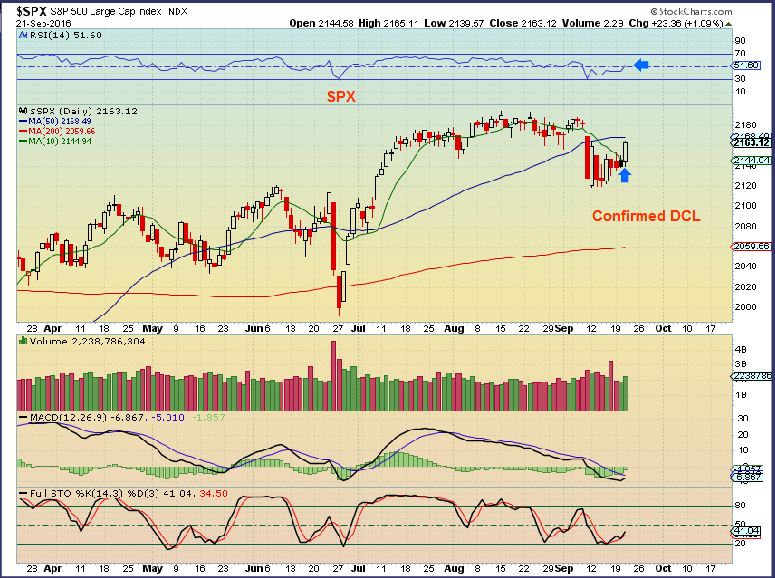

SPX - Yesterday, using this chart, I pointed out that this confirms the daily cycle low, and it is a bullish break.

This could be considered an Island Bottom reversal. It is a bullish break out, especially if that gap doesn't fill.

Read More

Read MoreMy High School Sociology Teacher used to start his class by saying, " O.K. friends, no fooling around here. I have a lot to cover today, so let's just get right into it." I miss that, and I have a lot to cover too, so lets just get right into it! 🙂

.

SPX - I discussed that the NASDAQ, IWM, SOX, XBI / IBB, and so on had already made the break higher, as the SPX lingered. The Fed Decision gave it a good push and we have a confirmed DCL and we're on day 7. It is still oversold , and I would expect a break out to new highs sooner or later.

Read More

Read MoreLets discuss Fed Wednesday

Read More

Scroll to top

Read More

Read More